Bitcoin (BTC) has been exhibiting interesting fluctuations in the market as it looks to break through prior barrier levels. In the meantime, analysts believe that before the year is out, Bitcoin’s market dominance will have increased to a critical level.

Top analysts Rekt Capital and Benjamin Cowen offer insights into the present price action of Bitcoin and tendencies related to its market dominance. They also predict a key moment ahead of time for the leading cryptocurrency.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +What you'll learn 👉

BTC Price Retests Key Resistance

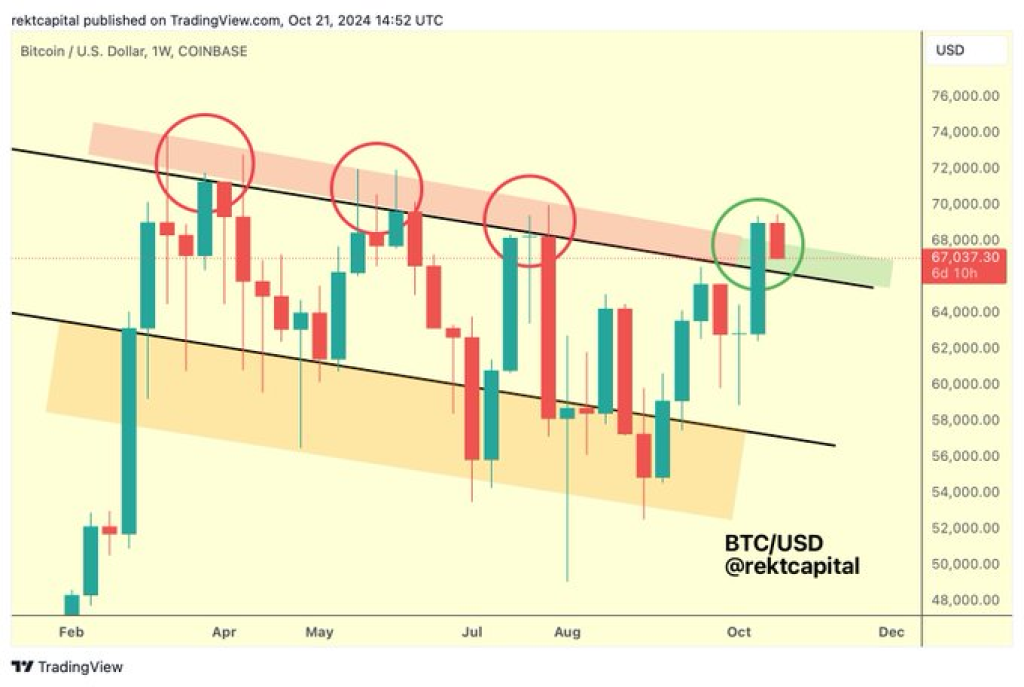

According to Rekt Capital, Bitcoin is undergoing a significant retest. The weekly chart reveals BTC moving within an ascending channel, where previous resistance levels have repeatedly challenged price growth.

The analyst highlights that Bitcoin is now “digging deeper” into this resistance area, aiming to convert it into a support zone. This retest is crucial, as a successful bounce could pave the way for renewed bullish momentum.

The chart analysis indicates that BTC may dip back to the upper boundary of the channel (marked in black), which would act as a strong support level. If this retest succeeds, Bitcoin may see a breakout to the upside.

The red zones on the chart have consistently repelled price surges, but BTC’s persistence suggests it could flip this resistance. Analysts believe that turning this area green would signal a bullish continuation, with Bitcoin potentially targeting new highs.

Bitcoin Dominance Trending Higher

The predominance of Bitcoin over the whole cryptocurrency market is subject to fluctuations in its price. A clear increasing trend can be seen in the weekly BTC dominance chart, which shows recurring higher highs and higher lows.

Benjamin Cowen adds credence to this discovery by claiming that the dominance of Bitcoin has been steadily increasing and is expected to reach 60% by year’s end. The path to this milestone, according to Cowen, involves a spike followed by a pullback and a slow grind upward.

The dominance of BTC is currently stabilizing at a resistance level that is just below 60%. According to this pattern, there may be a little correction in the short run, but overall the trend is still upward, and as investors increase their stakes in the safer asset, Bitcoin is predicted to perform better than other cryptocurrencies.

Read Also: How Much Will 10,000 SUI Tokens Be Worth in 2025?

What Analysts Expect Next

The outlook from both analysts indicates that Bitcoin is at a pivotal stage. Rekt Capital’s analysis suggests that there is a possibility that BTC will convert the previous barrier into a level of support, potentially leading to bullish gains. Nonetheless, according to Cowen’s study of BTC dominance, Bitcoin is projected to continue leading the market, maybe reaching 60% dominance by year’s end.

These elements can suggest to investors that Bitcoin is ready for more growth. However, much depends on whether BTC can solidify its retest and if dominance can break past the current resistance levels. Both scenarios would reinforce Bitcoin’s standing as a preferred asset, particularly during periods of broader market uncertainty.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.