Bitcoin hit $38,000 for the second time in the last 5 days on Tuesday before quickly pulling back to around $37,800. The renewed bullish momentum has crypto analysts attempting to forecast where bitcoin goes from here after a turbulent year in the crypto markets.

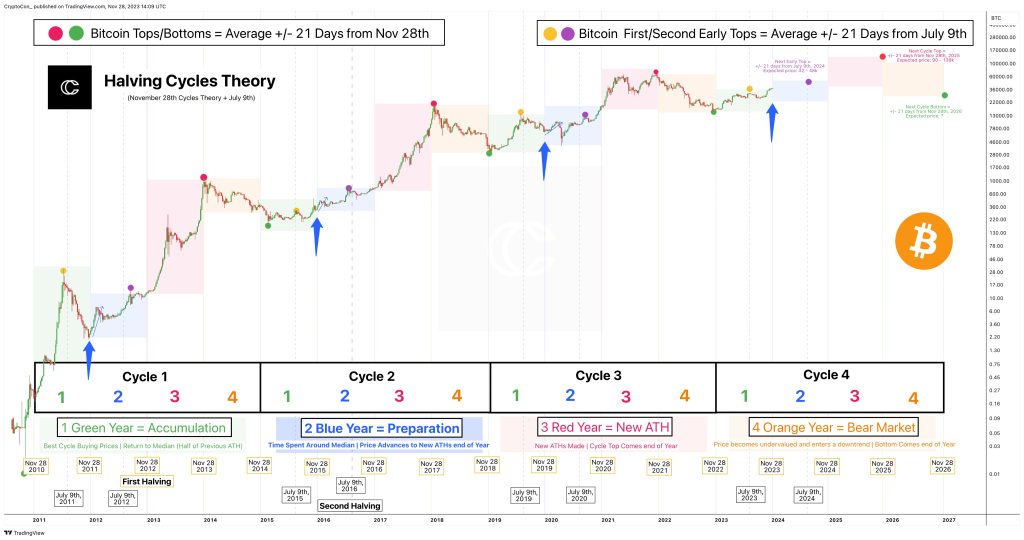

Notable crypto analyst CryptoCon, with over 65,000 followers, shared an upbeat outlook. As he put it, “Today is the most important day of the year for #Bitcoin. All cycles are centered around the date of the first halving, November 28th, 2012.”

CryptoCon believes bitcoin follows four-year cycles tied to past “halving” events where the bitcoin mining reward gets cut in half. He stated, “Green Accumulation Year is now over, and Blue Year has begun. Every single prediction of the Halving Cycles Theory Green Year was right.”

Specifically, CryptoCon claims he accurately predicted key bitcoin price levels earlier this year, saying: “We had: A bottom +/- 21 days from Nov 28th, 2022; The best cycle buying prices; An early top +/- 21 days from July 9th, (July 13th Yellow Dot); A Return to the median price (half of the previous ATH) at $34,500.”

In the current “Blue Year,” CryptoCon expects consolidation around the median before the next bull run, stating “price will spend most of its time around the median ($34,500). It will form the second early top +/- 21 days from July 9th, 2024.” He tentatively estimates that interim peak from “$42,000-$48,000, but to be determined.”

By the halving anniversary again on November 28, 2024, CryptoCon sees bitcoin approaching but not surpassing its all-time high, noting that “Blue Year has always started off on a great note, with every cycle seeing a rally early off.”

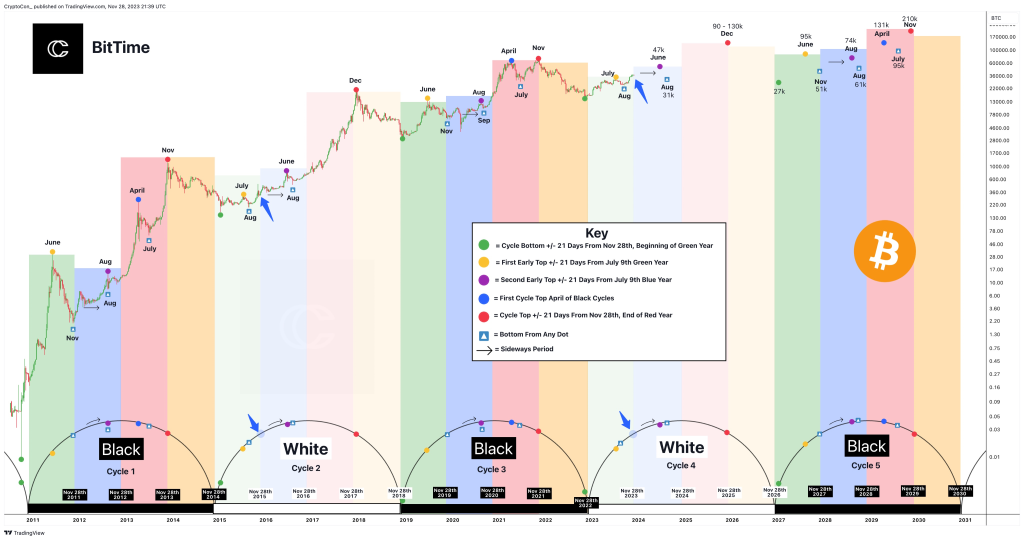

Beyond the Halving Cycles Theory, CryptoCon revealed another model called BitTime that he sees as a potential blueprint for this cycle playing out into 2025:

“Another model has also turned a new ‘blue’ leaf, BitTime. According to this model, #Bitcoin will follow a cycle very close to cycle 2 (2015 – 2018)…The double top was written in the books for 2021 according to 2013.”

However, he cautions about expectations of an exact repeat performance, stating “We shouldn’t expect Bitcoin to do exactly as it did in 2015 – 2018… that would make it too easy.” Still, CryptoCon points to the initial rise in 2015 extending into December as similar to current positive momentum.

The BitTime model specifically predicts a peak around $47,000 in June 2024, followed by a bottom in August. The ultimate single top is forecasted in December 2025, with CryptoCon estimating “$90,000 – $130,000 with favor to the higher end.”

In conclusion, analyst CryptoCon outlines strong conviction that the halving cycles that have governed past bitcoin bull runs remain intact. If his predictive modeling proves correct, bitcoin has plenty of room to run over the next couple years with six-figure price predictions on the table. While only time will tell if bitcoin hits such ambitious heights, CryptoCon’s followers are likely crossing their fingers his optimistic outlook pays off.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.