Crypto analyst Rekt Capital has shared his newsletter examining the market trends for Chainlink (LINK) and SUI. The analysis highlights key support and resistance levels for both assets, offering insights into their recent price movements and potential future trajectories.

What you'll learn 👉

Chainlink Shows Resilience Amid Pullback

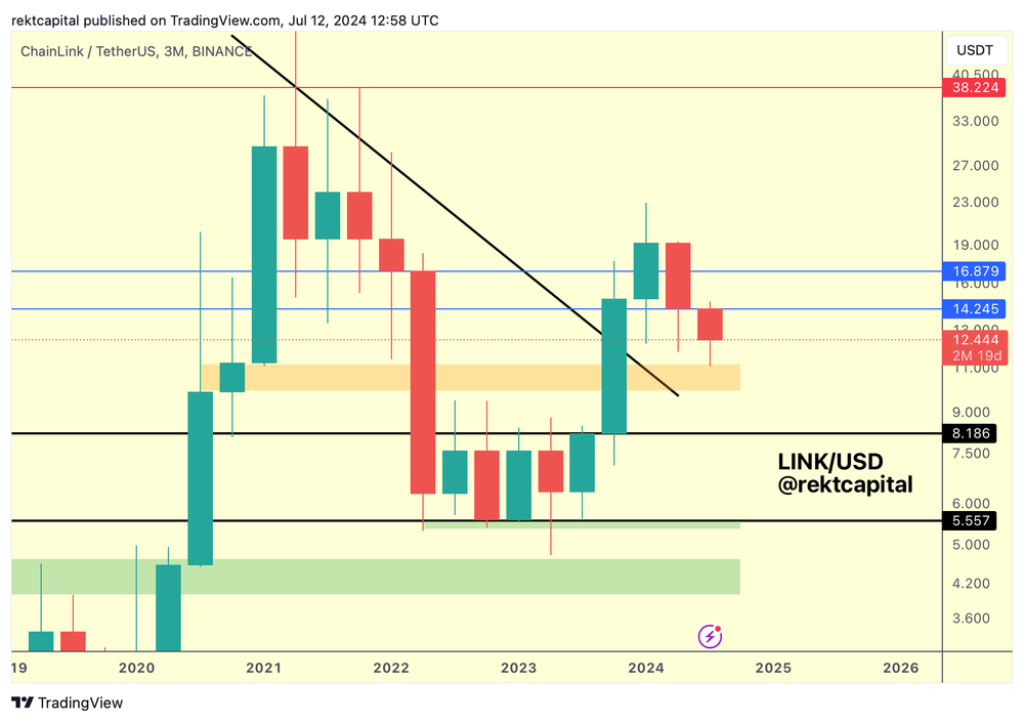

Rekt Capital’s examination of Chainlink’s quarterly chart reveals an intriguing development. Despite a recent pullback, LINK maintains its macro uptrend that began after breaking out of a long-term accumulation range.

The analyst notes that LINK has been retracing for two quarters, finding support in a weighty zone.

“This area previously acted as resistance in mid-2020 and Q3 2020,” Rekt Capital points out. Interestingly, this former resistance may now serve as crucial support for Chainlink.

While LINK has initially retested the top of this support area earlier in the current quarter, Rekt Capital suggests that further retesting may occur in the coming months. This behavior could indicate a potential consolidation phase before the next move.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +SUI Navigates Key Price Levels

Turning attention to SUI, Rekt Capital identifies critical price levels that may influence its future trajectory. The analysis centers on a light blue support level and a black resistance level at $0.97.

Currently, SUI is finding support at the light blue level, which could pave the way for upward momentum. However, the analyst cautions that SUI recently lost the $0.97 level as support, closing below it last month.

“If SUI rebounds but rejects at the black level, it would confirm a new resistance,” Rekt Capital explains. This scenario could significantly impact SUI’s short-term price action.

Read also: Expert Draws Out Path for Bitcoin (BTC) and Altcoins Recovery: Reveals Key Timelines

Conclusion

Rekt Capital’s analysis of Chainlink and SUI provides the price trajectory of two notable crypto assets in the market. While LINK shows resilience in its macro uptrend despite recent pullbacks, SUI goes through a potentially new trading range.

Captain just hit his first 100x among a lot 2-5xs. Want to be a part of a profitable community?

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.