The resilience of memecoins like Dogecoin has ignited a heated discussion about the legitimacy of such assets. Despite being born as a satirical take on the crypto craze, Dogecoin has defied expectations by bottoming at $8 billion market cap amid the market turmoil lately. This unexpected strength has prompted analysts and investors to reevaluate their stance on memecoins, questioning whether these digital assets have transcended their humorous origins and solidified their place as a legitimate asset class.

What you'll learn 👉

Analyst Perspectives

Andrew Kang, a crypto influencer (@Rewkang), took to X to share his perspective on this phenomenon. He tweeted, “The biggest sign that memecoins are here to stay is Doge bottoming at $8 Billion. Solana bottomed at $4 Billion. What does that tell you? Society is placing real lasting value on memes. We are seeing memes develop into an asset class.”

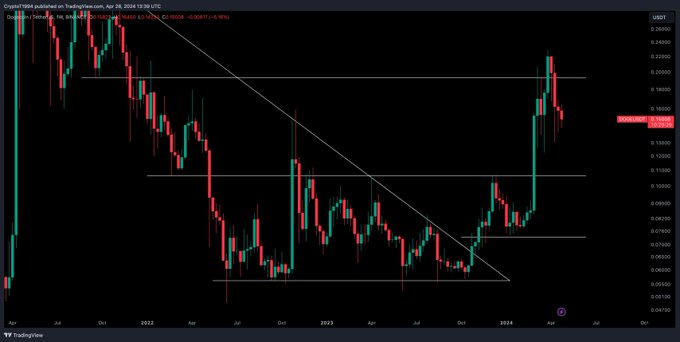

Kang’s assessment seems to align with the technical analysis shared by crypto analyst, Crypto Tony (@CryptoTony__). In a tweet, Crypto Tony highlighted a key support level for Dogecoin at $0.148, emphasizing that holding this level would be crucial for maintaining bullish momentum.

Consequently, he cautioned that a breach of this level could potentially lead to a retest of the $0.106 level. Moreover, to substantiate his analysis, Crypto Tony shared a weekly price chart for Dogecoin, which depicted a descending trend line, horizontal support and resistance levels, a significant breakout, and a subsequent price pullback.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Market Sentiments

Despite the optimism surrounding memecoins, skeptics remain unconvinced. Critics argue that the surge in popularity and market capitalization of these assets is driven more by speculation and hype than by any underlying utility or fundamental value. However, proponents counter that the very notion of value is subjective, and memecoins have managed to capture the imagination of a significant portion of the crypto community, thereby cementing their place in the digital asset landscape.

Hence, as the crypto market grows, the debate surrounding memecoins’ legitimacy as an asset class is likely to intensify. While their origins may be rooted in satire, the resilience of assets like DOGE in the face of market turmoil has undoubtedly challenged conventional wisdom. It remains to be seen whether this resilience will translate into long-term sustainability. However, one thing is clear: memecoins have carved out a niche for themselves in the crypto ecosystem, and their impact on the industry’s narrative is undeniable.

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.