A wave of geopolitical tension has washed over the global markets this weekend after reports emerged that the United States carried out direct airstrikes on three major nuclear facilities in Iran. Former President Donald Trump, who authorized the operation, announced that the sites were “obliterated,” warning of even harsher responses if Iran retaliates.

The move follows more than a week of escalating crossfire between Israel and Iran, but this latest strike marks a sharp escalation. With roughly 40,000 U.S. troops stationed in the region, fears of broader conflict are rising fast. Political fallout in the U.S. has also been swift, with Rep. Alexandria Ocasio-Cortez calling for impeachment proceedings, while others defend the strike as a necessary step to stop Iran’s nuclear ambitions.

Global analysts are warning that retaliation could come in many forms – not just direct military responses, but also cyberattacks, attacks via regional proxies, or threats to oil trade routes in the Gulf. The situation is still developing, but the impact is already being felt in crypto markets.

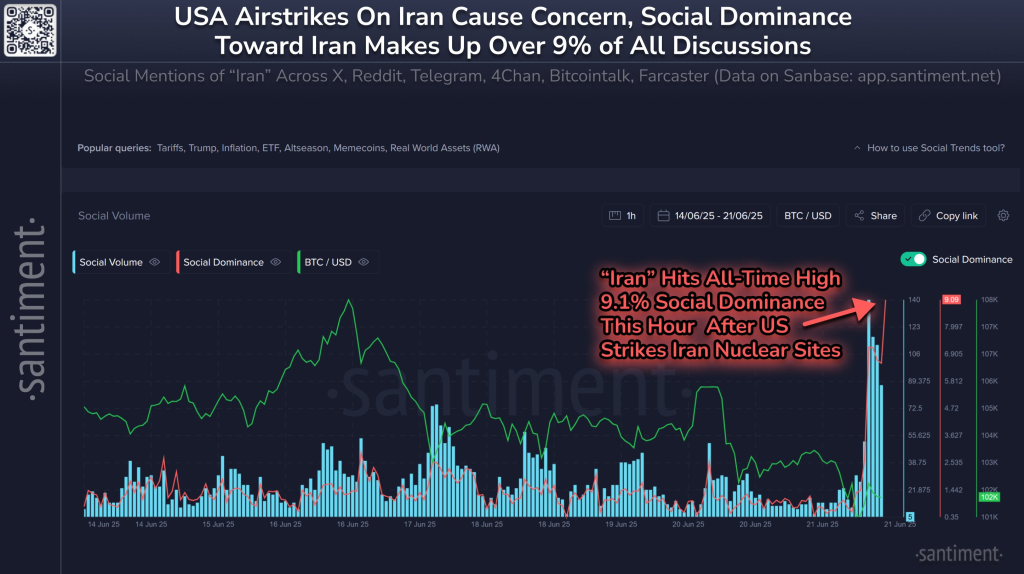

According to blockchain analytics firm Santiment, social media mentions of “Iran” exploded instantly after the news dropped. Investors are clearly watching the headlines closely, even if immediate market reactions have been mixed.

Bitcoin Holds, But Ethereum and Alts Suffer

Interestingly, Bitcoin has remained relatively stable through the weekend so far. Analysts suggest this may be due to timing – the airstrikes happened at night in the U.S. on a Saturday, when markets are typically quieter.

However, Ethereum and the broader altcoin market are not faring as well.

Ethereum has slipped below the key $2,300 support level, dragging many altcoins down with it. Several Layer 1 and DeFi tokens are posting daily losses of 5% to 10%, as traders begin to price in the uncertainty of potential global conflict.

Altcoins are often hit hardest in times of geopolitical unrest, as investors tend to rotate out of riskier assets and back into either Bitcoin or stablecoins. With volatility likely to increase as Western markets wake up and react to the news, the next 24 to 48 hours could bring sharper moves.

What Comes Next

While no full-scale market panic has emerged yet, that could change quickly if tensions escalate further or oil markets react strongly when they reopen. For crypto traders, the weekend is rarely a time to relax – and this one is proving especially charged.

Santiment’s social data will likely be a key resource in the coming days, as it helps track whether fear is spreading or cooling. For now, markets remain on edge, Ethereum is under pressure, and the next headline could decide the direction of the entire space.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.