Capital in crypto often rotates based on opportunity and timing. When large caps slow or consolidate, investors look for assets with lower entry prices and higher long-term upside potential. This cycle has pushed attention from mature networks such as Ethereum toward newer projects building financial utility with clearer yield paths. One of these newer assets is now drawing accumulation interest from Ethereum whales as it prepares for its first major activation window.

What you'll learn 👉

Ethereum (ETH)

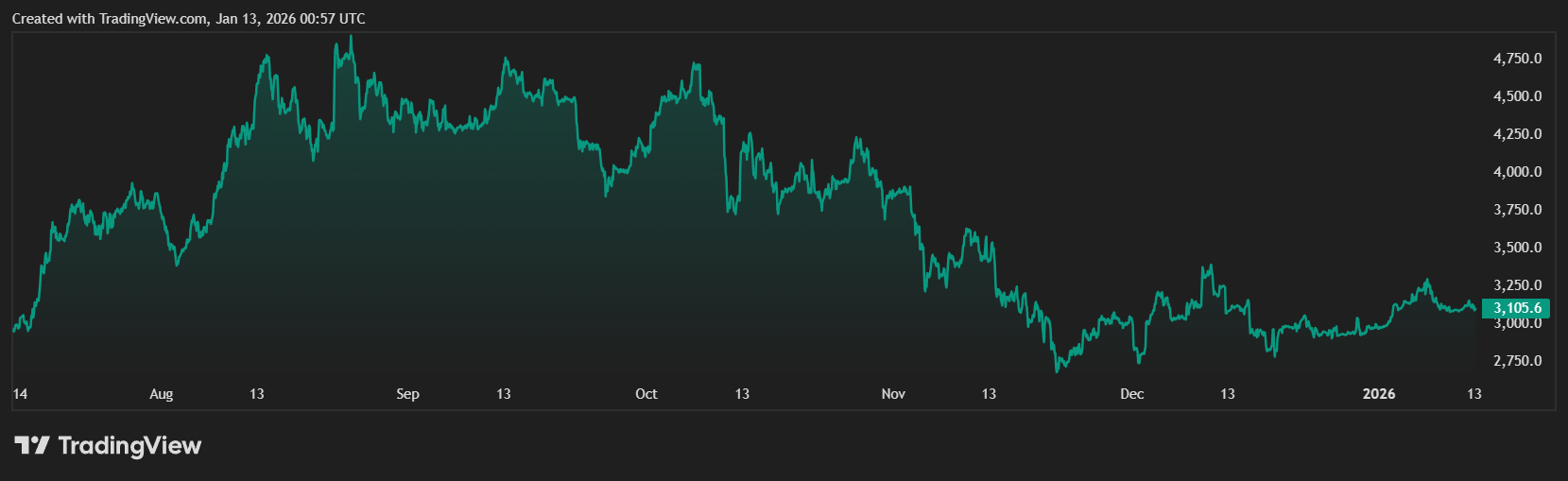

Ethereum remains one of the most influential assets in the crypto sector. ETH trades near $3,100 with a market cap above $400 billion, making it the second-largest asset after Bitcoin. Its position comes from smart contract execution, developer activity, and wide integration across platforms ranging from applications to financial tooling.

Despite this strength, ETH’s chart has shown slow behavior in recent sessions. Technical models highlight resistance around the $3,500 zones, where several breakout attempts have failed to sustain momentum. Most forward outlooks show mild upside over the next cycle, reflecting the reality that large tokens need significant liquidity to move aggressively.

For investors seeking larger multiples, this dynamic has pushed attention toward lower-priced emerging assets that still operate in early development phases and have room to reprice around future usage.

How Mutuum Finance Creates Yield Through Mechanics

The asset now drawing attention from ETH whales is Mutuum Finance (MUTM). Mutuum Finance is building a lending and borrowing platform that connects lenders and borrowers through structured rules. The system supports two separate market models.

The first market is Peer to Contract (P2C). In this model, users deposit assets into shared liquidity pools and receive mtTokens that track their deposit positions. mtTokens earn yield because borrowers pay interest when they draw from shared pools.

For example, if a user deposits 3,000 USDC, they receive mtUSDC. If borrowing demand rises, APY increases because more interest flows back into the pool. This gives depositors passive yield without having to match with specific borrowers.

The second market is Peer to Peer (P2P). Here, loans are matched directly between lenders and borrowers. Borrowers post collateral and choose interest rate structures. The system uses Loan to Value (LTV) rules to determine how much can be borrowed.

For example, at 65% LTV, $2,000 in collateral supports a $1,300 loan. If collateral value drops below safety limits, liquidation events occur. During liquidation, a portion of the loan is repaid and discounted collateral transfers to liquidators. These mechanics protect liquidity providers and help maintain solvency during volatility.

Presale Participation and Security Preparation

Mutuum Finance (MUTM) opened its presale in early 2025 at $0.01. Pricing has advanced through multiple phases as demand increased. In the current stage, the token sells at $0.04, which marks a measured 300% increase from the first tier. More than $19.7 million has been allocated to the offering and over 18,800 wallets now hold MUTM.

Two participation tools also shape distribution behavior. The first is the 24-hour leaderboard, which rewards the most active buyer each day with $500 in MUTM. This keeps rotation steady rather than sporadic. The second is card payment support, which removes technical barriers and allows users to participate without advanced wallet setup.

On security, Mutuum Finance completed a Halborn smart contract audit, received a 90/100 CertiK Token Scan, and opened a $50,000 bug bounty ahead of deployment. These steps matter for lending platforms because they handle collateral, interest logic, and loan liquidations, which require high correctness at launch.

Plans Ahead of the Launch Window

The project confirmed on its official X channels that its V1 protocol launch is approaching. V1 will activate borrowing, lending, collateral handling, and liquidation execution. This moves the protocol from concept to usage, which is often when valuation models begin shifting toward revenue-based analysis rather than sentiment.

Furthermore, Mutuum Finance plans to introduce a borrower-backed stablecoin model. Stablecoins are vital for lending systems because they give borrowers liquidity without forcing exposure to volatile assets. This design also increases protocol stickiness since users can open, adjust, and repay loan positions without leaving the ecosystem.

For Ethereum whales, this combination is important. ETH provides long-term exposure and ecosystem depth, but it is not built to deliver 5X or 8X growth at its current scale. MUTM sits early in its development curve with a usage window opening soon and a cost basis under $1, which is why accumulation interest has shifted during this phase of the market.

As Q1 2026 approaches, Mutuum Finance begins to look like a structured yield play at the early end of its lifecycle. This profile explains why Ethereum capital is flowing into MUTM as investors look for best crypto opportunitites with utility-driven demand rather than hype-driven cycles.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.