Crypto analyst Quniten shared an in-depth post on X with his 200,000 followers, explaining why he believes Bittensor (TAO) has the potential to reach a trillion-dollar market cap within the next decade. His argument focuses on the difference between Metcalfe’s Law, which explains Bitcoin’s growth, and Reed’s Law, which he believes applies more accurately to Bittensor’s structure.

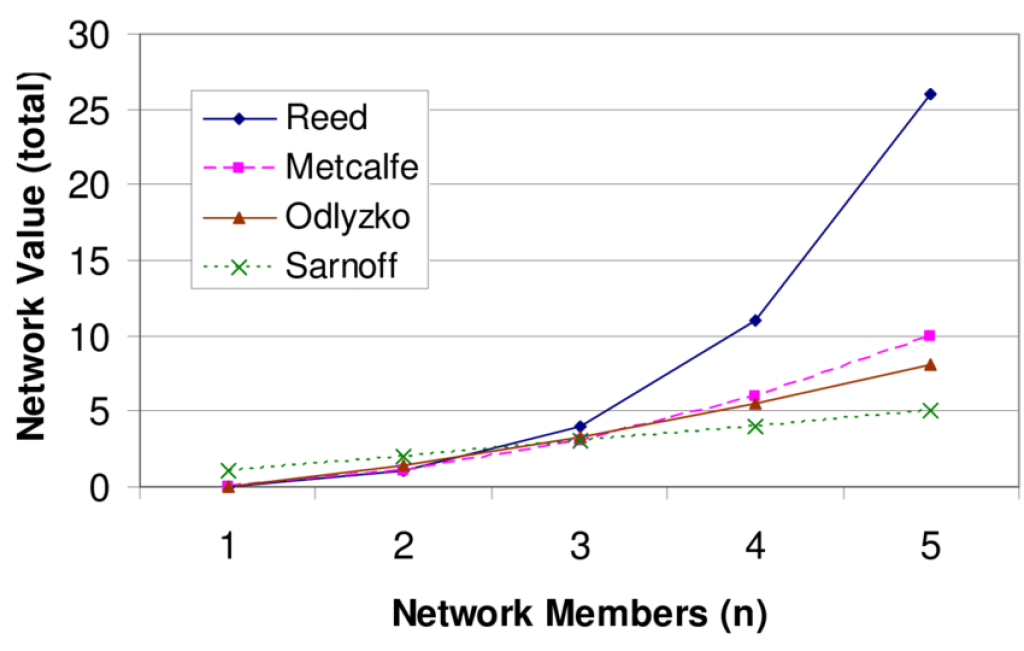

According to Quniten, Bitcoin’s rise to a trillion-dollar market cap in 2021, just 12 years after its launch, was driven by Metcalfe’s Law – the idea that a network’s value grows in proportion to the square of its number of users. Simply put, the more people who use and hold Bitcoin, the more valuable the network becomes.

In contrast, Reed’s Law suggests that the value of a network increases exponentially with the number of user groups or sub-networks it contains. Quniten believes this law better reflects how Bittensor operates, as it currently runs 128 independent subnets, each contributing to the broader ecosystem.

In his view, this structure creates a “network of networks” effect, where the value multiplies faster than in single-layer systems like Bitcoin or Ethereum. “In theory, TAO’s network should go up in value faster than Bitcoin,” Quniten said.

What you'll learn 👉

Why TAO Stands Out

Quniten argues that Bittensor’s model creates a powerful incentive for AI developers and teams to build on its decentralized network. The project currently limits subnet spots to 128, forcing constant competition.

When a new team joins and pays the entry fee in TAO, the least-performing subnet is removed from the network. This system encourages consistent improvement and innovation, as only the best-performing subnets survive. “It’s a Hunger Games-style competition,” Quniten noted, referring to the ongoing battle for subnet positions and rewards.

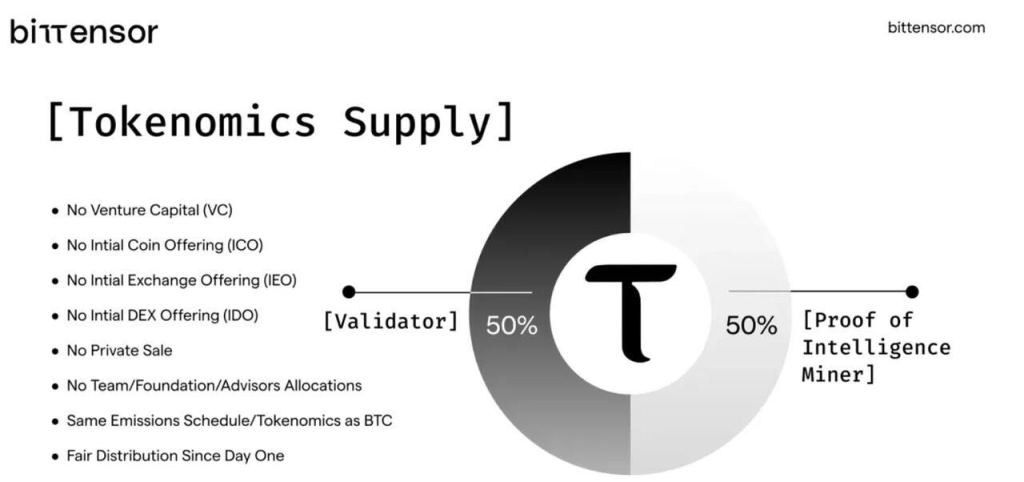

Each subnet earns a share of newly mined TAO tokens, following a token model similar to Bitcoin’s. The total supply is capped at 21 million tokens, with halvings roughly every four years. This scarcity, combined with the strong incentive mechanism, is designed to create long-term sustainability and value.

A Long-Term Bet on Decentralized AI

Quniten calls Bittensor an “asymmetrical bet” – a project where the potential upside far outweighs the risk. He places TAO alongside Ethereum and Chainlink as one of the few cryptocurrencies with the potential to become a trillion-dollar asset. Other major projects, he says, either lack sufficient market scope or first-mover advantage.

Bittensor, in his view, already has both. It’s the first decentralized AI network to effectively link incentives for machine learning models with blockchain-based rewards.

TAO’s Future: The Trillion-Dollar Timeline

Bittensor launched four years ago, and Quniten estimates it could reach a trillion-dollar valuation by 2030 or 2031, following a growth curve similar to Bitcoin’s early trajectory. “The art of investing,” he wrote, “is picking the projects that have the potential to become a trillion-dollar company, and where the odds of that happening are high.”

Read also: Analyst Who Nailed Last 2 Bitcoin ATHs Shares His Next BTC Price Target

For him, Bittensor checks all the boxes: first-mover advantage, strong incentives, competitive structure, and sound tokenomics.

While predicting a trillion-dollar market cap remains speculative, Quniten’s analysis highlights why Bittensor continues to attract attention among investors focused on decentralized AI – a sector that could define the next phase of crypto innovation.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.