After a tumultuous few months of underperformance, the original decentralized finance (DeFi) tokens are once again taking center stage in the crypto market. A detailed analysis by the well-known trader and technical analysis expert Ignas, better known as @DefiIgnas on Twitter, reveals that these so-called DeFi 1.0 tokens are making a comeback.

In a comprehensive 13-tweet thread, Ignas meticulously broke down the factors behind the surge in DeFi 1.0 tokens, which have been outperforming the market recently. According to his analysis, the 30-day performance of top DeFi 1.0 tokens paints an impressive picture:

Compound (COMP) has seen a 154% increase, Maker (MKR) is up by 51.6%, AAVE has grown by 47.5%, Uniswap (UNI) has risen by 31.1%, Frax Share (FXS) increased by 30.6%, yearn.finance (YFI) grew by 30.3%, and DeFi Pulse Index (DPI) recorded a 28.1% growth. Interestingly, almost all these DeFi 1.0 tokens outperformed Ethereum (ETH) in the past 30 days.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The seasoned trader attributed this market behavior to possibly being a simple cycle rotation. With the market relatively quiet, traders may be seeking undervalued assets, and according to Ignas, DeFi 1.0 tokens offer at least three unique value propositions:

- Standing the Test of Time: Ignas mentions that DeFi 1.0 protocols like Aave, Compound, Maker, and Instadapp have been around since 2018, and have weathered significant market turmoil, including the 2020 Coronavirus crash and the 2022 CeFi collapse.

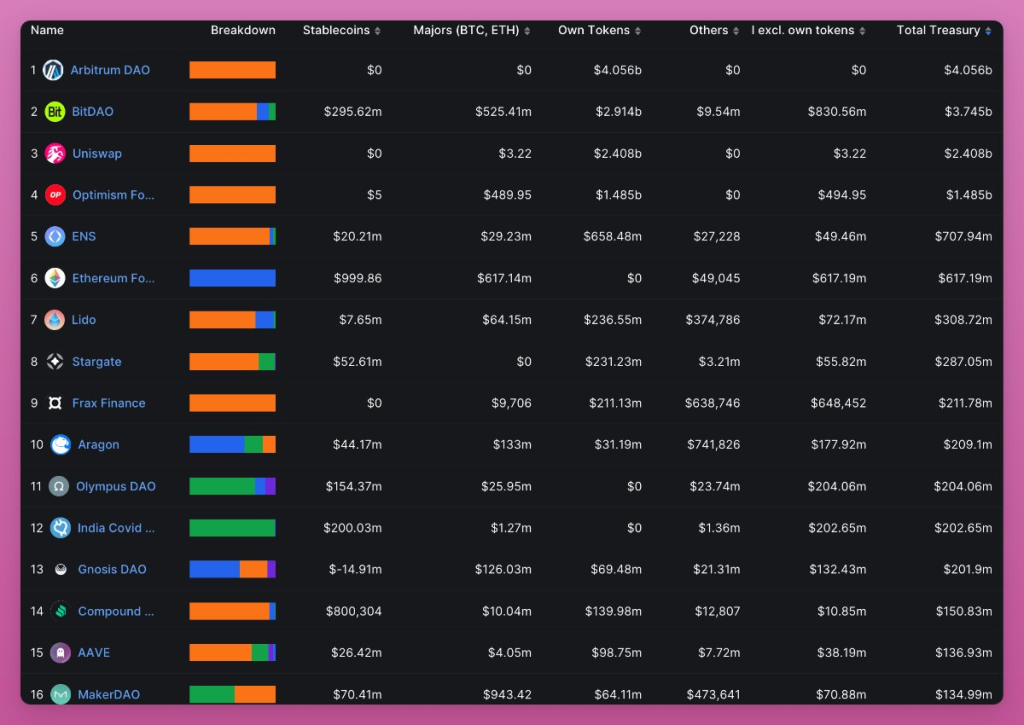

- Sound Financial Position: DeFi 1.0 protocols are in a solid financial position. Uniswap reportedly has $2.3 billion in treasury, while Compound, Maker, and Aave have between $135 million and $150 million USD earmarked for development.

- Continuous Development & Upcoming Upgrades: Ignas states that DeFi 1.0 protocols have evolved significantly since their inception. Aave and Compound have successfully rolled out their respective third iterations, while Synthetix and Instadapp are developing new features and protocols. For example, Aave and Curve are working on their respective stablecoins GHO and crvUSD, which promise increased capital efficiency and value proposal for their native governance tokens.

Despite the impressive performances and developments of DeFi 1.0 tokens, Ignas also expressed his optimism for newer protocols, such as LQTY, MORPHO, MAV, GNS, PENDLE, and GMX. According to him, they either build upon or complement the established DeFi 1.0 protocols.

The market will be watching closely to see how this resurgence plays out, and whether DeFi 1.0 tokens can continue to outperform Ethereum and other major cryptos in the days to come. To stay ahead of the curve, analysts and investors are advised to keep an eye on both the DeFi 1.0 tokens and the newer DeFi protocols, which represent the future of the decentralized finance landscape. As the DeFi market continues to evolve, experienced analysts like Ignas continue to provide invaluable insights to navigate these complex waters.