Widely-followed crypto analyst Rekt Capital has identified a key technical setup on Bitcoin’s monthly chart that could present the next major pre-halving buying opportunity.

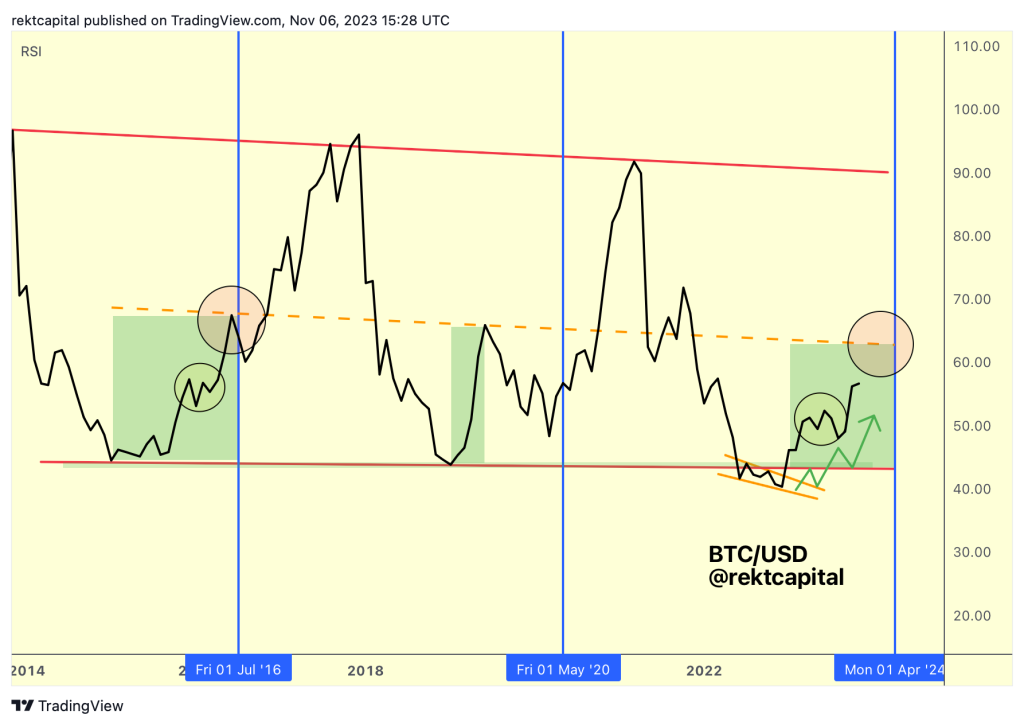

In his recent newsletter, Rekt Capital pointed out that Bitcoin’s monthly RSI is fast approaching the orange dashed midpoint trendline that acted as resistance during the 2016 and 2019 bull runs. A rejection here would suggest a local topping signal.

However, Rekt Capital highlighted that a brief overshoot into the red shaded zone between 60-65 on the RSI is also a possibility before topping out. This red area marked major cycle highs in 2016 and 2019.

If Bitcoin’s monthly RSI pushes into this red zone in the coming months before reversing lower, it could represent the final bull trap before a substantial pre-halving pullback occurs.

With the next halving estimated around April 2024, the next 6-12 months look primed to offer ideal pre-halving accumulation conditions before the real parabolic advance to 6-figures potentially kicks off.

Once the halving arrives, Rekt Capital expects the RSI to breakout above the current midpoint toward the upper half of the large macro uptrend wedge. This would signal the start of the exponential bull run phase.

In summary, Rekt Capital has highlighted the monthly RSI’s approaching encounter with a key horizontal resistance zone. A rejection here, perhaps even an overshoot into the red danger zone, would set the stage for opportunistic Bitcoin accumulation in anticipation of the next halving tailwind.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.