In a recent video, More Crypto Online, a well-known trader and technical analysis expert, delved into the intricate details of Bitcoin’s price movements. This article aims to summarize the key points made in the video and provide an understanding of Bitcoin’s current market dynamics.

What you'll learn 👉

Technical Analysis and Elliott Wave Theory

The Current Scenario

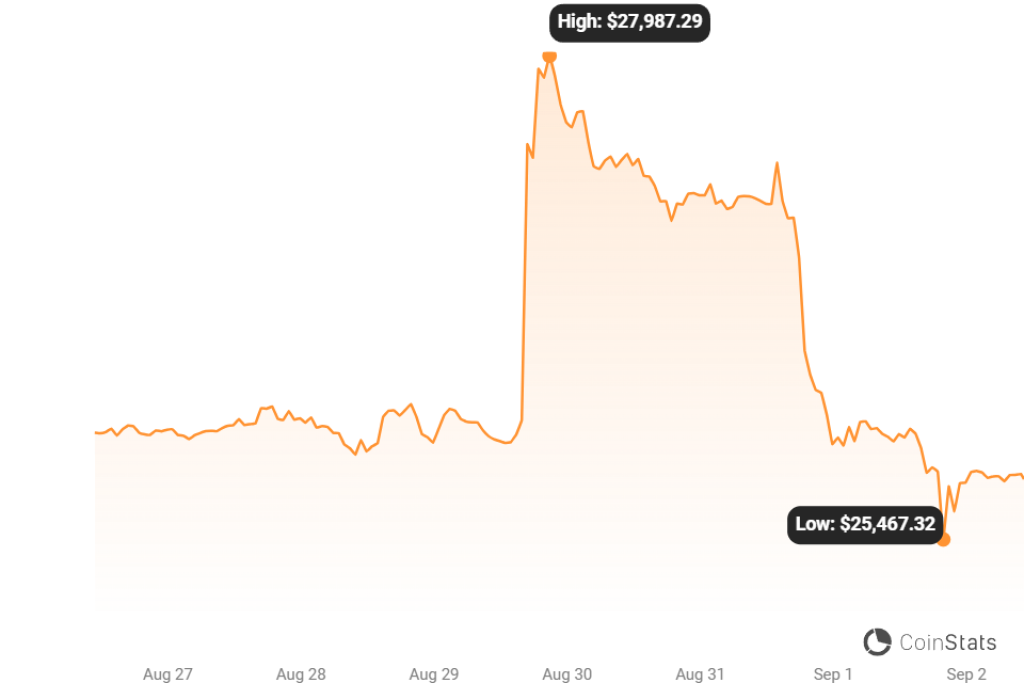

More Crypto Online begins by discussing the recent price movements of Bitcoin. He notes that Bitcoin has made a “tiny low” recently and is expected to go lower in a fifth wave according to Elliott Wave Theory. The resistance level to watch is 26,620 USD; a break above this level would warrant considering different price movement scenarios.

Third Wave Extension

Interestingly, the analyst suggests that the third wave in the Elliott Wave count might be extending. This is based on the observation that the third wave slightly missed the 1.618 Fibonacci extension level, which is a minimum expectation for a third wave. The fourth wave was also very shallow, leading to the assumption that the third wave is actually extending.

Updated Resistance Level

Due to the potential extension of the third wave, More Crypto Online advises moving the resistance level along with the price. The updated resistance is now at 26,450 USD. If this level is broken to the upside, it would indicate that a higher B wave is in place.

Source: CoinStats – Start using it today

Predictions for the Weekend and Beyond

Short-Term Movements

For the weekend, the analyst speculates that Bitcoin might enter a more pronounced fourth wave, possibly reaching levels between 26,180 and 26,450 USD. If it stays below this range, another low is expected, possibly early next week, in a fifth wave that could realistically reach the 24,000 USD level.

Long-Term Outlook

After the next low, the focus will be on whether the recovery is a three-wave or a five-wave move. A five-wave move would indicate that a low has been made, and traders should look for an ABC pullback to trade the third wave higher. If it’s only a corrective rally, then a good short setup for lower levels would be in place.

Additional Insights and Member Benefits

More Crypto Online also mentioned that he would be discussing Bitcoin structures before halvings and how Bitcoin escaped from previous bear markets in a member live stream. The channel offers daily updates, signals for certain coins, and a wealth of educational content about Elliott waves for its Gold members.

Conclusion

In summary, Bitcoin is currently in a critical phase, and its price movements in the coming days will be pivotal in determining its longer-term trajectory. Whether you’re a trader or an investor, keeping an eye on these levels and patterns could provide valuable insights into Bitcoin’s future.

For more in-depth analysis and real-time updates, you can check out More Crypto Online’s YouTube channel.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.