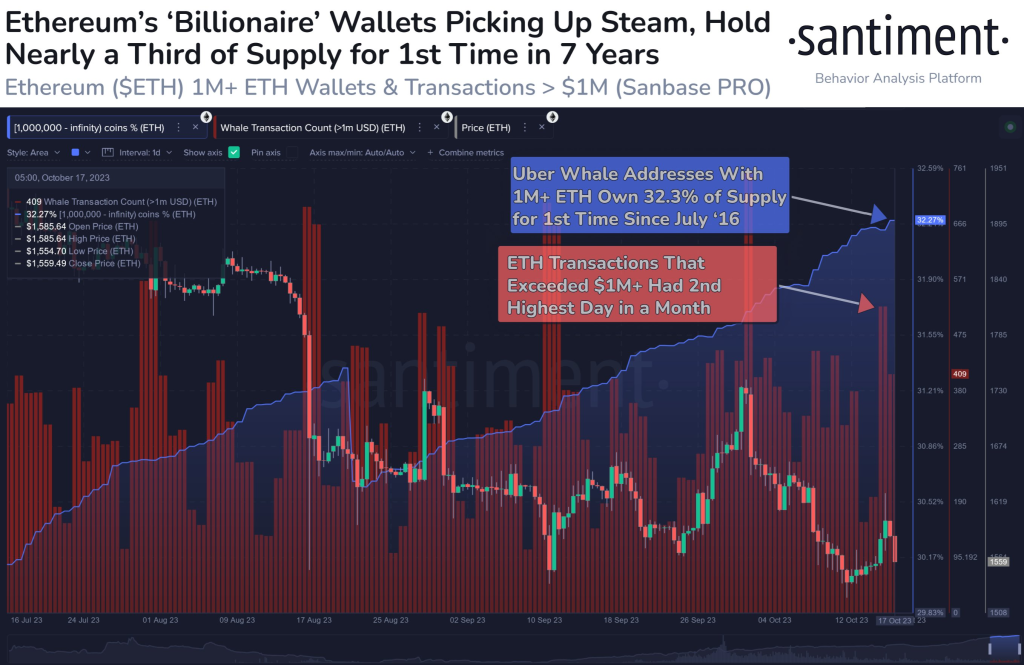

Ethereum whales, defined as addresses holding at least 1 million ETH, now hold 32.3% of the total ETH supply according to data from on-chain analytics firm Santiment. This is the highest percentage these mega-whales have held since 2016.

With ETH trading around $1,565 at the time of this report, these billionaire tier addresses hold a combined $50+ billion worth of Ethereum. The increasing accumulation by whales suggests strong confidence in Ethereum’s long-term outlook despite recent price volatility.

Source: Santiment – Start using it today

The last time Ethereum whale holdings reached similar levels was in 2016, right before ETH staged a massive bull run throughout 2017. After trading under $10 in 2016, Ethereum prices skyrocketed to highs of $1,400 by early 2018 – a 14,000%+ increase!

Whales accumulating ETH is a bullish sign for the asset’s future price appreciation based on historical trends. In addition to whale accumulation, Santiment also noted that transactions valued at $1 million or higher had their second highest day in 5 weeks on Monday. Large individual transfers often precede major price moves as wealthy investors rebalance their portfolios.

The on-chain data paints a picture of renewed interest in Ethereum from large investors. With the Merge completed in September transitioning ETH to a proof-of-stake consensus model, positive technical developments alongside bullish whale behavior could signal the start of Ethereum’s next price growth cycle.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.