Crypto investors are often tempted to focus solely on altcoins, lured by the promise of massive returns during bull markets. However, as Trade Travel Chill, a crypto analyst, points out in an X thread, neglecting Bitcoin in favor of altcoins is misguided advice. We will discuss the analyst’s thoughts in the following paragraphs.

With over 2.2 million altcoins currently in existence and only one Bitcoin, the odds of picking the right altcoin are slim. In contrast, Bitcoin stands as a singular, reliable choice for investors.

What you'll learn 👉

Reducing Overall Portfolio Volatility

Bitcoin is considered a high-risk investment in the financial world. As such, even a Bitcoin-inclusive portfolio is already inherently high-risk. By diversifying with Bitcoin, investors can reduce the overall volatility of their crypto holdings.

Trade Travel Chill emphasizes that when Bitcoin’s price drops and its dominance (BTC.D) rises, altcoins tend to experience even more severe losses. An all-altcoin portfolio can see losses of up to 40%, while Bitcoin may only be down 10%. Holding Bitcoin mitigates the pain and panic associated with such severe drops.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Read more: Top Crypto Unlocks This Week: SPACE ID (ID) and Merlin Chain (MERL) Joins the Top 7

Building a Balanced Portfolio

Constructing a well-balanced portfolio for the bull market involves more than simply choosing between Bitcoin and altcoins. Trade Travel Chill highlights that factors such as age, responsibilities, available capital, and market knowledge should all be taken into account.

Blindly following wealthy influencers can be dangerous, as they may be able to afford sustaining losses and reinvest in bleeding altcoin portfolios, while most investors cannot. A responsible portfolio includes Bitcoin to act as a safety net against potential losses.

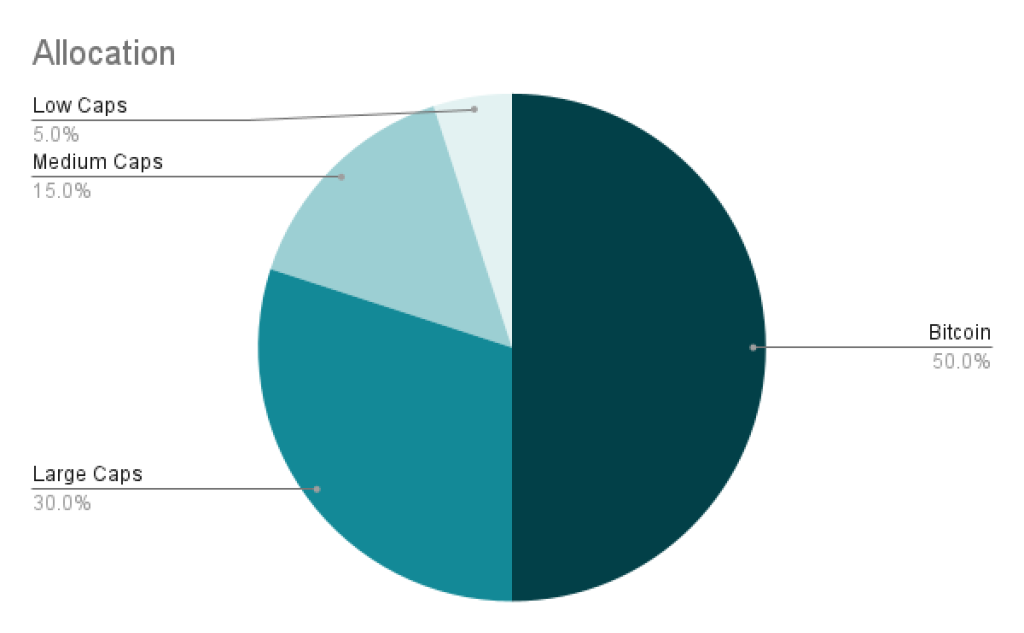

Trade Travel Chill recommends that a balanced altcoin portfolio should include a substantial portion of Bitcoin, followed by high-cap, mid-cap, and a few low-cap “degen” plays. Allocating 100% of one’s portfolio to low-cap plays is considered excessively risky.

The analyst advises that an investor’s portfolio strategy should reflect their age, time horizon, responsibilities, and capital. Those with more time and capital can afford a higher risk tolerance, while those with less time and capital should adopt a more conservative approach.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.