Ali, a prominent crypto analyst, has made a bold prediction regarding Bitcoin’s future price trajectory, suggesting that if the Long-Term Power Law holds, Bitcoin could reach around $400,000 in the next market cycle.

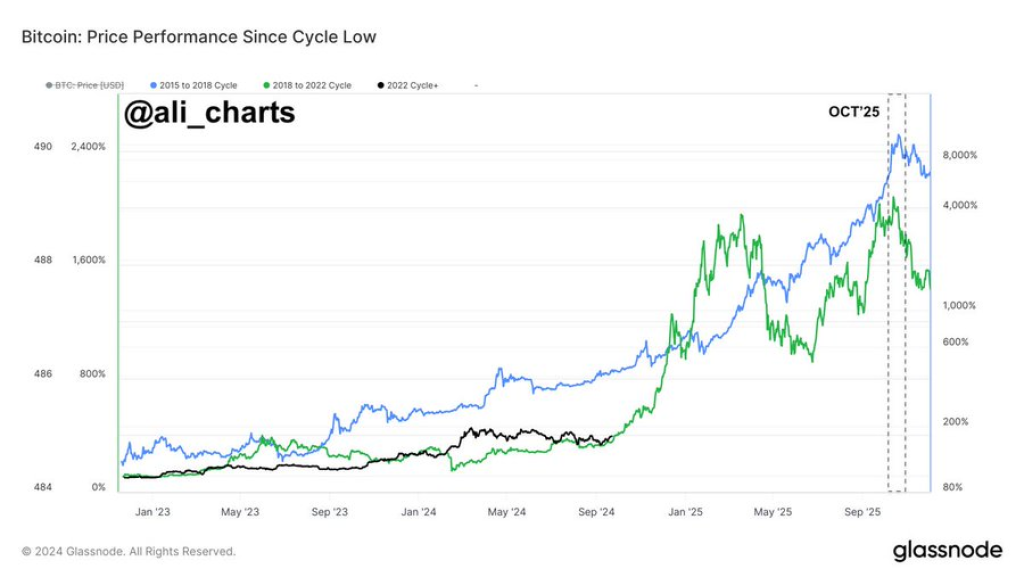

The analysis is based on a logarithmic price chart that tracks Bitcoin’s historical price movements, highlighting significant trendlines that illustrate its long-term behavior. Here are some critical data points from the chart:

What you'll learn 👉

BTC Price Prediction Based on the Power Law Model

- $392,532.17: Projected price around 2025, indicating a potential market peak if the Long-Term Power Law continues to hold.

- $104,693.17: A mid-level price projection for the same timeframe.

- $63,569.34: An earlier resistance level.

- $37,146.75: A long-term support level.

Context of Ali’s Tweet

Ali refers to the Long-Term Power Law, which posits that Bitcoin’s price tends to follow a predictable logarithmic growth pattern over time. This suggests that future price peaks and troughs can be anticipated based on historical data.

The chart illustrates a long-term resistance line (in purple) that aligns with this power law. If Bitcoin’s price movements continue to adhere to this pattern, the next major bull cycle could see Bitcoin reach the projected peak of approximately $400,000.

Read Also: Near Protocol Finally Breaks Out of a Strong Resistance: What’s Next for NEAR Price?

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Analysis of Bitcoin’s Cyclical Behavior

Bitcoin has historically demonstrated a cyclical pattern, with market tops occurring roughly every four years, often coinciding with BTC halving events. The next significant peak is expected around 2025, following the halving that happened in April 2024.

The primary price projection of $392,532.17 indicates that if Bitcoin maintains its historical power law, this could mark the next cycle’s peak.

Future Market Top Prediction

Ali also posted in another tweet that Bitcoin could see a peak in October 2025, based on the prem,ise that it repeats what happened in the last two cycle.

This reinforces the idea that if Bitcoin’s current cycle mirrors the previous two, a significant peak could indeed occur in the near future.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.