DWF Labs, a name that was obscure in the crypto universe just a year ago, has swiftly emerged as a focal point in the crypto arena, branding themselves as a market-making and investment firm. The sudden rise of this entity and the individuals behind it, including founder Andrei Grachev, has sparked curiosity and speculation.

This article aims to present a comprehensive and objective overview of the information amassed on DWF Labs and its associates. The investigation was shared by HumaCapital on Twitter.

What you'll learn 👉

The Genesis of Grachev

Andrei Grachev, a name that surfaced in the Russian crypto community circa 2017, had his roots in the logistics industry, a realm distant from the technological sphere. He initiated several logistics companies, all of which have since ceased operations. Grachev introduced himself to the crypto community as a triumphant trader and a partner at Crypsis Blockchain Holding.

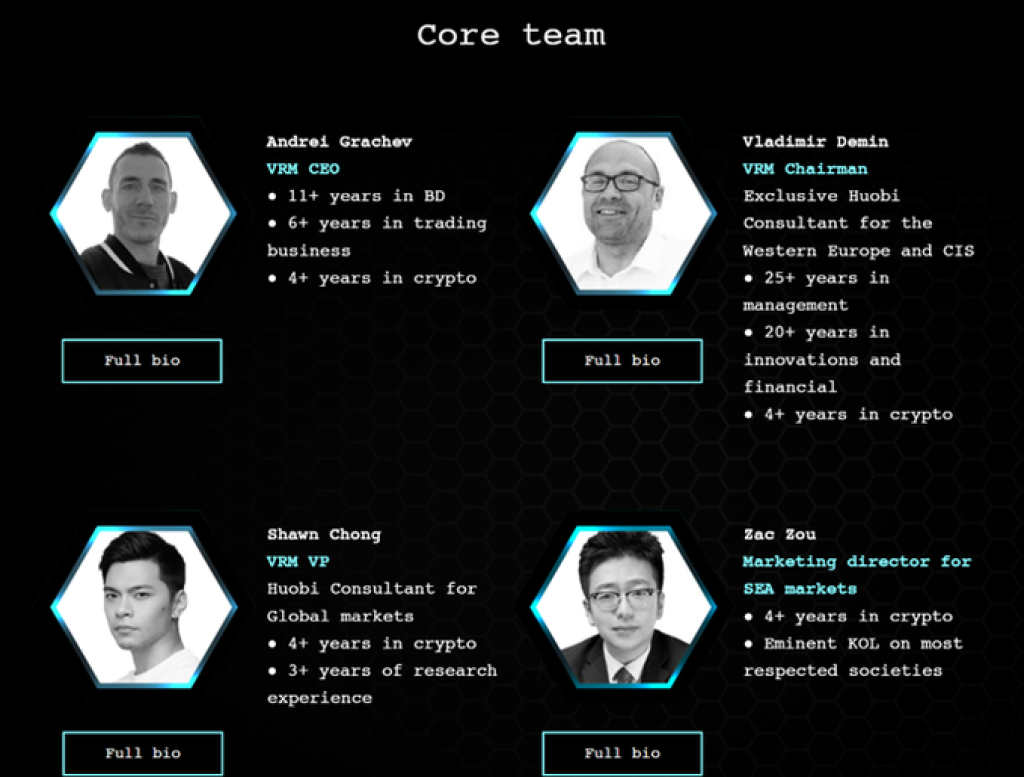

In 2018, Grachev ascended to the vice-presidency of RACIB, a non-profit organization with close ties to the state-owned Foreign Economic Bank (VEB). RACIB’s mission was to advocate for crypto regulations in Russia. By 2019, Grachev assumed leadership at Huobi Russia, with Vladimir Demin, his partner at RACIB and a former high-ranking manager at VEB Ventures, succeeding him. Demin and Grachev later co-founded VRM.trade, the precursor to DWF Labs.

Grachev was also implicated in a contentious project, Export.online, which intended to launch an ICO but retracted due to the 2018 bear market. Allegations arose regarding Grachev misappropriating approximately $157,000 of investor funds. The forklog article also mentions accusations against Grachev of defaulting on a debt of 10k in 2019 during his tenure at Huobi Russia.

The Enigma of VRM.trade

Demin and Grachev established VRM.trade, an HFT trading firm, whose operations and scale remain ambiguous. They purported to handle daily volumes of 10-20 billion USD. Zac Zou, a member of the VRM team and the founder of HTR Trade, is currently affiliated with DWF Labs. VRM was an investor in HTR Trade, alongside prominent Chinese VC, LDcapital. The VRM team also inaugurated their own OTC desk, Black Ocean.

The Flight of FLY (Franklin coin)

FLY was envisioned as the native token of the Black Ocean exchange. The token experienced a continual decline in price and currently holds a $350k market cap. Despite the decline, their Twitter and Medium accounts maintain activity.

The Emergence of DWF Labs

DWF Labs appears to be a rebranded version of VRM, with the last tweet from VRM Trade dated May 31st, 2022, and the registration of the DWF Labs domain on May 30th, 2022. The rationale behind the rebranding remains undisclosed.

On March 20th, 2023, DWF Labs transferred $7.5m in USDT to a wallet, which subsequently sent $163k to a wallet labeled as “AyeletNoff” on OpenSea. Ayelet Noff is the CEO of SlicedBrand, a PR agency. The purpose of this transaction is speculative, raising questions about whether it was intended to amplify media focus on DWF or to aid the marketing of projects DWF invested in.

This investigation endeavors to provide an unbiased and thorough examination of the history of DWF Labs and its key players. The information presented is intended to enlighten the crypto community and foster informed discourse on the subject matter.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.