Crypto trader Michael Pizzino has made a bold prediction about Bitcoin’s price trajectory, forecasting a potential additional 15-20% drop despite the cryptocurrency already experiencing a 10% decline. This prediction comes as part of what Pizzino describes as the “final leg” of the current bull market.

What you'll learn 👉

Pizzino’s Bullish Outlook Amid Price Corrections

In a tweet, Michael Pizzino (@PizzinoMichael) stated, “Bitcoin is gearing up for its FINAL LEG in the bull market. IT IS TIME TO BE BULLISH.” This optimistic stance comes despite his acknowledgment of ongoing price corrections.

Pizzino recalled his previous prediction of a potential 30% correction, which he claims was met with significant backlash, becoming his “most disliked video in history.” He interprets this negative reception as a market signal in itself.

Current Market Status and Further Dip Potential

According to Pizzino, the market has already dropped 10% following his initial prediction. However, he warns that there’s still potential for another 15-20% drop, which he considers the “worst case” scenario.

Despite this bearish short-term outlook, Pizzino advocates for a shift to “bull mode,” encouraging traders to “go fishing for the end of the correction.” He believes the crypto market is preparing for what he terms “Wave 5,” suggesting an upcoming phase of the market cycle.

The crypto trader’s analysis aligns with ongoing market trends, as Bitcoin’s price has dropped by 7% in the last 10 days. Currently, the leading cryptocurrency is testing a critical support level that has held firm for the past 26 days.

Short-term Projections and Support Levels

If the current support level holds, analysts anticipate a price recovery that could potentially push Bitcoin to $69,000. However, if this support fails, the price might initiate a decline from $65,000. A breakdown below this level could see Bitcoin’s value fall further to the next support at $63,000.

Despite these short-term fluctuations, the long-term outlook for Bitcoin remains bullish, based on general market sentiment and on-chain analysis.

On-chain Analysis Reveals Increased Buying Interest

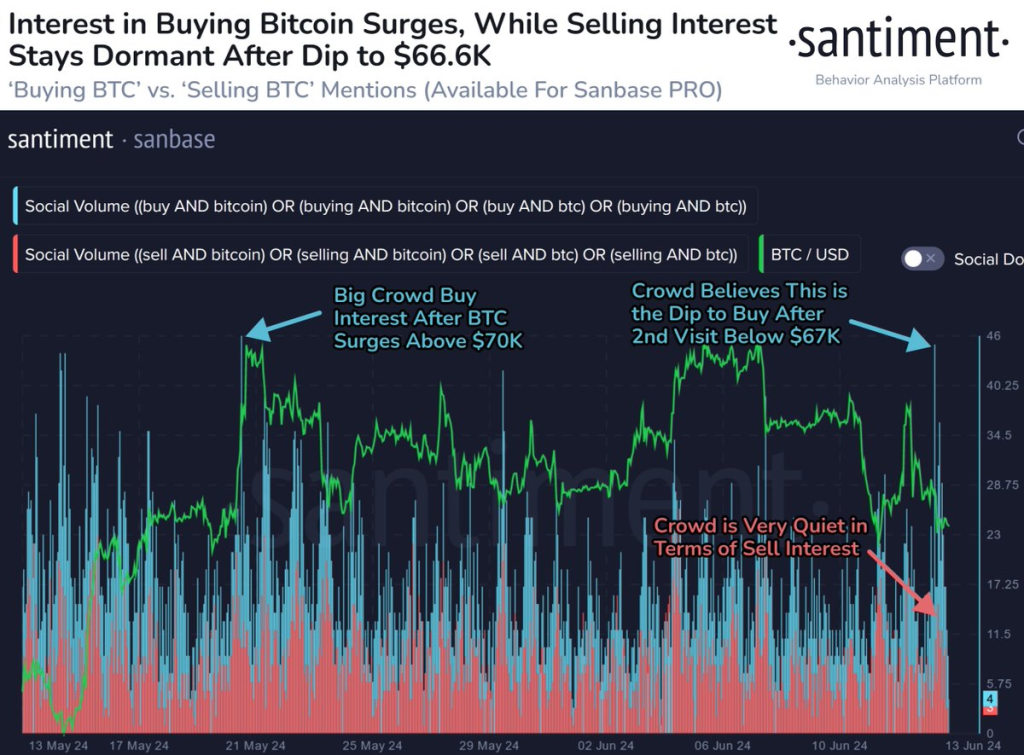

Data from Santiment (@santimentfeed) indicates a significant spike in Bitcoin buying interest following the recent price dip below $67,000. This surge represents the second-largest increase in crowd buying interest over the past two months.

Source: Santiment – Start using it today

Santiment’s analysis highlights two scenarios driving this behavior:

- Price eruptions leading traders to buy in hopes of continued growth.

- Price drops prompting traders to buy, believing the dip to be unwarranted and anticipating a quick recovery.

Pizzino suggests that the crypto market is gearing up for “Wave 5,” implying that we’re entering a new phase of the market cycle. This perspective encourages a shift to a more bullish stance, despite the potential for short-term price corrections. In addition, while short-term volatility persists, the overall market sentiment remains positive.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.