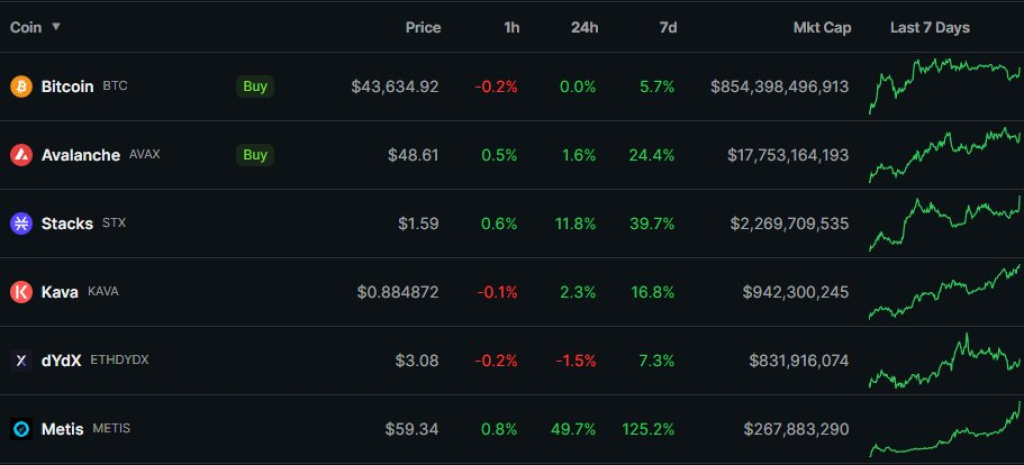

Popular crypto analyst DeFi Investor shared his latest watchlist today on Twitter, highlighting the top blockchain projects and cryptocurrencies that he believes could make big moves in the coming week. DeFi Investor is known for his prescient calls on both bluechip cryptocurrencies like Bitcoin and Ethereum as well as smaller cap altcoins.

In today’s watchlist, he points to key developments happening across decentralized finance stalwarts like Avalanche, layer 2 Ethereum solutions like Metis, and beta plays on Bitcoin like Stacks. Regulatory moves around the long-awaited Bitcoin spot ETF also make the list.

Let’s take a closer look at DeFi Investor’s crypto picks for the week ahead:

Bitcoin (BTC) – The SEC is expected to make final decisions on spot Bitcoin ETF applications by the end of this week. Approval could bring more institutional investment into Bitcoin and crypto markets.

Metis (METIS) – Metis plans to launch a $270 million ecosystem fund soon to support dApp development on its layer 2 scaling solution for Ethereum. This could attract more developers. It also has a major network upgrade coming in Q1 2024 which promises faster transactions and lower fees.

Avalanche (AVAX) – Avalanche tends to rally in price after big runs by Solana, its rival layer 1 blockchain. With Solana pumping recently, Avalanche may be next inline for its own price run.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Stacks (STX) – The testnet launch of Stacks’s big Nakamoto network upgrade is expected this week. This will bring smart contract functionality and better Bitcoin interoperability to the Stacks blockchain. As a leading BTC beta play, advancements by Stacks tend to benefit Bitcoin prices.

dYdX (DYDX) – Over $100 million worth of DYDX tokens will be unlocked January 1st, 2024. Most of these tokens will go to team members and investors, who may take profits by selling. This increase in token supply could create downward price pressure.

Kava (KAVA) – Kava will completely end its token inflation schedule on January 1st, 2024. With no new tokens being minted, KAVA could see increased scarcity and upside price potential.

That wraps up DeFi Investor’s crypto watchlist for the coming week. With major protocol upgrades, developer ecosystem funds launching, token unlocks, and the SEC’s big decisions on spot Bitcoin ETFs all happening over the next few days, it is sure to be an action-packed week across crypto markets.

You may also be interested in:

- Red-Hot Avalanche (AVAX) Surges Again Despite These Overbought Warnings

- Why is Polkadot (DOT) Price Up?

- Next Crypto Success: Experts Highlight a Promising Coin Following Injective and Bonk’s Performance

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.