Trader Rekt Capital recently posed an intriguing question on Twitter: “Could Bitcoin Crash to $22,000 in September?” To unpack this query, it’s essential to first delve into Bitcoin’s performance in August and examine historical trends.

Historical Context: August Drawdowns

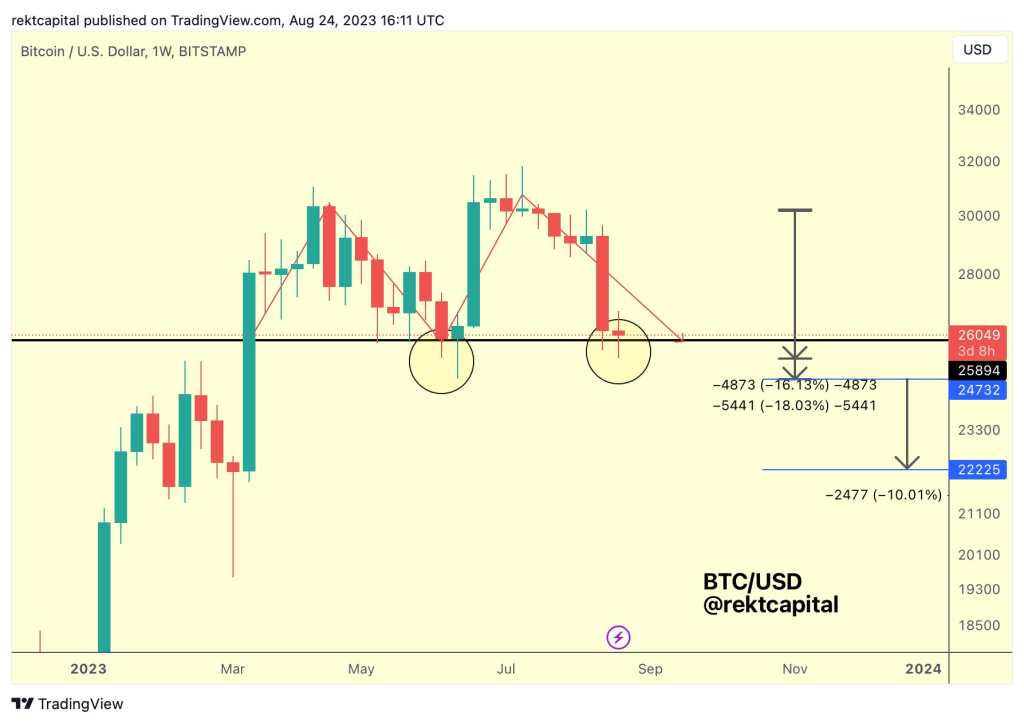

The worst drawdowns for Bitcoin (#BTC) in the month of August were recorded as -17% in 2014 and -18% in 2015. Fast forward to August 2023, and Bitcoin is already down by approximately -16%. If the cryptocurrency were to mimic its worst August performance by dropping an additional -18%, we could see Bitcoin’s value plummet to around $24,700.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +However, the August drawdown might just be the tip of the iceberg. There are two compelling reasons to believe that Bitcoin could face further retracement:

- Double Top Pattern: Bitcoin is currently forming a technical pattern known as a “Double Top,” which is often a bearish indicator. This pattern typically signals a reversal from an uptrend to a downtrend.

- September Drawdowns: Historically, Bitcoin tends to experience single-digit drawdowns in the month of September.

If Bitcoin were to retrace an additional -10% in September, following the August drop, the price could potentially fall to approximately $22,200. Intriguingly, this figure aligns almost perfectly with the “Measured Move” target for a Double Top breakdown, which is estimated to be around $22,000.

While past performance is not indicative of future results, the historical data and current technical patterns suggest that a Bitcoin crash to $22,000 in September is within the realm of possibility. Investors should exercise caution and consider these factors when making their investment decisions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.