Although Bitcoin recovered above $70K on February 6, the recent crypto crash was so significant that it left traders wondering about the cause. While there are plenty of theories and comparisons to historical drawdowns, many believe that the crypto crash was the result of Hong Kong traders placing high-leverage BTC bets.

Meanwhile, DeepSnitch AI remains the popular choice for traders who don’t want to overextend into major assets that could experience additional volatility.

Raising $1.50M and putting forth 100x community projections, DeepSnitch AI also gained ground for its utility (trading/analytics suite powered by five AI agents), and 300% whale bonuses.

What you'll learn 👉

Crypto crash analysis

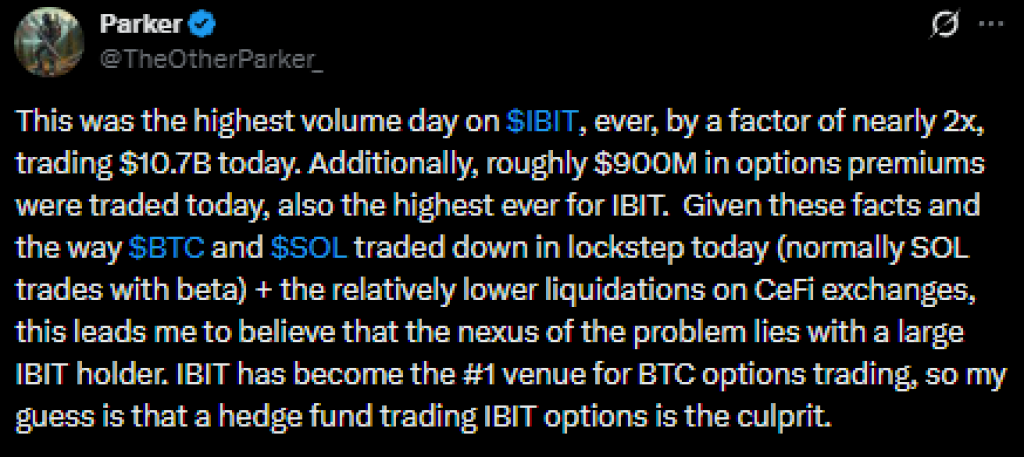

Parker White, COO at DeFi Development Corporation and former equities trader, laid out a theory that explains the recent Bitcoin selloff and total market capitulation.

White points to Hong Kong hedge funds that loaded up on out-of-the-money call options in BlackRock’s IBIT (the world’s largest Bitcoin ETF) using cheap Yen carry trade borrowing. The funds doubled down on a BTC rebound after October’s slump, which didn’t happen.

The growing carry costs and silver market turmoil likely hammered their positions.

As BTC continued cascading down, the leveraged option blew up, which led to mass liquidations of IBIT shares, amplifying the crypto crash.

White also notes that these funds operated outside traditional crypto circles, meaning the “FUD” and early signals never surfaced on social media.

Since historical drawdowns always point to volatility even after recovery starts, presale projects and other high-performing altcoins could present a solid choice amid volatility.

Coins to watch after the crypto crash

- DeepSnitch AI: Is $DSNT safe from volatility?

While Bitcoin did find its way back above $70K, aftershocks may be coming. As such, if you’re looking for a solid hold after the crypto crash, then presales are your best bet.

In short, going for DeepSnitch AI not only allows you to take part in a project that raised $1.50M, but your spot will stay safe, and you won’t need to watch the charts biting your fingernails.

At $0.03906 entry, it’s dirt cheap for the expected 100x pop everyone’s calling out in the community. While the promise of gains is fine and well, the project’s utility does two things: it provides the project with long-term potential, but it will also give you access to a powerful set of trader tools.

The combo of five AI agents in a single central intelligence suite will allow you to get easy risk scoring, contract audits, live sentiment checks, and predictive FUD spotting.

AI agents are all the rage now, so there’s probably merit to the 100x and mass adoption narrative that is spreading in the community like wildfire.

Degens and whales are piling in because the tools actually work for daily trading while the DeepSnitch AI community gets hyped for a rumored “huge” update.

- Bitcoin: What happens to BTC next?

According to CoinMarketCap, BTC recovered to $70K on January 7.

So what’s in store for Bitcoin after the recent crypto crash?

While the $60K drop was catastrophic, the RSI was pushed into the oversold territory, indicating sellers were losing steam. Thus, the relief bounce was a natural progression.

However, to confirm a full recovery, BTC needs to reach $74.5K and close above this resistance. If the bullish scenario plays out, the surge toward the 20-day of $80K is next.

If the price rejects $74.5K, then the downside could repeat, with a possible reprise of the $60K drop.

- Solana: Is SOL regaining strength?

According to CoinMarketCap, SOL logged a 10% recovery on February 7, reaching the $88 area.

Despite traders claiming SOL is “cooked”, the price bottomed out at a meme-friendly $67 level. Similar to what happened with BTC, the RSI was driven into the oversold territory, which led to the recovery.

The next bullish target is $95. If buyers overcome this hurdle, SOL could rally to $110, the 20-day EMA.

Alternatively, if sellers wrestle back control at $95, SOL could tumble back to its support.

Final words: Crash-resistant bag?

While BTC and SOL recover, they may still get wrecked if another flash crypto crash hits.

To avoid the wildfire, DeepSnitch AI is the prime choice. Think of the presale as the crash-resistant bag that keeps your funds safely tucked away.

The AI trading suite alone could carry you through a bear winter, and if the 100x narrative plays out, you could be rolling in some serious dough.

It gets even better if you have whale aspirations, as the recent bonuses are super exciting. The DSNTVIP300 code alone unlocks 300% extra on $30K+ (which translates to $90K extra worth of DSNT).

Fear not the crash – secure your spot in the DeepSnitch AI presale now. Follow X or Telegram for the latest updates.

FAQs

- What caused the recent crypto crash?

The crypto crash stemmed from Hong Kong hedge funds heavily leveraged on out-of-the-money IBIT call options via cheap Yen carry trades. When BTC failed to rebound strongly, rising carry costs and silver turmoil triggered massive liquidations, amplifying the selloff.

- Why are traders rotating into DeepSnitch AI after the crypto crash?

DeepSnitch AI raised $1.50M at $0.03906 despite the crash, offering five AI agents for real-time contract audits, risk scoring, rug/honeypot detection, breakout spotting, and predictive FUD/sentiment alerts hedge.

- What is the current Bitcoin outlook after the recent drop?

Bitcoin recovered to $70K after hitting $60K. RSI oversold suggests the bounce was natural, but full recovery needs a close above $74.5K resistance to target $80K. Rejection could repeat the downside toward $60K support.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.