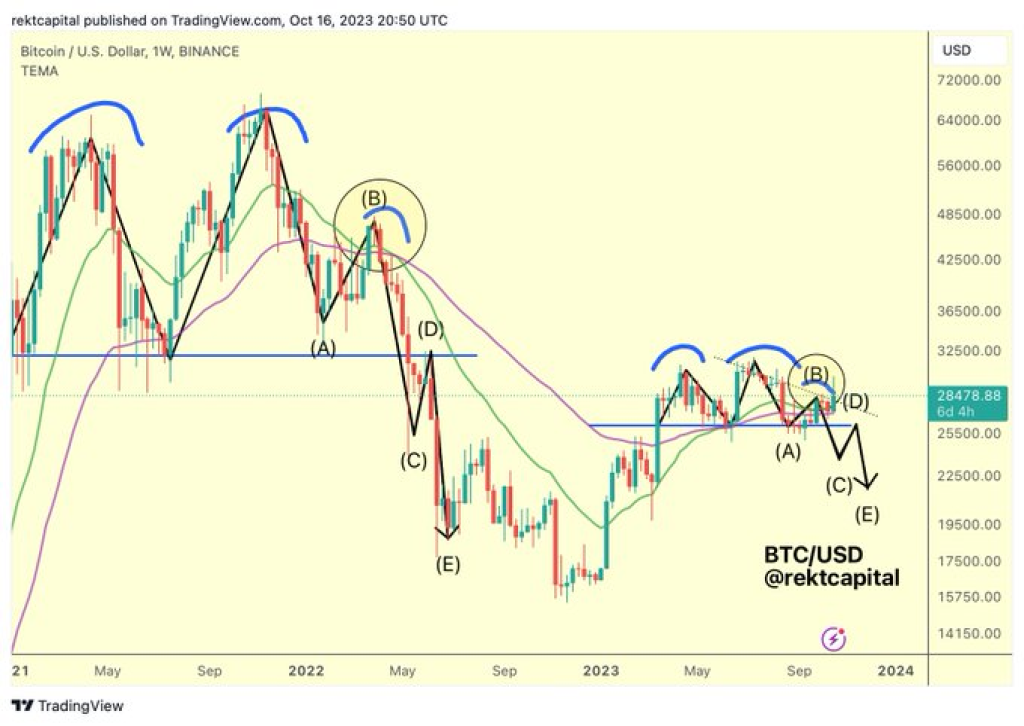

Crypto analyst Rekt Capital laid out specific criteria required for Bitcoin to invalidate its current bearish trend in a recent tweet.

First, Bitcoin’s bull market support band must hold as support. Rekt Capital notes this box has held so far.

However, Bitcoin has yet to register a weekly close above the key lower high resistance around $28,050. Doing so would represent significant progress towards a trend reversal.

Finally, Bitcoin prices need to decisively breach the $31,000 yearly highs to confirm a definitive breakout. This level remains elusive for now.

In summary, Rekt Capital believes Bitcoin is showing some early signs of reversing its bearish momentum. But several key milestones, especially a weekly close above $28,050, are required to validate this.

Until these conditions are met, the analyst suggests exercising caution regarding a bullish breakout. Sustaining the recent recovery will depend on reclaiming crucial resistance levels.

For Bitcoin bulls, the path forward involves meticulous invalidation of the prevailing downtrend. Rekt Capital’s criteria provide helpful guidelines for gauging the market’s progress on this front. Still, the ultimate verdict relies on price action confirming the indicators.

With potentially significant resistance ahead, traders are watching whether Bitcoin can build enough upside momentum to decisively change the tides. The coming weeks will prove pivotal in determining the short-term trend.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.