As Bitcoin (BTC) trades near its recently achieved all-time high, traders and analysts are shifting their focus to altcoins, particularly Ethereum (ETH), which may be primed for a strong performance in the short term. According to well-known trader CrediBULL Crypto, ETH could be on the verge of a 10% move to the upside, outperforming BTC as the market leader consolidates its gains.

What you'll learn 👉

ETH/BTC Pair Forming Local Bottom

CrediBULL Crypto’s analysis suggests that the ETH/BTC trading pair is forming a local bottom, setting the stage for a potential rally. The trader’s thesis had been that BTC would outperform altcoins until reaching new all-time highs. Now that this milestone has been achieved, CrediBULL Crypto believes it’s time to start gradually shifting focus to altcoins, with ETH being a prime candidate.

To capitalize on this potential opportunity, the trader is adjusting their portfolio, shifting their primary swing long position on BTC to an equal-sized position in ETH.

This move reflects the growing confidence in Ethereum’s short-term prospects and its potential to outperform Bitcoin in the current market environment.

Successful Retest of Support Signals Trend Continuation

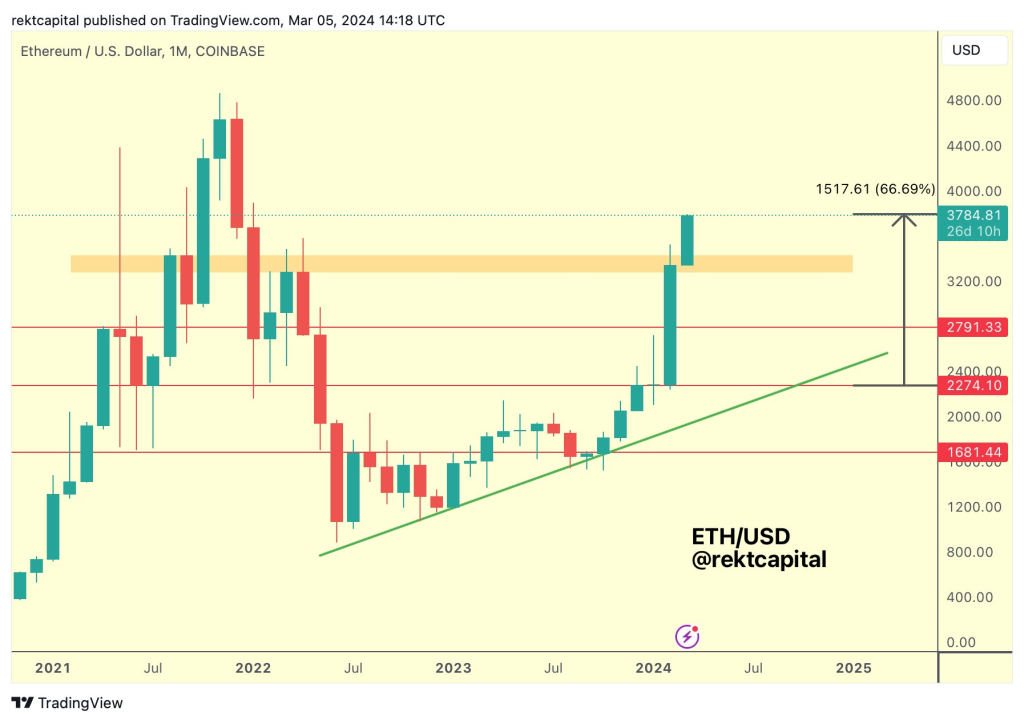

Renowned analyst Rekt Capital has also observed a bullish development for Ethereum, noting that the cryptocurrency has successfully retested a key support area (depicted in orange on their chart) and has since “springboarded” into trend continuation.

A successful retest of support often indicates that buyers are stepping in to defend a crucial price level, increasing the likelihood of a continued uptrend. With ETH now trading above this key support area, the path may be cleared for further upside momentum.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +altFINS Technical Analysis: Bullish Breakout and Upside Potential

Technical analysis platform altFINS has issued a bullish outlook for Ethereum, identifying a resistance breakout pattern that has reached the breakout stage.

The platform highlights a bullish break above $3,600, which signals a continuation of the prevailing uptrend, with near-term upside potential targeting $4,000 and mid-term prospects pointing to a retest of ETH’s all-time high near $5,000.

Source: altFINS – Start using it today

However, altFINS also cautions that ETH’s Relative Strength Index (RSI) is currently at 86, indicating that the cryptocurrency is very overbought in the short term. This could lead to a temporary pause in the uptrend or some profit-taking. The platform suggests using such pullbacks as potential entry points for swing trades within the broader uptrend.

One of the key factors contributing to the bullish sentiment surrounding Ethereum is the anticipated launch of an Ethereum Spot ETF in May 2024. This development is expected to drive increased institutional interest and investment in ETH, potentially benefiting not only Ethereum but also related altcoins within its ecosystem.

You may also be interested in:

- Top 7 Token Unlocks to Watch This Week: Ethereum Name Service(ENS), Near Protocol (NEAR), and More

- Theta Network’s (THETA) Price Rallies: Expert Highlights Potential Retest Level, But There’s a Catch

- Advertising Potential Propels DeeStream (DST) Presale As 100X Rumours Circulate Post Binance Coin (BNB) & Cardano (ADA) Whales Buy-In

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.