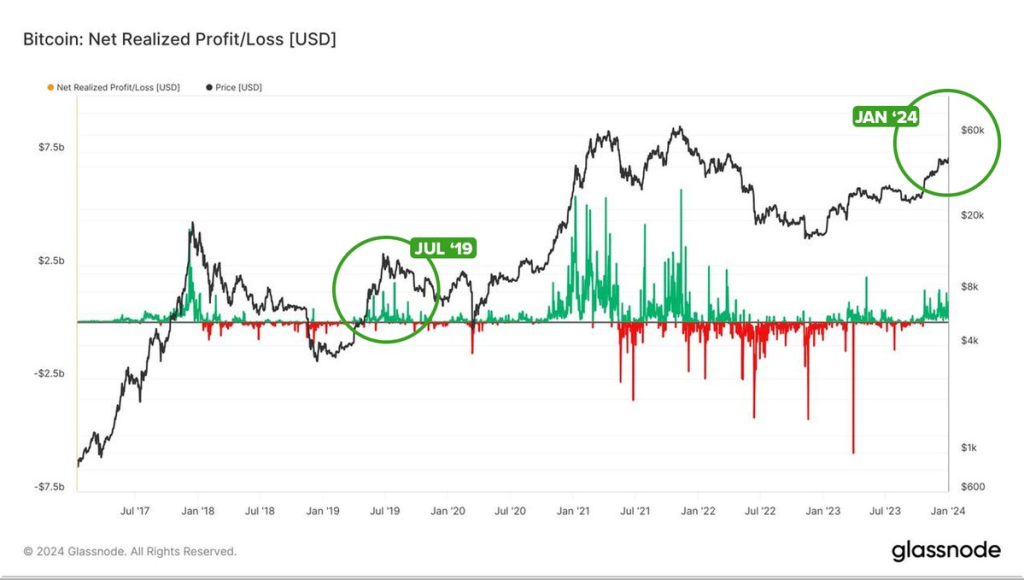

Crypto analyst Cryptonary drew parallels between the current market conditions and July 2019 based on on-chain data analysis. There are some key differences that could mean a larger correction is incoming.

“The difference is we’re currently 4 months out from a Bitcoin halving, in july 2019, we were 10 months out,” said Cryptonary.

The shorter time period leaves less room for price discovery ahead of one of Bitcoin’s most significant supply constraints—one that has historically led to bull markets.

With such a macro catalyst looming on the horizon, there is a chance hype and speculation have driven prices artificially higher in the short term. A pullback in Q1 could provide an opportunity to buy Bitcoin at lower prices before the halving supply shock kicks in. But it also carries more downside risk given its proximity to the event.

Cryptonary also drew attention to this week’s decision on the Bitcoin ETF filed by VanEck over a decade ago.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +If approved, it would mark the long-awaited opening of the floodgates for mainstream crypto investment through traditional brokers and retirement accounts.

Expect lots of volatility and noise as big money starts pouring into an asset class many have been waiting years to get exposure to.

For investors, the advice is to stay calm and focused on the long term, because this decision has the potential to bring unprecedented levels of capital into our industry.

You may also be interested in:

- Router Protocol Bullish Following MATIC’s Early Success: Why ROUTE Will Secure Coinbase Listing This Year

- Bitcoin Hits $46,000 For First Time In Over Two Years On ETF Approval Hopes

- Holders From Pepe (PEPE), Dogecoin (DOGE), and Uniswap (UNI) Rush To Jump Into Early Stages Of Pushd (PUSHD) Presale

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.