Prominent analyst Ash Crypto has laid out a roadmap for Bitcoin’s path to $150,000. The forecast draws parallels between current market patterns and historical trends, offering a bullish perspective on Bitcoin’s future trajectory.

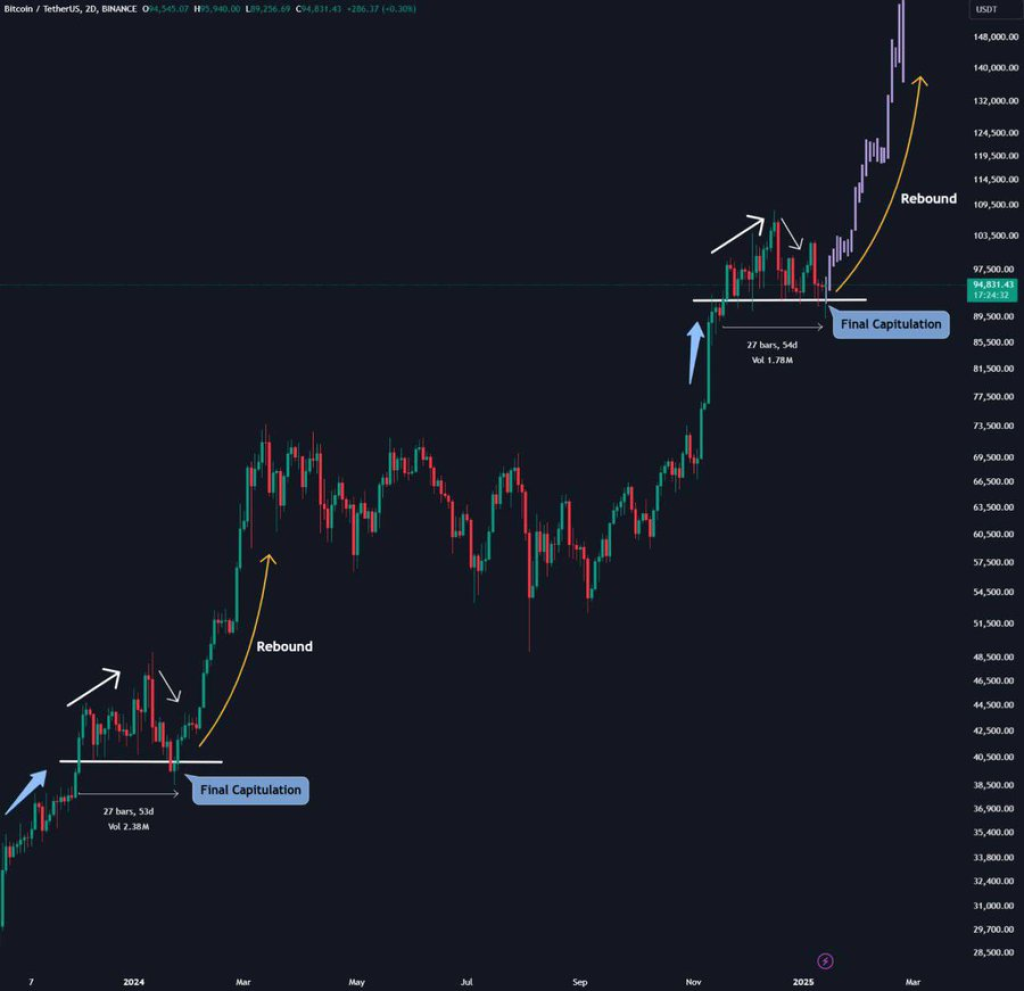

Looking back at January 2024, Ash Crypto’s analysis begins with the Bitcoin ETF approval hype, which drove prices to $49,000. However, what followed was a significant 20% correction, pulling Bitcoin below $40,000.

Despite substantial ETF inflows, market sentiment turned bearish, with many observers prematurely calling for a market downturn. Yet, according to Ash Crypto, this correction set the stage for an impressive 90% surge by March.

What you'll learn 👉

The Political Catalyst and Market Dynamics

The analyst’s timeline extends into January 2025, where Ash Crypto identifies Trump’s victory as a major catalyst pushing Bitcoin to $108,000. Similar to the ETF-driven rally, this surge was followed by another 20% correction, bringing prices below $90,000.

Ash Crypto notes that market participants are currently overlooking two critical factors: Trump’s crypto-friendly policy plans and the upcoming FTX token distribution.

BTC Path to New Heights

Drawing parallels with the January 2024 pattern, Ash Crypto suggests we’re on the cusp of another significant breakout. The analyst maintains that these market conditions, combined with the overlooked positive catalysts, will drive Bitcoin to new all-time highs during the first quarter of 2025.

Read Also: Expert Analyst Reveals Upcoming 150% Spike for Chainlink (LINK), Identifies Entry Point

What makes Ash Crypto’s analysis particularly interesting is the identification of a recurring pattern: major catalysts driving prices up, followed by 20% corrections, and then explosive recoveries. This cycle appears to be playing out with remarkable consistency, lending credibility to the prediction of Bitcoin reaching $150,000.

The forecast aligns with the broader market dynamics of Bitcoin’s post-halving periods, where significant price appreciation typically follows initial volatility. While Ash Crypto’s prediction might seem ambitious to some, the detailed analysis of market patterns and catalysts provides a thoughtful framework for understanding potential price movements in the coming months.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.