The Bitcoin price entered April at around $83.2k after dipping around 4% in month. However, what’s worrying is that the sentiment on the market is not good, to say the least. In any case, let’s see whether April and Q2 could potentially be better for BTC and broader crypto market.

Meanwhile, crypto veteran ‘Ali Martinez’ pointed out to an interesting Bitcoin indicator.

What you'll learn 👉

The Concerning “Air Gap” in Bitcoin’s Support Structure

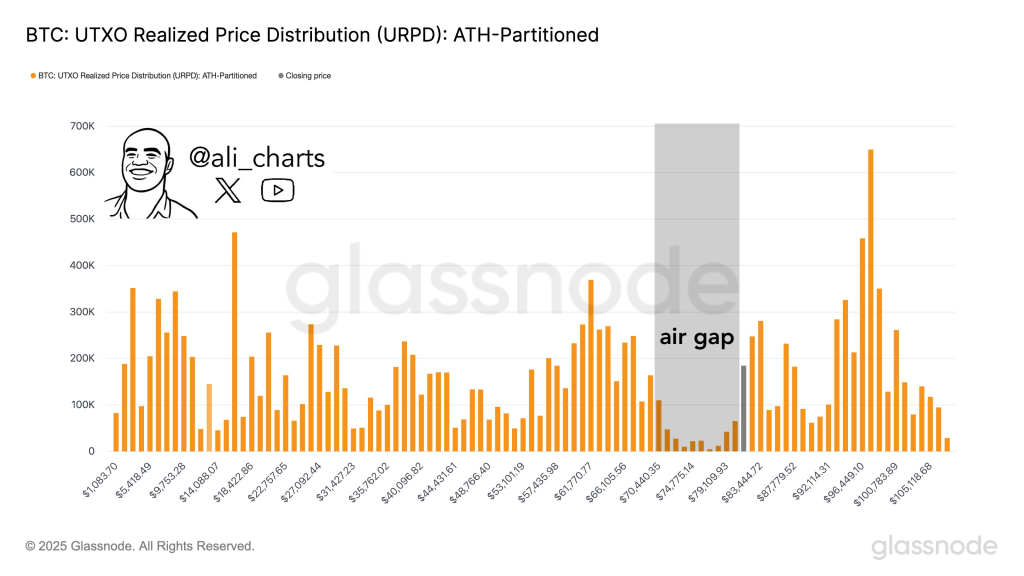

Martinez shared a critical Glassnode chart showing Bitcoin’s UTXO Realized Price Distribution (URPD). This key metric reveals where current Bitcoin holders acquired their coins. It provides insight into actual support zones. It relies on transaction history rather than speculative analysis.

The most alarming feature of the chart is what Martinez calls an “air gap” between $70,000 and $80,000. This gray-shaded zone shows remarkably low UTXO activity. Very few holders acquired Bitcoin in this price range. Without substantial historical transactions in this zone, there’s minimal on-chain support to prevent rapid price movement.

This is concerning for current holders. If Bitcoin falls below $80k, there’s little to prevent it from sliding quickly down to $70k. There would be no significant buying pressure to slow the descent.

Bitcoin’s Strong Support Levels

Dense clusters of activity appear below $70k, particularly around $60k, $50k, and $40k levels. These zones represent stronger areas of historical accumulation. Many UTXOs were created at these levels. They potentially form solid on-chain support where previous buyers might step in again.

The BTC chart also shows huge recent Bitcoin volume in the $100k-$105k range. This suggests new market participants are entering at current highs. This area could act as a resistance zone if prices drop and retest from below.

Martinez’s tweet captures the essence of the chart: “Below $80,000, $BTC faces an air gap! There’s little to no support until $70,000.” This is a warning signal for short-term BTC price action. The current price structure lacks historical backing in the $70K–$80K range.

Read also: Bitcoin Price Prediction: Analyst Maps Out 3 Price Targets For BTC in 2025

Implications for Traders and Investors

Traders should be aware of several key points:

- Risk Management is crucial. Anyone trading in the $80K–$100K range should know there’s minimal on-chain support until $70K. If a correction starts, it could be fast and sharp.

- Long-term investors might consider the $60K–$70K range as a more solid entry or re-entry zone. This is based on the higher UTXO density in those areas.

- If BTC holds above $80K despite the air gap, it shows bullish strength. It would be trading in low-support territory without falling through.

The UTXO Realized Price Distribution is a powerful metric for Bitcoin analysis. It helps determine support and resistance zones based on actual transaction history. When Bitcoin enters a price range with little historical activity, there’s less incentive for holders to buy or defend that price. This makes the price more volatile within that range.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.