Ethereum has been a constant topic of discussion, especially given its significant range-bound trading pattern observed over the past year. A renowned cryptocurrency trader, Wick, has recently issued a word of caution to potential investors, advising them to refrain from purchasing Ethereum at the current moment.

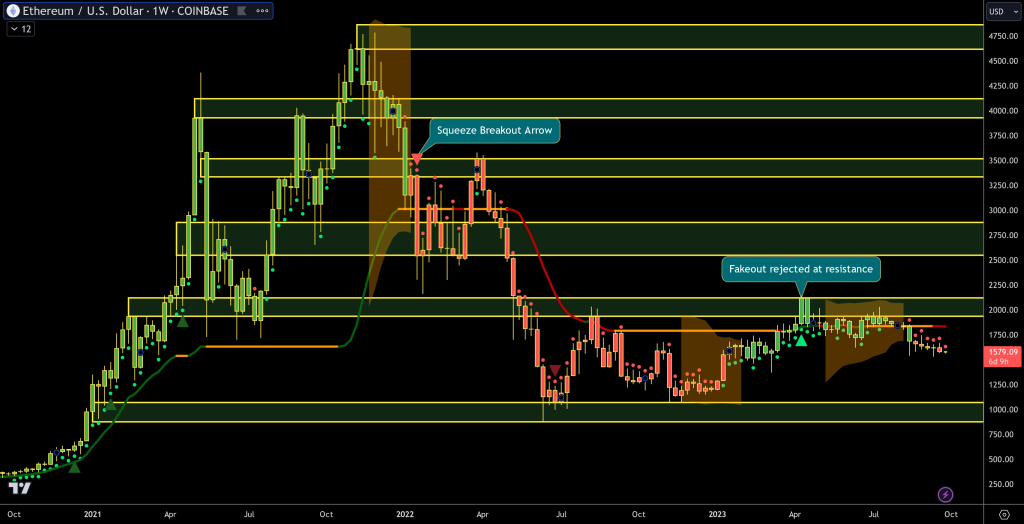

The analyst, due to the sensitive nature of market predictions, has expressed concerns over Ethereum’s present market position. Ethereum is currently perched at the apex of a trading range, a position it has maintained for over a year. This stagnant position, coupled with the appearance of red dots on trading charts, signals a lack of momentum and potential downward pressure on the asset.

“Do not touch Ethereum with a ten-foot pole right now,” warns the analyst, emphasizing the heightened risk associated with investing in Ethereum under the prevailing market conditions. The red dots, often indicative of a bearish market trend, suggest that there is no substantial reason for Ethereum’s value to experience a surge in the near future.

However, the analyst also brings a message of hope and optimism for prospective Ethereum investors. He believes that, despite the current unfavorable market conditions, there will be lucrative opportunities to earn substantial returns from this asset in the future. “We’re going to eventually make insane amounts of money on this asset together. Patience is key,” he asserts.

The analyst’s advice underscores the importance of patience and strategic timing in cryptocurrency investments. While the present may not be the opportune moment to invest in Ethereum, waiting for favorable market conditions could yield significant rewards. The analyst encourages potential investors to exercise caution and conduct thorough research before making any investment decisions, emphasizing the unpredictable and high-risk nature of the cryptocurrency market.

In conclusion, while Ethereum continues to hover at the top of its trading range, the prevailing market signals advise against immediate investment. The elite analyst’s counsel to exercise patience suggests a strategic approach to investing in Ethereum, with a focus on long-term gains rather than short-term profits. As the cryptocurrency market continues to evolve, staying informed and making well-researched decisions will be crucial for navigating the turbulent waters of crypto investments.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.