According to top analysts, Ethereum is showing key signals of a bottom being formed while Bitcoin tops out from its vertiginous run. This turning point could set the stage for ETH to markedly outperform BTC in the first quarter of 2024.

What you'll learn 👉

Monthly Support Preventing Deeper Drawdowns

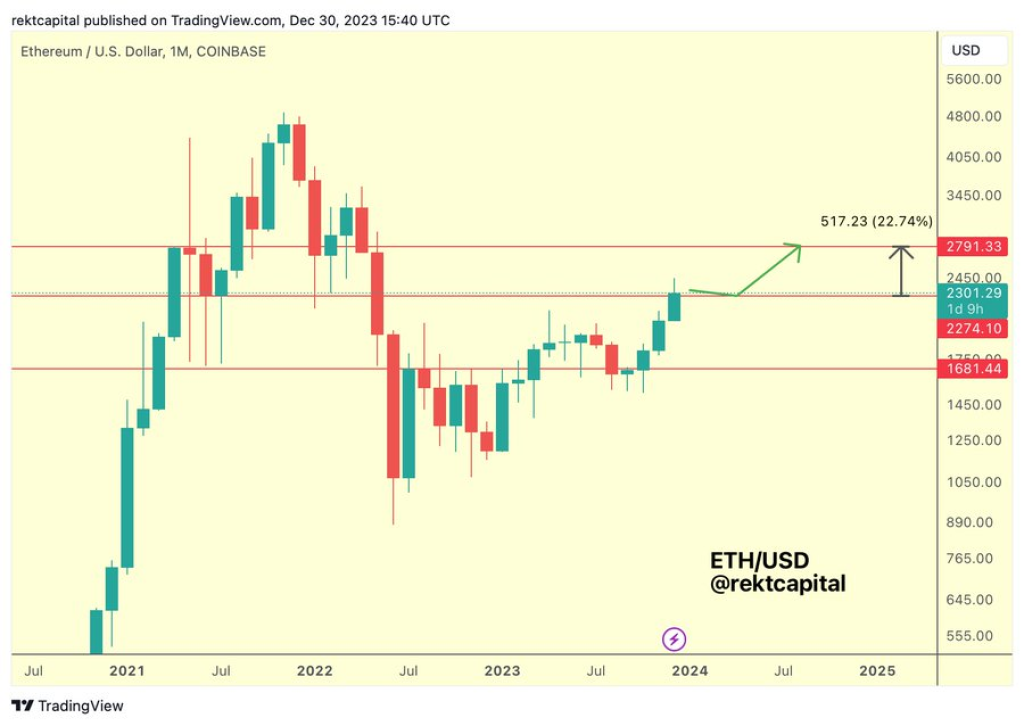

In recent tweets, market observers note how vital monthly support continues to prevent deeper sells offs for Ethereum as the year wraps up.

As crypto strategist Rekt Capital points out, “**$ETH Still just about positioning itself favourably for a bullish Monthly Close, despite the dip Already following the first part of the green path.**”

Indeed, the critical floor at $2,300 has so far held to develop a higher monthly candle close for December – typically indicative of medium-term bottoms. A successful close above the resistance which will turn support will see the price eyeing $2,800 next.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Historically Bullish Setup Aligning For ETH

Beyond the charts, analysts like Michaël van de Poppe also cite timing and momentum signals that have consistently preceded Ethereum upswings against Bitcoin.

“**As I suspect Bitcoin to be close to finalizing this upward run, I think Ethereum will start to take over. Based on historical price actions, multiple signals of a potential reversal + Q1 is a reasonable period for Ethereum,**” remarks veteran trader Michaël van de Poppe.

So with BTC cooling off from overbought peaks while ETH flashes reversal signals plus entering its seasonally strongest quarter, a changing of the guard appears underway to start 2024.

This technical alignment marks a reversal of market dominance from the majority of 2023 when Bitcoin soared while Ethereum lagged severely. With the macro landscape now flipping favorable, Ethereum seems geared to regain leadership next – likely translating to substantial outpacing of BTC gains as capital rotates toward high-upside altcoins after Bitcoin’s parabolic run tops out.

You may also be interested in:

- Kaspa (KAS) Secures New Exchange Listing Again Despite Unencouraging Price Action

- Why Is Creditcoin (CTC) Pumping? There Is Even Room for Further Price Increase

- Why Is Internet Computer (ICP) Price Surging: Analyst Anticipates 30% More Price Rise From Here

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.