Ethereum (ETH) is testing a critical resistance level that could confirm the end of its macro-bear market, according to top analysts.

Founder of MN Trading Michaël van de Poppe notes that ETH breaching $2,150 decisively would be comparable to Bitcoin breaking above $30,000 in significance given the current market structure. With strength in 2023 so far, this benchmark could propel ETH back toward the $3,000 to $3,600 range.

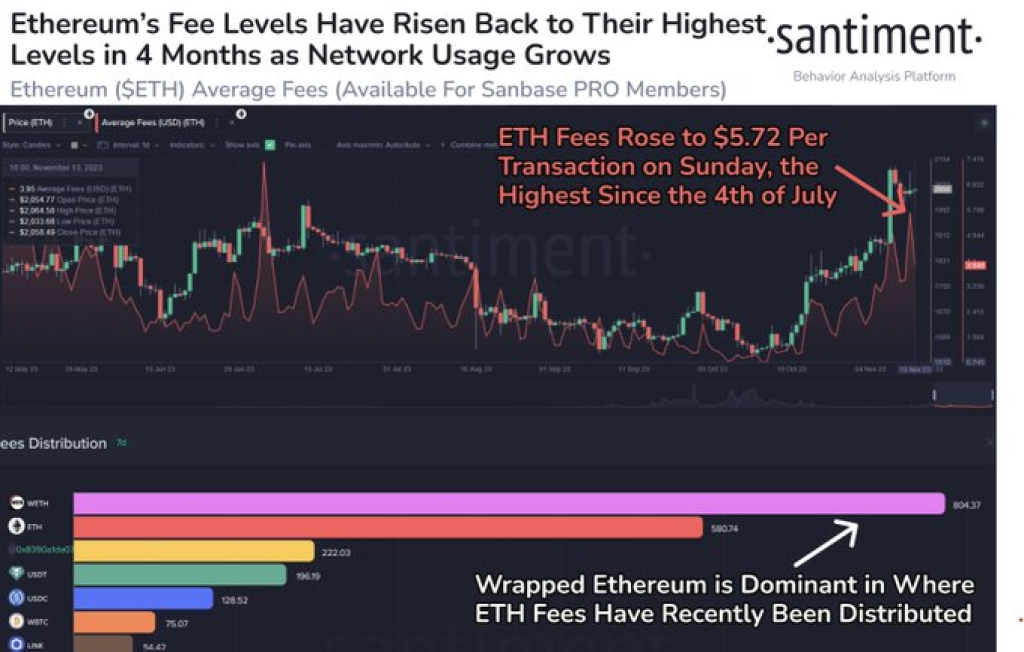

However, on-chain analytics provider Santiment cautions that while network growth is positive, Ethereum transaction fees remain a wildcard. As ETH pushed back above $2,000 last week, fees have spiked but are still below the extreme levels seen in May 2022 during heightened congestion.

Santiment suggests monitoring how sustained high fees could impact the use of ERC-20 tokens and limit adoption of Ethereum in the near term. Layer 2 scaling solutions will be key to managing throughput limitations.

Read also:

- Tellor Whales Trigger 33% TRB Freefall: Who Dumped, and How Much Did They Make?

- Analyst Compares Kaspa to Cardano, Revealing His KAS Strategy While the Coin Trades in Red

- Uncovering Hidden Crypto Treasures: The Growth Potential of NEO, $RBLZ, and EGLD

In summary, overcoming the $2,150 threshold would be very bullish technically for ETH. But fee dynamics that worsen as activity picks up remain a longer-term headwind. Striking the right balance between scaling and decentralization will determine if Ethereum can grow to its full potential this cycle.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.