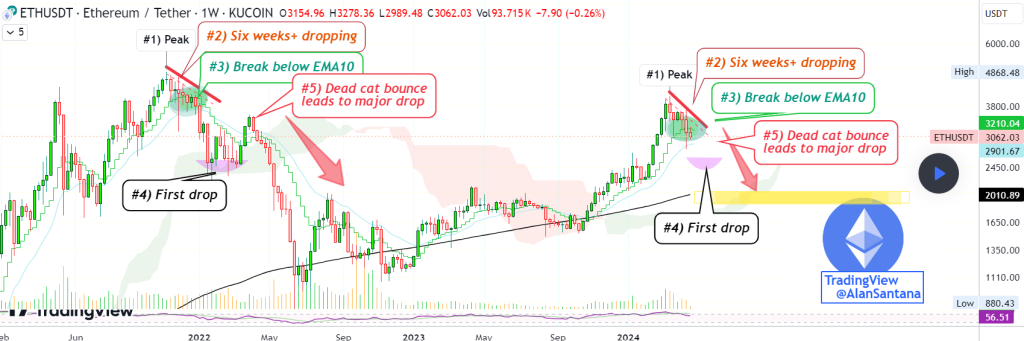

Ethereum has been experiencing a period of consolidation following its recent multi-year high. However, according to a technical analysis by Alan Santana, the cryptocurrency is likely to face a significant price drop in the coming days or weeks, with a potential target of $2,000.

What you'll learn 👉

The Disbelief Phase

Santana points out that despite Ethereum’s six-week decline, many investors are still waiting for new all-time highs, indicating that the market is currently in a disbelief phase within the current market cycle. This phenomenon implies a misalignment between market sentiment and technical indicators, potentially resulting in a significant price correction.

The Five-Step Sequence

Both the current market cycle and the one that ended in November 2021 follow a five-step sequence that is the focus of the technical analysis.

Steps 1 and 2: New All-Time High and Immediate Reversal

In both November 2021 and March 2024, Ethereum produced a peak, reaching a new all-time high or multi-year high, respectively. However, immediately after hitting these highs, the market turned bearish, with prices starting to decline.

Santana emphasizes that the best time to sell is when prices are trading near resistance levels, as predicting a reversal becomes more challenging once the market fully confirms the bearish trend.

Step 3: Break Below EMA10

Following the all-time high in November 2021, Ethereum moved below the 10-week Exponential Moving Average (EMA10), confirming that the top was in and a new bearish wave had begun. This led to the “first drop” in prices.

Similarly, in the current market cycle, Ethereum broke below the EMA10 on April 8, 2024, confirming that the top is in and a bearish trend is likely to follow.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Steps 4 and 5: First Drop and Lower Low

Ethereum experienced a dead-cat bounce after the first drop in November 2021, followed by a lower low, indicating a bearish impulse. Santana predicts that a similar pattern is likely to occur in the current market cycle.

Price Targets

Based on the technical analysis, Santana expects Ethereum to experience a “first drop” that could lead to a price target of approximately $2,222 to $2,400. Following this drop, the cryptocurrency may face a major flush, potentially reaching $2,000 around the 200-week Moving Average (MA200). While prices could go lower, the MA200 is expected to act as a significant support level.

The technical analysis by Alan Santana suggests that Ethereum is poised for a significant price drop in the coming days or weeks, with a potential target of $2,000. Investors should be cautious and consider the possibility of a bearish trend, despite the market’s current disbelief phase.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.