News of the Trump administration’s clash with Venezuela hit while crypto was wide open, and prices reacted almost immediately.

Bitcoin and Ethereum moved first, with traders reacting to the news while traditional markets were still closed. The response came through price, not commentary.

The Bitcoin price is trading near $91,549 and Ethereum around $3,144; both right up against levels that were already in place, even before the conflict.

So far, the move hasn’t looked like panic. Instead, trading has stayed controlled, with attention on support, resistance, and where real buying or selling might show up next.

What you'll learn 👉

Bitcoin Price Outlook After the News

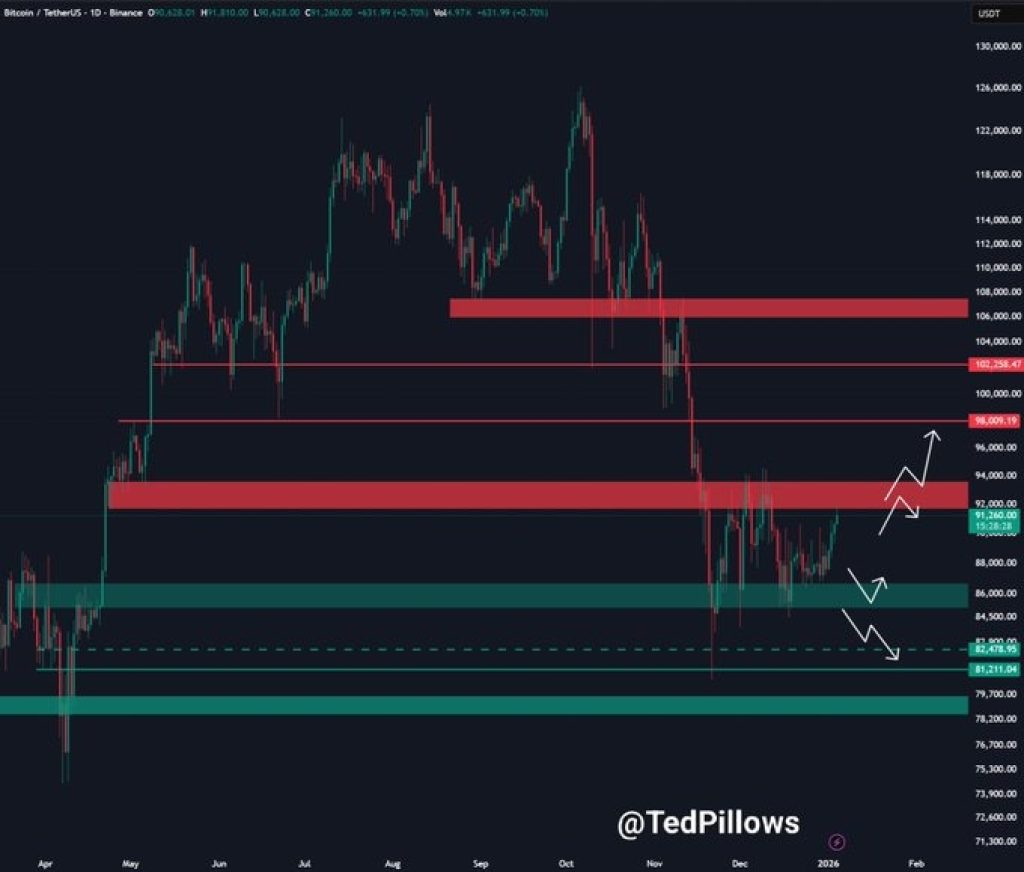

Bitcoin is approaching a level that has defined its range for months. As highlighted by analyst Ted Pillows, BTC is once again testing the $92,000–$94,000 resistance zone. Since November, every attempt to reclaim this area has failed, making it one of the most important levels on the chart.

The recent rebound from the lower support band suggests buyers are still active, but momentum remains constrained below resistance. If the Bitcoin price manages a clean daily close above this zone, the chart opens up quickly.

There is limited resistance until the psychological $100,000 level, which explains why traders are watching this area so closely.

If price gets turned away here, Bitcoin is likely to stay stuck in its range. A loss of the $90,000 zone would open the door for further lower values, in which lower liquidity levels are in the mid-$80,000s.

However, at the current point, Bitcoin finds itself at a crossroads, and the future will be dictated by confirmations and not assumptions.

Ethereum Price Faces a Tougher Technical Test

ETH setup is more fragile. According to Han Akamatsu, ETH remains below its 200-day moving average and has also slipped under the monthly Hull Moving Average ribbon. These higher-timeframe losses often signal that momentum is no longer on the bulls’ side.

Price action reflects that hesitation. The ETH price has struggled to build acceptance above recent highs and continues to stall below the $3,500–$3,600 region.

That zone now acts as the clear line between recovery and continuation of weakness. Until Ethereum can reclaim it, upside moves risk fading rather than accelerating.

If ETH fails to regain those levels, downside pressure could build gradually rather than all at once. The structure suggests chop and frustration are more likely than a clean breakdown, but the longer price stays below key averages, the harder a bullish reversal becomes.

Read also: Litecoin Regains Control After a Liquidity Sweep – What Comes Next for LTC Price?

What ChatGPT Is Predicting From Here

The outlook for Bitcoin and Ethereum is conditional, not directional. The charts are doing most of the talking right now.

Bitcoin is trading just under a key resistance area, at $92,000-94,000. ChatGPT predicts that if the BTC price breaks through and holds above it, upside could come fast, with the $100,000 level back in view.

If it fails there once again, Bitcoin is more likely to chop sideways or slide back toward support at $90,000 instead of starting a new rally.

Ethereum setup is more fragile. As long as ETH remains below its long-term moving averages, upside attempts are likely to struggle.

The ETH price only starts to look constructive again if price can reclaim the $3,500–$3,600 area. Until that happens, caution still makes sense, with sideways action or slow downside pressure toward $3,000 remaining possible.

The Bitcoin price is at a decisive area, whereas Ethereum needs to do a bit more to confirm the strength. The direction from here forward is going to depend on the price behavior around these levels, not the headlines.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.