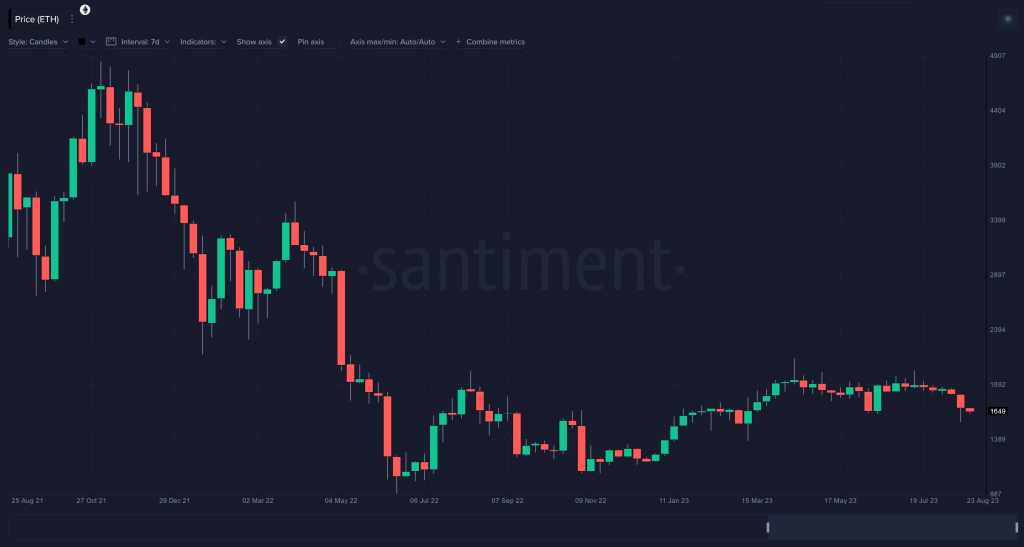

In an analysis conducted by Santiment, the journey of Ethereum (ETH) has been a rollercoaster, especially considering its peak market cap of $489.17 billion on November 10, 2021. At that time, the crypto asset was a hot topic, not just for its market value but also for its promising projects. Fast forward to 2022, and ETH has faced a significant downturn, with its price now about one-third of its value 22 months ago.

Source: Santiment – Start using it today

The Ethereum project garnered significant attention about a year ago, particularly during the lead-up to its much-anticipated merge. The upgrade successfully improved scalability and energy efficiency. However, the asset has failed to break out, leading to dwindling interest among traders over the past year, especially when compared to other large-cap cryptocurrencies.

So, what’s the current state of Ethereum? Santiment remains optimistic about the project’s viability, irrespective of its current market value. It’s worth noting that Santiment’s native token, SAN, is an ETH-based ERC-20 token that operates on the Ethereum blockchain. But what do the metrics indicate?

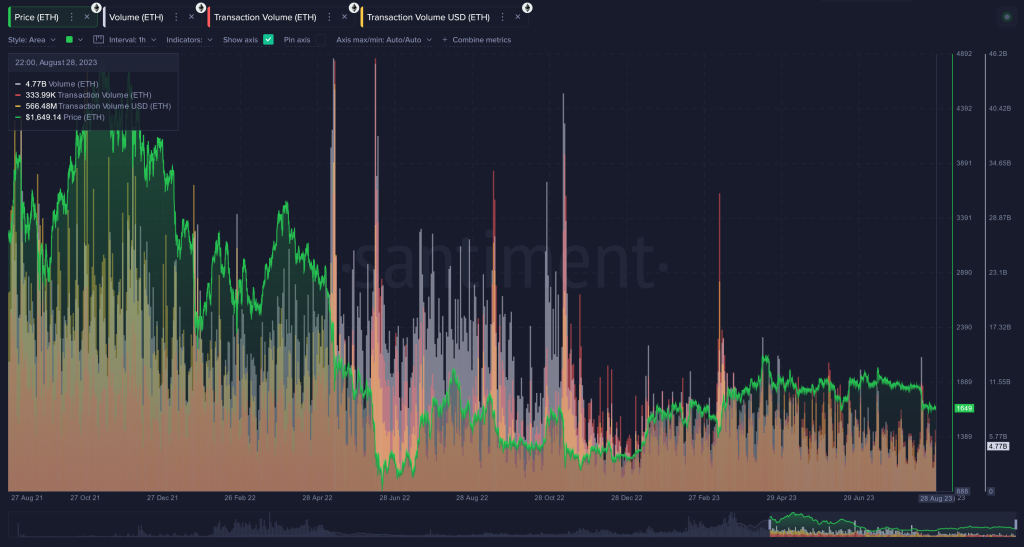

Transaction volume

When it comes to utility, Ethereum has experienced a significant decline. Both on-chain transaction volume and trading volume have dropped considerably since their peak in early November of the previous year. This decline is not necessarily a red flag but rather a sign of the market’s indecision about whether Ethereum’s current price level of around $1,650 is overvalued or undervalued.

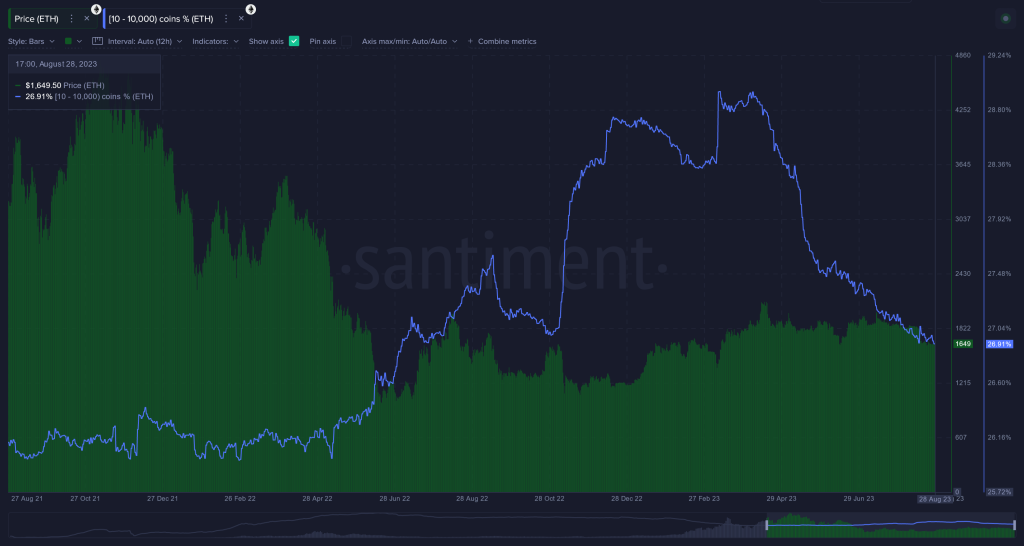

In terms of market behavior, it’s crucial to examine the actions of key players, often referred to as “sharks” and “whales.” These entities have been offloading their ETH holdings for about four months, particularly when the price reached a one-year high of approximately $2,120. While this doesn’t perfectly correlate with price movements, it’s a trend worth monitoring.

Addresses holding between 10 and 10,000 ETH

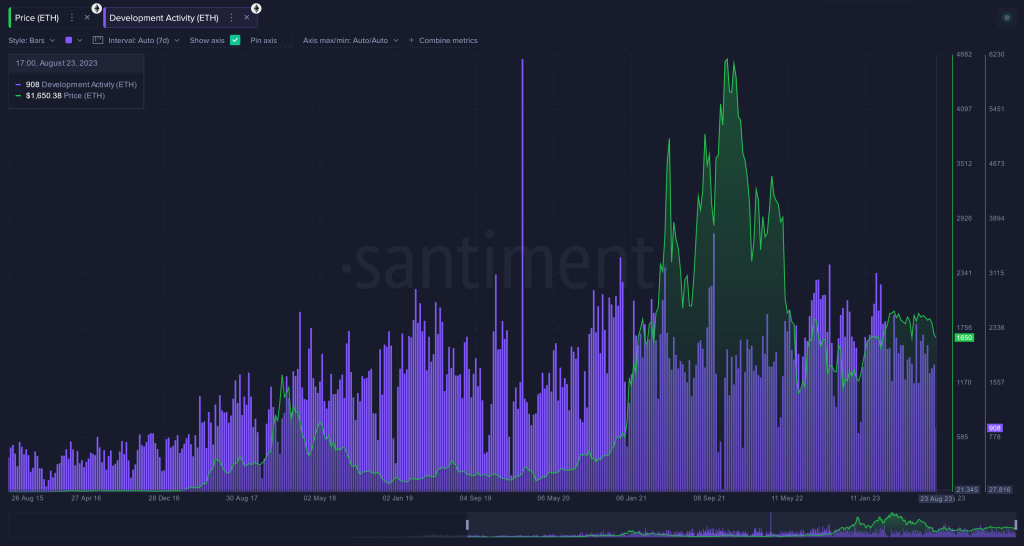

On a brighter note, Ethereum’s development activity remains robust. Over its eight-year history, there has been a noticeable uptick in efforts to innovate and improve the platform. Despite occasional rumors suggesting otherwise, Ethereum’s active GitHub repository indicates a committed team unlikely to deceive investors.

Development activity

In conclusion, while there are reasons to be optimistic about Ethereum’s long-term prospects, Santiment’s metrics suggest that now may not be the most opportune time for swing trading or expecting an immediate return to higher price levels.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.