Ethereum appears to have been building upside momentum this past week based on improving technical factors and on-chain activity. However, the native ETH asset now approaches crucial resistance levels that could determine trend sustainability, according to expert analysis.

What you'll learn 👉

Fundamentals Strengthening

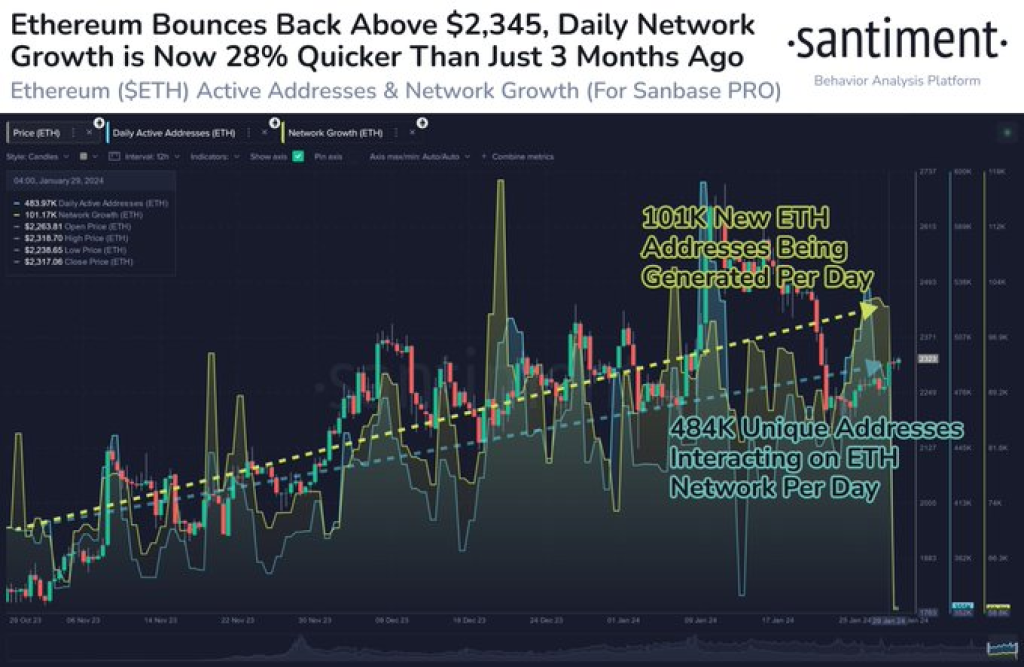

Industry data provider Santiment notes positive signals as Ethereum climbs back above the $2,300 threshold:

“Ethereum has returned to a $2,345 value for the first time since its fall began on January 22nd. The network is encouragingly rising in active addresses and network growth.”

This aligns with the analysis from trader Moustache:

“Isn’t it remarkable how similar the [current ETH] structures are? Imagine what will happen with our altcoins.”

The technical posture mirrors previous constructive accumulation periods that preceded sustained bull runs.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Resistance Looms

However, fellow analyst CryptoMojo points out a crucial technical zone around $2,400 that bulls must conquer to validate upside conviction:

“Ethereum is facing the 2370$ to 2400$ range and the lower trendline of this channel is a strong resistance…In case of bullish momentum. But in case the bear pressure in the market remains the same then it’s likely to see a reject in Ethereum towards the lower support level.”

So in essence, while optimism returns given improving adoption metrics and historical chart patterns, Ethereum must still overcome pivotal near-term barriers.

Sustaining above $2,400 resistance would add credence to 2024, continuing the elongated cycles that propel outsized ETH upside. But failure to breakout could lead to retests of underlying support levels near $2,100. ETH’s response to resistance will prove telling over coming weeks.

You may also be interested in:

- Cardano Surges Past Important Resistance, Analyst Predicts ADA Could Reach $0.85 If This Happens

- This Shiba Inu Indicator Flashes “Buy” Signal – Pay Attention SHIB Holders

- Avalanche (AVAX) Resilience at $36.33 Amid Ethereum (ETH) Competition; Dogecoin (DOGE) Poised for Rally, Analyst Forecasts; Early Bitcoin (BTC) Investor Predicts Kelexo (KLXO)

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.