LINK lost over 20% of its value this week, trading slightly above $13 – the lowest level since mid-November 2023. However, an elite crypto analyst believes this pullback may signal a prime buying opportunity for investors.

What you'll learn 👉

Analyzing the MVRV 30-Day Ratio

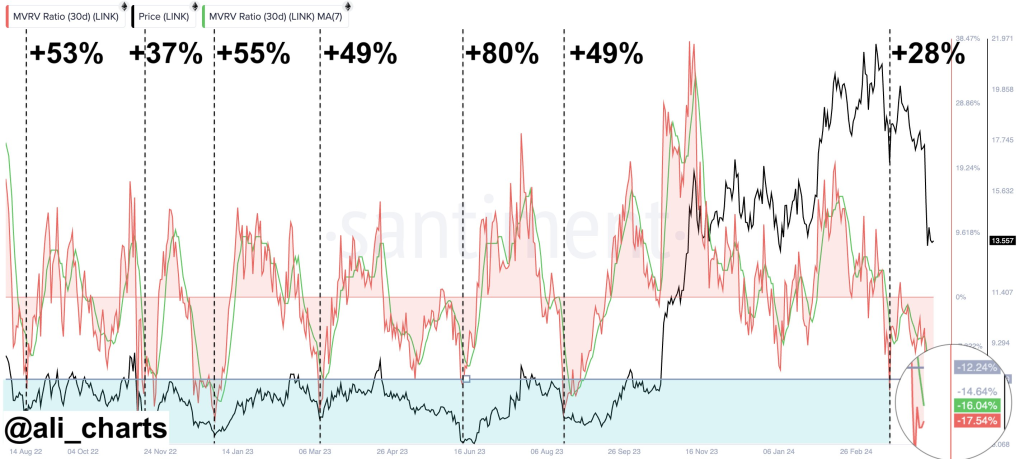

According to Ali, a respected crypto analyst, the Chainlink MVRV (Market Value to Realized Value) 30-Day Ratio has dropped below -12.24% since August 2022, signaling a potential buying opportunity. Currently, the LINK MVRV 30-Day Ratio stands at -17.54%, suggesting that now could be another chance to buy the LINK dip.

The MVRV ratio is a metric that compares a cryptocurrency’s market capitalization to its realized capitalization, which is the sum of all the coins’ purchase prices. When the MVRV ratio is below 1, it indicates that the asset is potentially undervalued, as the market value is lower than the realized value. Conversely, when the MVRV ratio is above 1, the asset may be overvalued.

Ali’s analysis shows that each time the Chainlink MVRV 30-Day Ratio has dropped below -12.24% since August 2022, it has signaled a prime buying opportunity, with an average return of 50% following these instances.

Exploring the RSI Indicator

In addition to the MVRV 30-Day Ratio, the Relative Strength Index (RSI) is another technical indicator that suggests Chainlink may be presenting a buying opportunity. The RSI currently stands at 61, which is considered within the neutral zone, neither overbought nor oversold.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with values below 30 considered oversold and values above 70 considered overbought. When the RSI is in the neutral zone, it indicates that the asset is neither overextended to the upside nor the downside, making it a potential entry point for investors.

The Underlying Strength of Chainlink

Chainlink is a decentralized oracle network that provides real-world data to smart contracts on the blockchain. The network has gained significant traction in the DeFi (Decentralized Finance) space, with numerous projects integrating Chainlink’s oracles to enhance the reliability and accuracy of their applications.

Despite the recent market pullback, Chainlink’s fundamentals remain strong. The network has continued to expand its partnerships and integrations, with major players in the crypto industry, such as Google Cloud, Oracle, and Amazon Web Services, leveraging Chainlink’s technology.

The Potential for Future Growth

Chainlink’s long-term growth prospects remain promising. As the blockchain ecosystem continues to evolve, the demand for reliable and secure data feeds is expected to increase. Chainlink’s position as a leading oracle network positions it to capitalize on this growing demand, making it a potentially attractive investment opportunity for crypto investors.

Furthermore, the recent market downturn has presented a buying opportunity for those who believe in Chainlink’s long-term potential. With the MVRV 30-Day Ratio and RSI indicating a potential undervaluation, now could be an opportune time for investors to consider adding Chainlink to their portfolios.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.