Based on data from Spot on Chain, several prominent crypto whales have embarked on a massive Ethereum (ETH) buying spree, propelling the price of the second-largest cryptocurrency to soar by 6% over the past 24 hours. The surge in demand has been fueled by a series of strategic moves from these deep-pocketed investors, underscoring the growing institutional interest in the Ethereum ecosystem.

What you'll learn 👉

Amaranth Foundation Founder’s Splurge

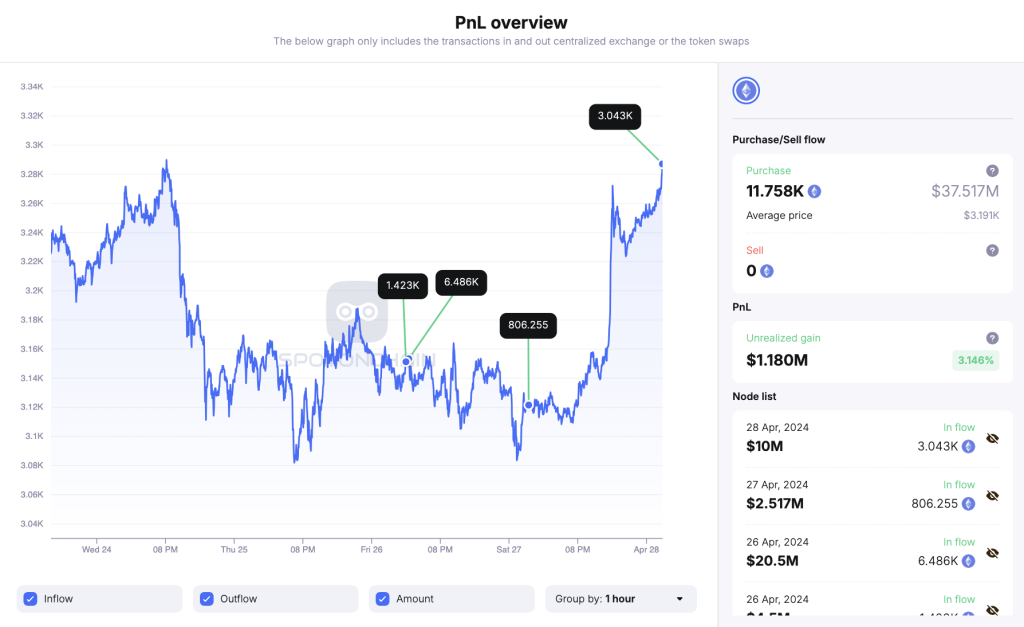

At the forefront of this buying frenzy is James Fickel, the founder of the Amaranth Foundation. Over the past 44 hours, Fickel has acquired 11,758 ETH, valued at approximately $37.52 million, using USDC stablecoins. This massive purchase was executed at an average price of $3,191 per ETH, with the tokens subsequently supplied to the decentralized lending platform Aave.

Fickel’s foray into Ethereum doesn’t stop there. In a strategic move to expand his long positions on the ETH/BTC trading pair, he has borrowed an additional 40 BTC (worth $2.51 million) from Aave over the past 24 hours, subsequently selling them for 806 ETH.

Since the start of 2024, the Amaranth Foundation founder has borrowed a total of 2,301 Wrapped Bitcoin (WBTC) worth around $145 million from Aave, converting them into 41,944 ETH. The cost basis of his ETH/BTC trading pair stands at an impressive 0.055, highlighting his conviction in Ethereum’s potential.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Binance Withdrawals and Market Impact

The buying frenzy extends beyond Fickel’s activities. Another prominent whale, has withdrawn a substantial 14,146 ETH (worth approximately $45.3 million) from the Binance exchange over the past 17 hours. This withdrawal was executed in two transactions at an average price of $3,204 per ETH, resulting in an unrealized profit of $1.39 million (3.06%) following the recent price surge.

Notably, the first transaction from this whale preceded the 6% spike in ETH’s price, which was reportedly triggered by the addition of Franklin Templeton’s ETH ETF to the Depository Trust & Clearing Corporation (DTCC) ETF list. This strategic timing suggests that the whale may have anticipated the bullish market reaction.

In addition to the Ethereum withdrawals, the same whale also withdrew 95.67 million USDT from Binance. Based on their similar behavior, this whale (0x205) may be linked to the “Giant ETH Whale” (0x435), which has withdrawn a colossal 176,117 ETH (currently worth $551 million) from Binance since March 31, 2024.

Institutional Interest and Market Outlook

The concerted efforts of these whales have undoubtedly contributed to the recent surge in Ethereum’s price, which has risen by 6% over the past 24 hours. This bullish momentum is further bolstered by the addition of Franklin Templeton’s ETH ETF to the DTCC ETF list, signaling growing institutional interest in the Ethereum ecosystem.

The continued participation of prominent institutional players and whales is expected to drive increased liquidity and stability, paving the way for broader adoption and mainstream recognition of blockchain technology and digital assets.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.