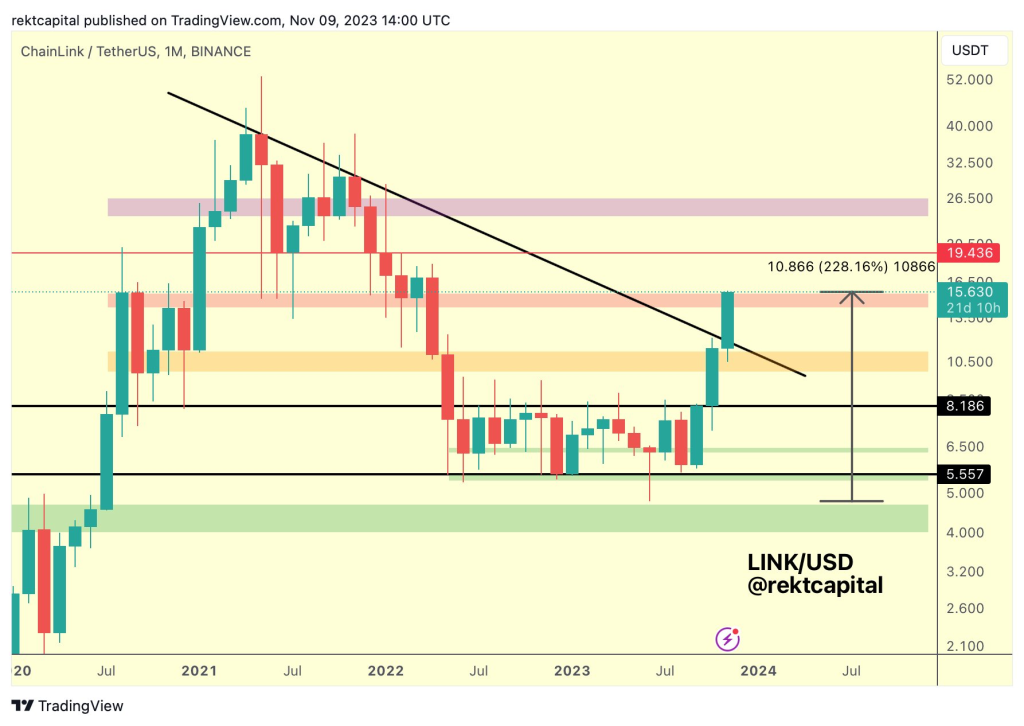

Chainlink’s LINK token has been on a tear in recent weeks, gaining over 100% in the last month alone. However, the price hit resistance around $16 two days ago and has since pulled back, consolidating around $14. Despite LINK’s impressive 34% gain over the past 7 days, it has risen less than 2% today as traders eye the next key level. According to analysis from Rekt Capital, LINK could quickly spike to $20 if bulls can reclaim one crucial resistance point.

What you'll learn 👉

Consolidation Provides Opportunity

Even with LINK’s meteoric rise over the past month, the price action has shown signs of fatigue the last few days. LINK attempted to break past $16 but was rejected, leading to a pullback to around $14 to $15. So far, LINK has struggled to reclaim this zone as support.

However, Rekt Capital views this consolidation as a healthy development that is providing an opportunity for bulls. Now that LINK is trading just below resistance, it is setting up for a potential breakout. A decisive move above $15.60 would flip this to support and could spark a quick rally up to $20.

Clear Skies to All-Time Highs

A break above $15.60 is key because there is minimal resistance between that level and the psychological $20 mark. As Rekt Capital notes, his chart shows a clear pathway for LINK if it can turn $15.60 to support. From there, a rally to $20 would represent a 30%+ gain from current prices.

Read also:

- Will History Repeat as Solana (SOL) Faces Tough Resistance Again?

- Polygon Market Cap Surges +54% in 3 Weeks as Whales Continue to Accumulate MATIC

- Bitcoin ETF Token Crosses $100K With BTC Price Surge – 1 Day Left in the Presale Stage

In summary, Chainlink looks poised for a major breakout if key resistance around $15.60 flips to support. This would pave the way for a spike towards $20, with LINK’s all-time high soon within reach. Traders and investors will be watching closely how this key level plays out.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.