Crypto markets have undergone their fastest correction in 4 months, with total capitalization shedding nearly 5% over the past day. The decline has sparked some trader concerns amid growing fears of a global economic slowdown weighing on risky assets in 2023.

According to analytics provider Santiment, buy-the-dip calls are high, indicating a degree of overeagerness and FOMO that often surfaces at local price bottoms.

Source: Santiment – Start using it today

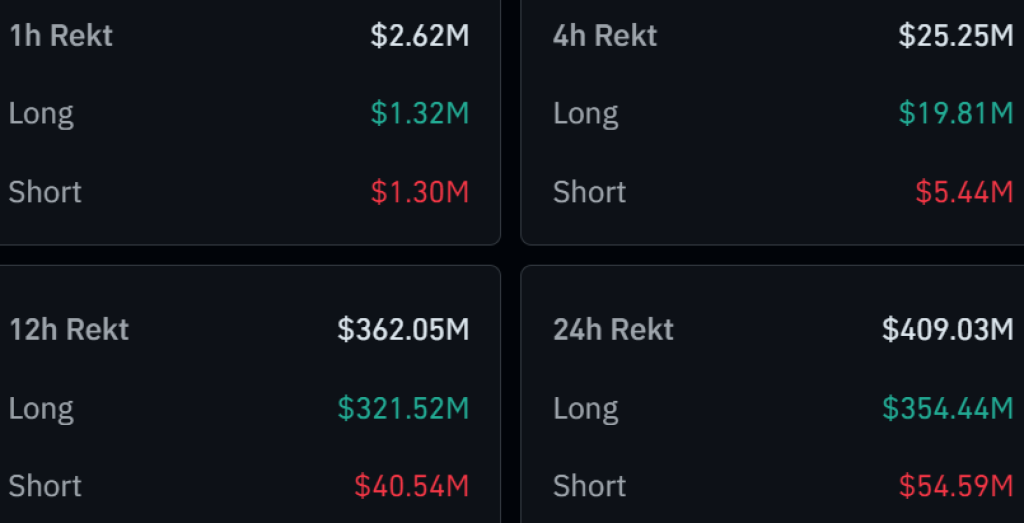

Moreover, cascading margin liquidations have accelerated the downward spiral. Data from Coinglass shows $408.88 million worth of positions have been force-closed over the past 24 hours amid swelling volatility.

In particular, a sharp leg lower over the past 45 minutes has liquidated around $150 million worth of leveraged bets. This massive wave of liquidations likely placed significant selling pressure on already shaky markets.

Read also:

- Chainlink (LINK) Nears Make-or-Break Resistance Level

- Why Has Avalanche (AVAX) Pumped 300% in Two Months?

- Rebel Satoshi Demonstrates BIG Profit Potential: How Do Ethereum (ETH) and Avalanche (AVAX) Compare?

Ultimately, this week’s pending economic data and events may prove decisive for charting crypto’s next moves. But excessive leverage and eager dip-buying in the face of macro uncertainty could expose traders to further downside risk. Tighter risk management and prudent position sizing are warranted given the current conditions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.