Ethereum has struggled this week but popular analyst Mags believes the second-largest cryptocurrency is gearing up for significant price appreciation.

After hitting 2024 highs around $2700 in mid-January following Bitcoin’s ETF launch, Ethereum has dropped around 8% this past week to current levels around $2270. However, in a recent CoinMarketCap post, Mags asserts “ETH is ready to pump hard.”

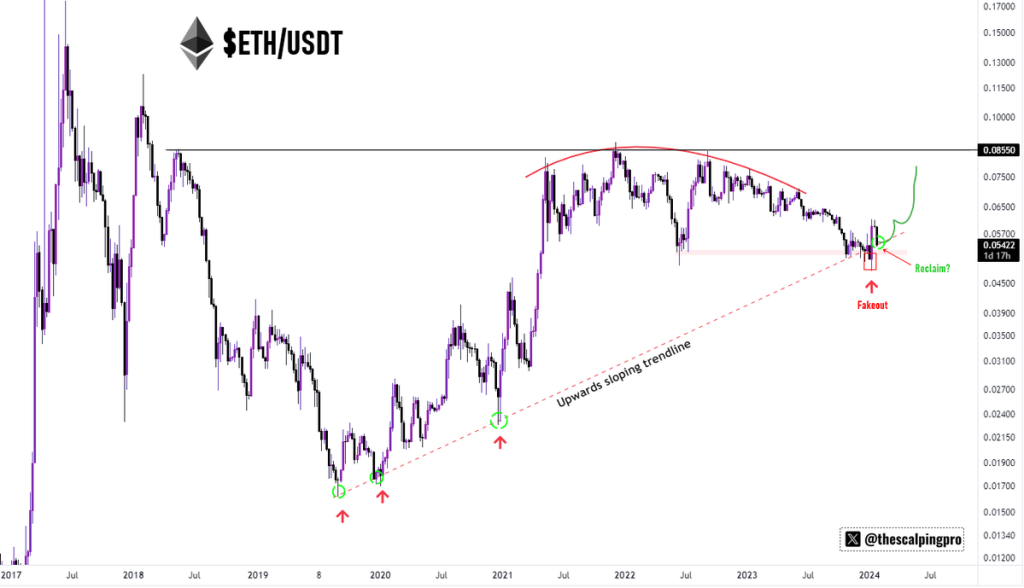

Mags points to a key long-term uptrend support level on Ethereum’s chart, noting “Every time ETH has tested this upwards sloping trendline, we have seen an aggressive upside rally.” While prices broke below this level weeks ago, Ethereum has reclaimed this trendline support which signals continuation higher to Mags if it remains valid.

In addition to bouncing off a key long-term support, the RSI indicator across all timeframes is around 50 which suggests building bullish momentum. The 200-day moving average at $1933 could act as potential resistance if an uptrend forms.

Ethereum has been trading in an ascending channel up pattern since September (blue lines on the chart below), but the plunge this past week has moved ETH prices below that reliable pattern.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Breakdowns from channel up patterns often lead to further declines. However, popular analyst Mags believes ETH is gearing up for significant price appreciation even after this breakdown.

While Ethereum remains in a short-term downtrend, Mags believes the chart and indicators point to a high-probability ETH price pump based on historical precedent at this trendline. If the current support fails, however, lower levels around $2000 could be tested next.

You may also be interested in:

- Why Is Polkadot (DOT) Price Up?

- Will Dogwifhat’s WIF Dethrone BONK as Top Solana Memecoin?

- The Graph (GRT) and Injective (INJ) Face Risks of Further Decline – Is Recovery Possible? Meme Moguls (MGLS) Asserts Dominance With Stage 5 Presale

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.