Copper has quietly put together one of its strongest yearly performances in recent memory, and some analysts believe the move is only getting started. Chamath Palihapitiya recently called copper his top trade idea for 2026, arguing that global supply shortages and rising demand are being massively underestimated.

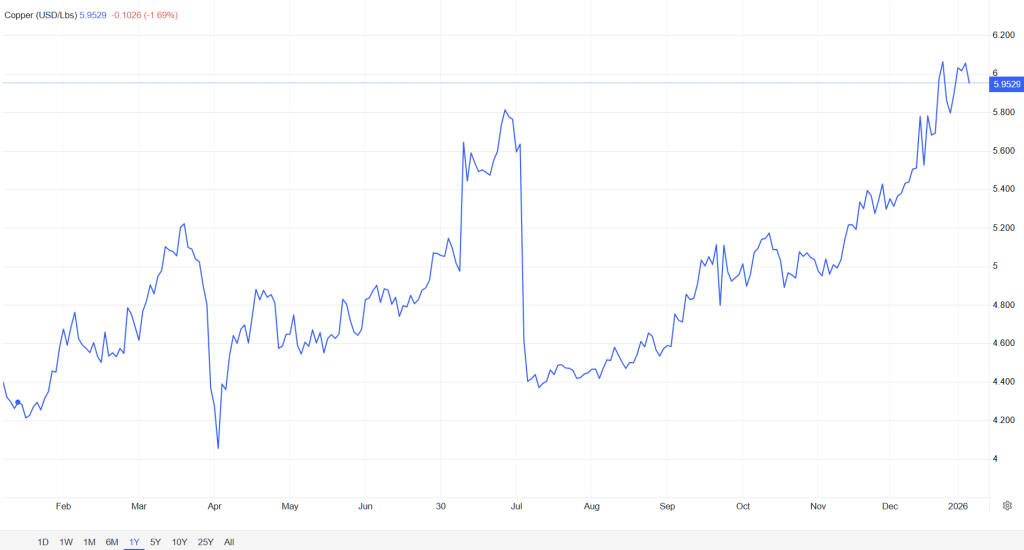

Looking at the chart, it’s easy to see why copper is back in focus.

What you'll learn 👉

How Copper Has Performed Over the Last Year

Over the past 12 months, copper has trended steadily higher, despite several sharp pullbacks along the way. Early in the year, prices traded closer to the low $4 range, with choppy movement and limited momentum. That changed in the spring, when copper broke higher and pushed above $5 for the first time in months.

April brought a sudden drop, but buyers stepped in quickly. The recovery was strong, and by early summer, copper surged toward the $5.80 area. That rally was followed by another sharp correction in July, where prices briefly dipped back toward $4.40. Once again, the downside did not last long.

From August onward, copper entered a more controlled uptrend. Higher lows formed, volatility eased, and prices climbed consistently through the fall. By December, copper broke above previous resistance levels and accelerated into the $5.90 zone, where it is currently trading.

Despite a minor pullback in recent sessions, the broader trend remains intact. Over the year, copper has gained roughly 40%, outperforming many equity sectors.

Read also: Silver Price Near $100? Analyst Says This Is the Start of a Financial Crack-Up, Not a Bull Market

Why Analysts See More Upside Ahead

Chamath’s argument goes beyond short-term price action. He believes copper sits at the center of multiple long-term demand trends. Data centers, chips, power grids, electric vehicles, and defense systems all rely heavily on copper. At the same time, new supply is struggling to keep up due to declining ore quality, long permitting timelines, and geopolitical friction.

“We are still completely underestimating how short we are,” Chamath said, adding that copper is “the most useful, cheap, and amenable conductive material we have.”

Chamath's best trade idea for 2026 is not a stock. It is copper.

— Boring_Business (@BoringBiz_) January 14, 2026

"We are still completely underestimating how short we are in terms of the global demand and supply dynamics of a handful of critical elements that we need.

The asset that is set up to go absolutely parabolic is… pic.twitter.com/jXvD5GKokB

Not a Typical Commodity Trade

What makes this setup different is that copper’s strength is not being driven by speculation alone. The price action over the last year shows repeated dips being bought aggressively. That behavior usually signals long-term positioning rather than short-term trading.

Copper is no longer just reacting to economic cycles. It is increasingly tied to infrastructure, energy security, and technology expansion.

If demand continues to rise while supply remains constrained, copper’s recent rally may look small in hindsight. For some investors, that’s why copper, not stocks, is being framed as the real trade as we go deeper into 2026.

Read also: The Real Reasons Gold and Silver Prices Exploded—And Why Few Are Talking About It