Popular DeFi protocol Yearn Finance’s native token YFI plunged 45% in an apparent insider exit scam that vaporized over $250 million in market value instantly.

According to WhaleWire, Yearn Finance insiders are suspected of orchestrating a pump-and-dump scheme that left YFI holders scammed. This massive selloff comes right after YFI surged from $4,900 to $16,000 since mid-October.

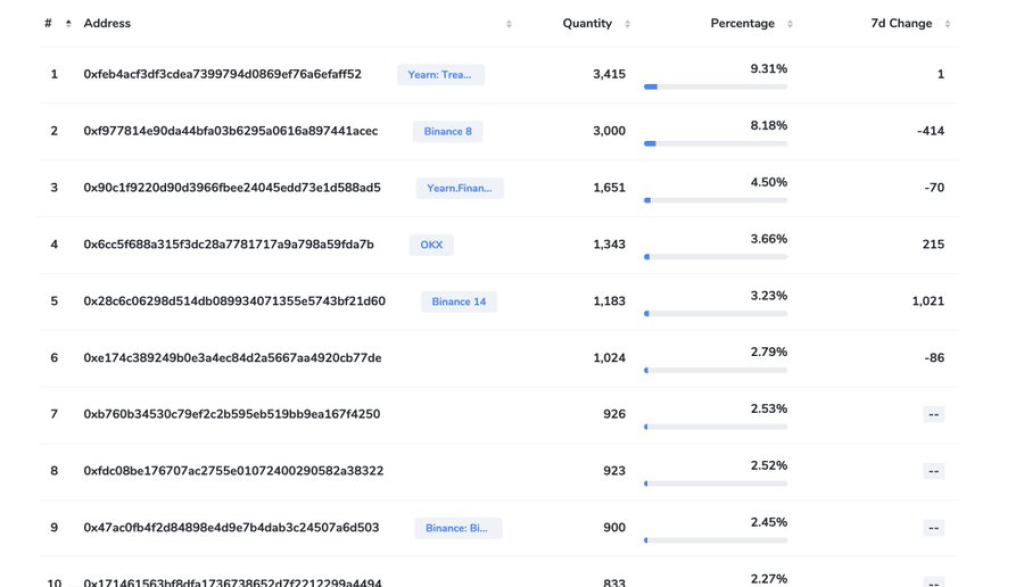

In hindsight, that rally now appears manipulated to prop up prices before insiders dumped their tokens. Nearly half the total supply of YFI is controlled by just 10 wallets, showing the concentration of tokens.

Once prices hit their peak, insiders cashed out, crashing YFI’s value in minutes. The scam demonstrates the continued risks in DeFi protocols with centralized token distributions.

Yearn Finance had cultivated an image as a leading DeFi protocol since launching in 2020. But this apparent pump-and-dump exit scam reveals potentially serious deficiencies in governance and trust.

The developers behind Yearn Finance will now face heavy scrutiny and backlash from the community following the collapse in YFI’s value. Faith in the project’s fundamentals is shattered.

Read also:

- Essential Cryptocurrencies to Acquire Before 2023 Ends

- Why This Analyst Says Avalanche Could ‘Trounce’ Solana Soon

- Mixed Reactions in Solana Community as Whale Unstakes Over $31M in SOL, Sends to These Exchanges

This serves as another warning to DeFi investors to vet token distribution schedules. Protocols controlled by a handful of insiders are susceptible to these pump-and-dump schemes that can decimate value instantly.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.