A Bitcoin wallet that has been dormant for 10.3 years has suddenly become active, transferring all of its 687.33 BTC, worth approximately $43.94 million at current prices.

According to a tweet from Lookonchain, a blockchain analytics platform, the whale received 687.33 BTC on January 12, 2014, when the price of Bitcoin was just $917, making the total value of the transaction around $630,000 at the time.

The awakening of this dormant whale has sparked curiosity and speculation within the cryptocurrency community, as it is rare to see such a large amount of Bitcoin move after being idle for over a decade. The wallet address associated with this transaction is 15WZNLACuvcDrrBL2btDErJggnaMQtHh5G.

What you'll learn 👉

Bitcoin’s Pre-Halving “Danger Zone” and Historical Retraces

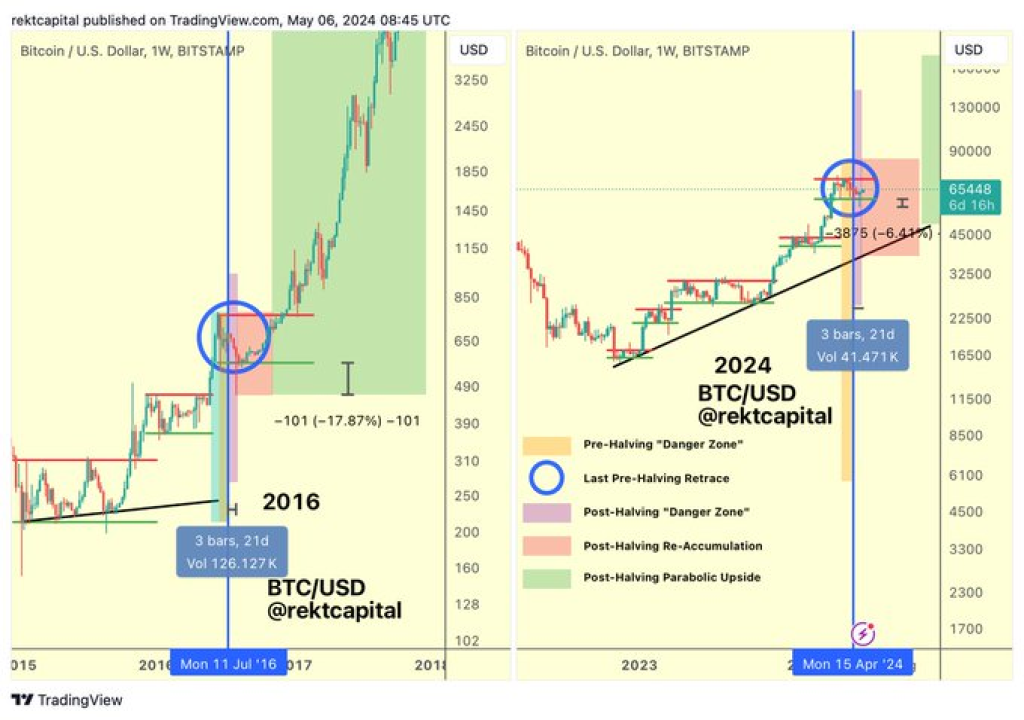

In a separate tweet, crypto analyst Rekt Capital discussed the concept of the Bitcoin “Danger Zone,” which refers to the period when historical pre-halving retraces have begun. According to the analyst, Bitcoin has typically experienced pre-halving retraces 14-28 days before the halving event.

In the current cycle, Bitcoin saw its first -18% pre-halving retrace approximately 30 days before the halving, closely mirroring the 2016 cycle, where the retrace began 28 days before the halving. This similarity suggests that history has repeated itself in terms of the timing of the pre-halving retrace.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The Bitcoin Post-Halving “Danger Zone” and Downside Volatility

Rekt Capital also highlighted the existence of a post-halving “Danger Zone,” which is a three-week window after the halving event where downside volatility below Bitcoin’s re-accumulation range low tends to occur. In 2016, Bitcoin experienced a long -11% downside wick approximately 21 days after the halving before reversing towards the upside.

In the current cycle, Bitcoin produced a -6% downside wick below its respective range low in the 15 days following the halving. This downside volatility has successfully occurred, and Bitcoin has since rebounded strongly to the upside, indicating that the post-halving “Danger Zone” is now over.

The awakening of the dormant Bitcoin whale and the transfer of 687.33 BTC after 10.3 years of inactivity have caught the attention of the cryptocurrency community. The substantial value of the transferred Bitcoin, which has grown from $630,000 to nearly $44 million, highlights the potential long-term benefits of holding cryptocurrency.

Also checkout: Analyst Shares Weekly Crypto Watchlist: Bitcoin (BTC), Jito (JTO) and Other Tokens in Focus

Meanwhile, Rekt Capital’s analysis of the pre-halving and post-halving “Danger Zones” provides valuable insights into the historical price patterns of Bitcoin surrounding the halving events. The similarities between the current cycle and the 2016 cycle suggest that history may be repeating itself, and understanding these patterns can help investors and traders make more informed decisions.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.