Trader and analyst AltCryptoGems (@AltCryptoGems) has provided a detailed analysis of Bitcoin’s price action, shedding light on the well-defined consolidation range it has been trading within for the past 60 days. In a tweet, AltCryptoGems highlighted the clearly demarcated levels of the range, including the range high, mid-range, and range low, which market participants have consistently respected.

What you'll learn 👉

Exercising Caution in Approaching the Range

AltCryptoGems emphasizes the importance of exercising caution when approaching the range, advising against blindly buying Bitcoin simply because it is nearing the range low. Instead, the analyst suggests waiting for specific conditions to manifest before entering positions. Moreover, these conditions include a proper sweep of all the lows, a deviation back into the range, and a bullish market structure break.

To navigate the range effectively, AltCryptoGems recommends monitoring the 30-minute EMA200 for guidance on the lower timeframe trend. This exponential moving average has been acting as support and resistance in recent days, providing valuable insights into potential entry and exit points.

Uptrend Resumption and Funding Rates

On higher timeframes, AltCryptoGems underscores the significance of the 4-hour EMA200 as a key indicator for a potential uptrend resumption. Conversely, Bitcoin is currently trading well below this level, suggesting that a strong bullish momentum has yet to materialize. Additionally, the analyst notes that funding rates across various trading platforms are positive, indicating that market participants are more exposed to short positions than long positions.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Low Market Participation and Limited Liquidity

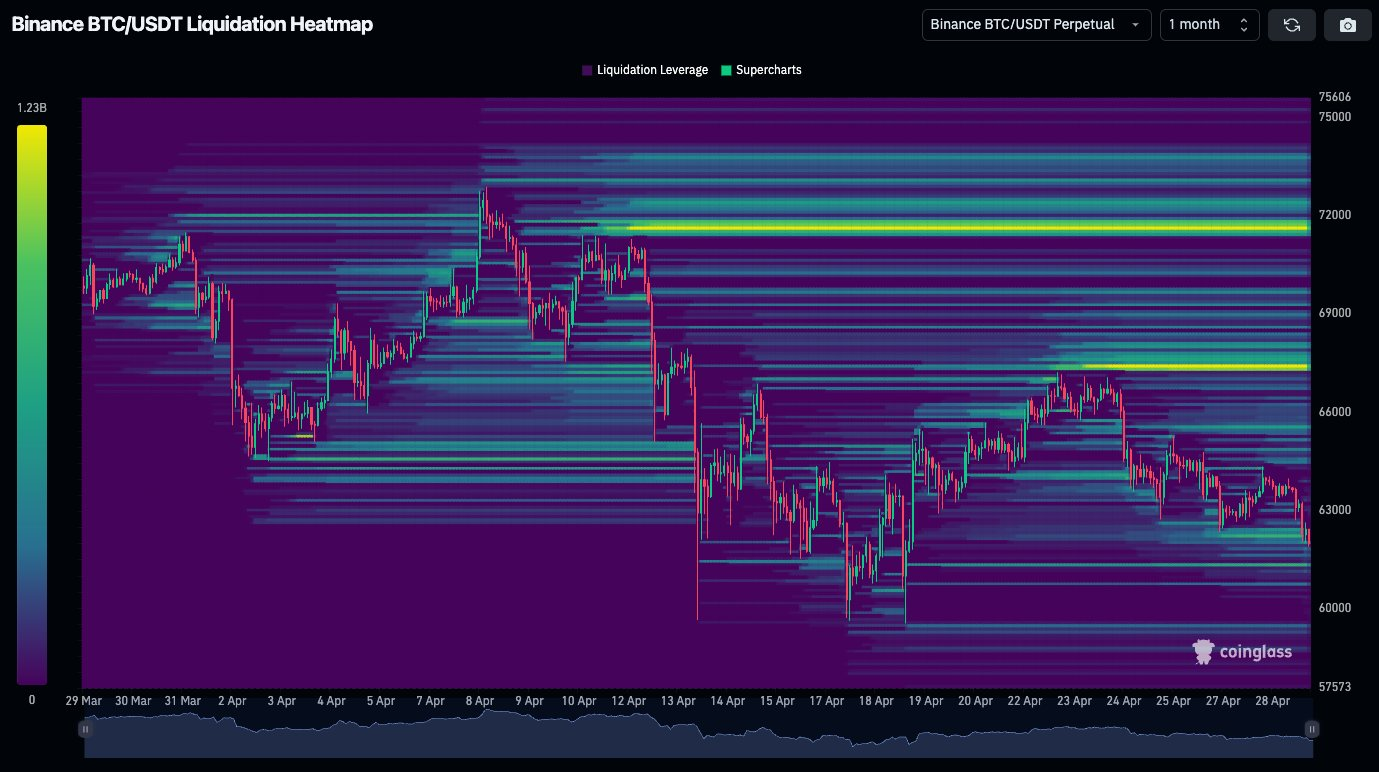

Moreover, according to AltCryptoGems, market participation is relatively low, suggesting that most traders are likely adopting a wait-and-see approach to gauge how the consolidation will ultimately resolve.

Furthermore, the analyst points out that there is limited liquidity below the current price level, with only a small cluster of orders observed below the untapped lows mentioned earlier.

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.