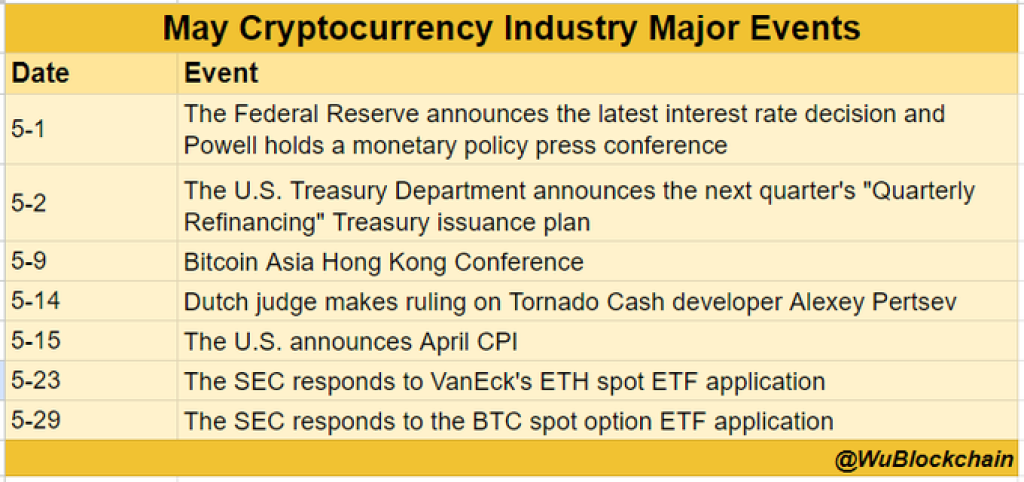

The month of May brings a flurry of significant events to the cryptocurrency world, each poised to leave its mark on the market. Chinese journalist Wu Bockchain has compiled the key events that could affect the crypto market this month.

What you'll learn 👉

Fed Chair Jerome Powell Monetary Policy Press Conference and Interest Rate Decision

Fed Chair Jerome Powell will hold a monetary policy press conference after the Federal Reserve announces its latest interest rate decision on May 1. Changes in interest rates have a significant impact on the prices of cryptocurrencies.

When interest rates increase, investors tend to shift their behavior and preferences, which affects the dynamics of the cryptocurrency market. Safer assets such as bonds become more appealing to investors compared to riskier investments like cryptocurrencies. Bonds offer higher returns and are considered a more secure option. Consequently, the attractiveness of cryptocurrencies diminishes, leading investors to move their funds to interest-bearing assets like bonds.

Additionally, higher borrowing costs associated with rising interest rates make it more expensive for crypto investors who use leverage. Leverage allows investors to amplify their potential gains but also exposes them to higher risks. When borrowing costs increase, investors may be forced to sell their crypto holdings to cover their borrowing expenses, leading to further selling pressure and exacerbating price declines.

U.S. Treasury Department to Release “Quarterly Refinancing” Treasury Issuance Plan

The U.S. Treasury Department is scheduled to announce its next quarter’s “Quarterly Refinancing” Treasury Issuance Plan on May 2. This announcement will provide insights into the government’s borrowing plans and could influence market sentiment and the demand for safe-haven assets, such as Bitcoin and other cryptocurrencies.

The size and makeup of Treasury debt issuances can have broader market implications, potentially extending to the crypto market.

Bitcoin Asia Hong Kong Conference Gathers Industry Leaders

The Bitcoin Asia Hong Kong Conference, scheduled for May 5-9, is set to occur at the Kai Tak Cruise Terminal in Hong Kong. This conference holds great importance for individuals passionate about Bitcoin, as well as investors and influential figures in the industry, who will converge from various parts of the globe. Participants will discuss the unveiling of groundbreaking announcements, extensive media coverage, and captivating discussions led by prominent thought leaders and innovators within the Bitcoin sphere.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Dutch Judge to Rule on Tornado Cash Developer Alexey Pertsev

In August 2022, Alexey Pertsev, a Russian developer involved in the Tornado Cash privacy protocol, was arrested by Dutch authorities on accusations of facilitating money laundering. However, on April 20, 2023, a Dutch court made a decision to release Pertsev from jail and allow him to await his trial from home, under the condition of wearing an ankle monitor. This ruling marked a reversal of previous determinations to keep him detained.

Pertsev’s trial is scheduled to commence on May 24, 2023. The Dutch prosecutors have charged him with engaging in repeated money laundering activities involving more than 500,000 ETH, which they believe originated from criminal sources. The upcoming ruling on May 14 will likely focus on Pertsev’s residential status, which may expire in July. This aspect could play a crucial role in determining whether he will be permitted to remain free until the trial. The outcome of Pertsev’s trial carries significant implications for the wider cryptocurrency industry.

U.S. to Announce April CPI Data

The anticipated release of the April 2024 U.S. Consumer Price Index (CPI) data is expected to have an impact on the cryptocurrency market, particularly on the prices of Bitcoin and other cryptocurrencies. Volatility is likely to occur around the time of the CPI data release.

If the CPI data reveals a higher-than-expected inflation rate, it could lead to a decrease in investor sentiment towards riskier assets, including cryptocurrencies. This is because higher inflation may prompt concerns about the purchasing power of fiat currencies and the overall stability of the financial system.

On the other hand, if the CPI data shows a lower-than-expected inflation rate, it may reignite expectations that the Federal Reserve, the central bank of the United States, could consider cutting interest rates sooner. This possibility could be viewed as positive for cryptocurrencies, as lower interest rates can stimulate economic growth and increase the attractiveness of alternative investments like Bitcoin and other digital assets.

SEC to Respond to VanEck’s and WisdomTree’s ETH Spot ETF Applications

The U.S. Securities and Exchange Commission (SEC) is expected to respond to VanEck’s ETH spot ETF application on May 23 and WisdomTree’s ETH spot ETF application on May 29. These decisions are crucial for the cryptocurrency market, especially for Ethereum (ETH). Approval of the ETFs would provide a regulated investment vehicle for ETH, potentially attracting more institutional investors, increasing liquidity, and driving up the price.

On the other hand, if the SEC denies the applications, it could lead to a decline in ETH’s price and reduced investor interest, as regulatory barriers would remain a hindrance to broader participation in the Ethereum ecosystem through regulated investment products.

Unlike the events in April, the market has a clearer picture of what to expect from the major crypto-related events scheduled for May. These events, ranging from monetary policy decisions to regulatory developments and ETF applications, have the potential to significantly shape the trajectory of the cryptocurrency market in the coming weeks and months.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.