Bitcoin (BTC) may be in for a period of consolidation within the $66,000 to $70,000 range before a strong altseason takes hold, according to crypto analyst Alex Wacy. In a tweet, Wacy suggested that any volatility within the $61,500 to $65,000 range is necessary to unsettle and pressure people into selling their bags.

Despite the potential for short-term volatility, Wacy maintains his position that $52,000 is an unlikely target for BTC and that an altseason is closer than ever. However, he also acknowledges that external news is currently exerting pressure on the cryptocurrency market, making patience a key factor for investors.

What you'll learn 👉

Upward Exit from Volatility Zone Expected

Wacy expects an upward exit from the current volatility zone, which he believes will be followed by strong movements in altcoins. This prediction aligns with the growing anticipation of an altseason, during which alternative cryptocurrencies typically experience significant gains.

Bitcoin currently trades at $62,000; however, based on the analyst’s insight, the price could rise above $66,000 in the coming days and then consolidate for a while. Thus, investors and traders should keep a close eye on market developments and be prepared for potential opportunities in the altcoin market.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Bitcoin’s Weekly Parabolic Trend and RSI

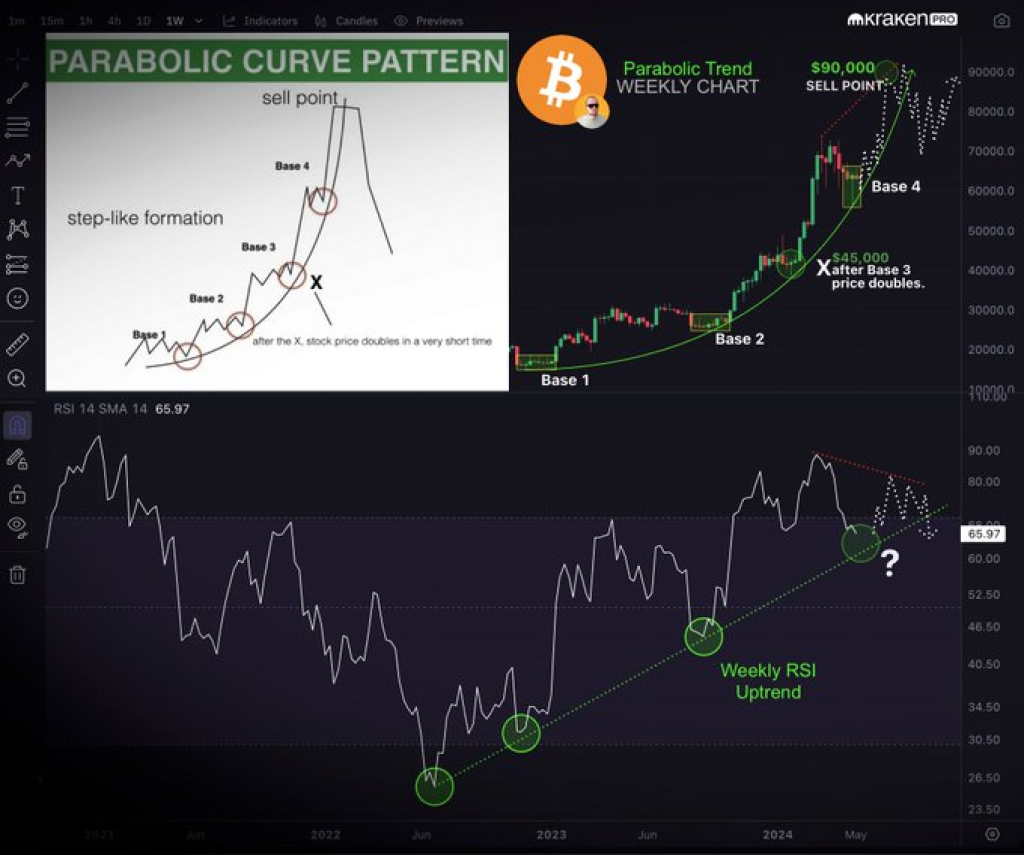

Kevin Svenson, another prominent crypto analyst, shared his insights on Bitcoin’s weekly parabolic trend. According to Svenson, a complete parabolic trend, as defined by the textbook, would be achieved after seeing another major extension up toward the $90,000 zone.

This bullish outlook is further supported by Bitcoin’s Weekly RSI (Relative Strength Index), which Svenson notes is still “trending.” The RSI is a popular momentum indicator used by traders to assess the speed and change of price movements. A trending RSI suggests that Bitcoin’s upward momentum may still have room to continue.

Read more: Experts Say VeChain (VET) is ‘Cooking Something’ in the Real World Asset industry – Here’s Why

As Bitcoin potentially enters a period of consolidation within the $66,000 to $70,000 range in the coming days, analysts like Alex Wacy and Kevin Svenson offer valuable insights into the market’s potential trajectory. While short-term volatility may be necessary to shake out weak hands, the anticipation of a strong altseason and Bitcoin’s weekly parabolic trend suggest that there may be significant opportunities on the horizon for well-positioned investors.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.