The actions of certain influential investors often capture the attention of the community. One such entity, commonly referred to as a “whale”, has recently made a series of significant transactions that have left many speculating about their motives.

The whale in question has been particularly active in the market, making substantial purchases of various cryptocurrencies. Some of the notable transactions shared by on-chain analyst Lookonchain reveal that:

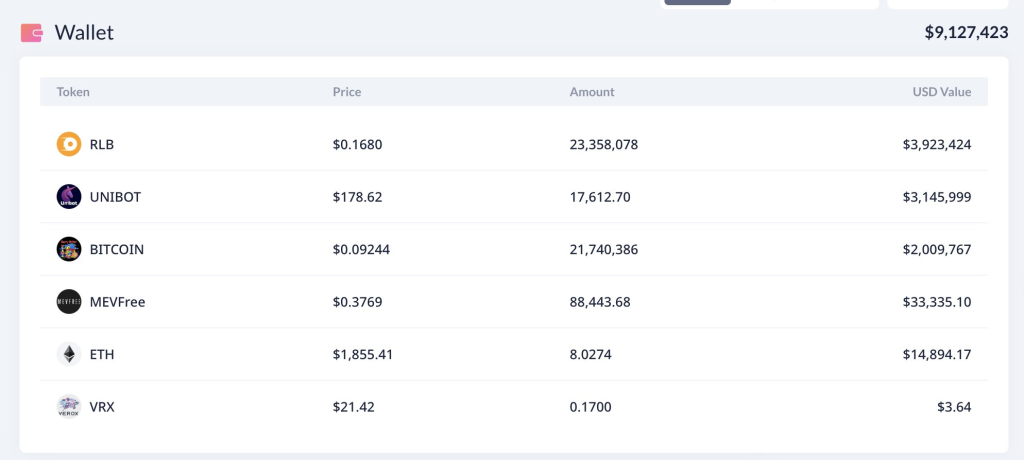

- A purchase of 23.36M $RLB for a staggering 1,430 $ETH, equivalent to $2.62M. This investment has since yielded a profit of approximately $1.3M, marking a 50% increase.

- An acquisition of 17,613 $UNIBOT, costing 1,360 $ETH or $2.53M. This move has garnered a profit of around $618K, a 24% gain.

- A somewhat less fortunate investment in $BITCOIN, where the whale bought 21.74M BTC for 1,125 $ETH, which is about $2.06M. This particular transaction resulted in a loss of $52K, a 3% decrease.

Furthermore, it was revealed that the same whale had previously invested a total of 2,885 $ETH, which is approximately $5.33M, in $UNIBOT, $RLB, $BITCOIN, and $MEVFree over a span of a little over two weeks.

As of the latest reports, the whale’s holdings include 1,085 $ETH, valued at nearly $1.96M, and it appears that the buying spree is far from over.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +These transactions have led to a flurry of discussions and speculations within the community. While some believe that the whale might have access to insider information, others argue that it could simply be a strategic move based on market analysis.

The actions of large cryptocurrency investors often spark intrigue and speculation among smaller investors, leading many to consider mirroring their moves. However, it’s essential to approach such strategies with caution. While these investors may have access to a wealth of resources, market insights, or even potential insider information, their investment strategies might not align with the risk profiles or financial goals of individual investors.

Moreover, the sheer volume of their transactions can significantly sway market dynamics, a luxury that smaller investors don’t possess. Following a whale’s lead might seem tempting, given their seemingly strategic moves and substantial capital. Still, it’s crucial for individual investors to conduct their own research, understand the inherent risks, and ensure that any investment decision aligns with their personal financial landscape and risk tolerance.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.