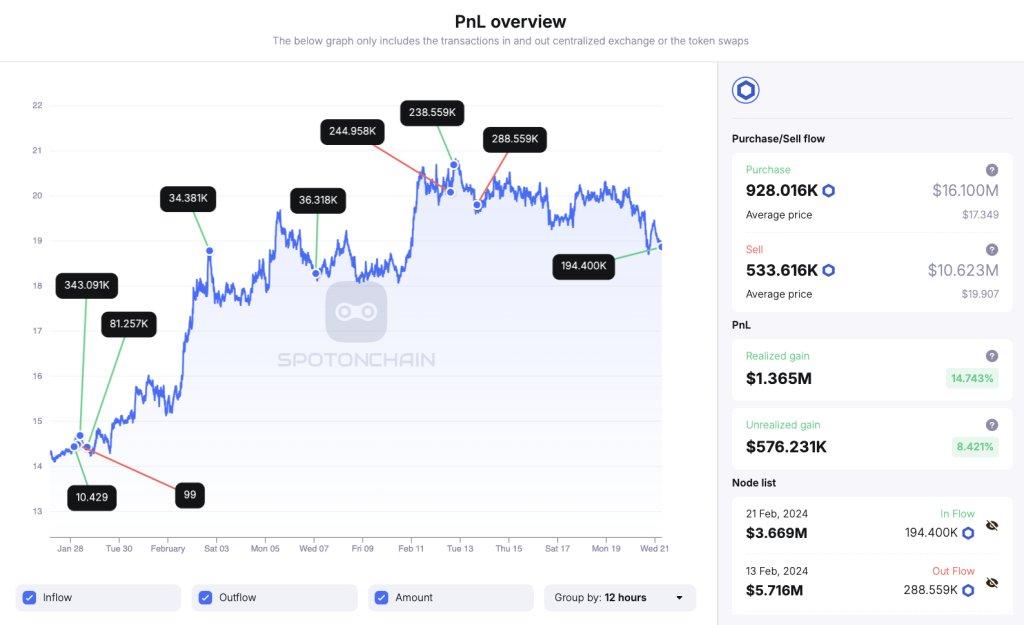

According to on-chain analytics provider SpotOnChain, one anonymous Chainlink whale recently withdrew over $3.67 million worth of LINK tokens from Binance across two transactions.

With the wallet still up nearly $1.94 million in realized profits from recent arbitrage, this activity may precipitate additional volatility.

What you'll learn 👉

Whale Cashes Out at Local Tops

As highlighted by SpotOnChain, wallet address 0x7d29eaca95d148629843d87c8d24fbaa6ad485a1 stands out for its systematically timed buy low, sell high trading patterns around LINK’s price swings.

After accumulating nearly 1 million LINK worth $16.1 million from Binance throughout January, the whale gradually sold back 533,616 tokens near local highs in February for $10.62 million. With Chainlink surging in the past month, timing the cyclic tops and bottoms resulted in an estimated $1.94 million in profits.

And with nearly 394,400 LINK still held as prices corrected almost 5% in the past day, room remains for this whale to capture additional gains on further rallies.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Technicals Show Promise After Key Breakout

On the price charts, algorithmic analysis by altFINS signals an already profitable uptrend in place across all timeframes. After rangebound trading between $13 and $17 for months, Chainlink finally breached channel resistance in early February.

With a textbook test of the breakout level now completed, altFINS anticipates LINK can make a run toward the next upside extension level around $23. That would require a 15% advance from current prices near psychological resistance at $20.

Source: altFINS – Start using it today

Whether prices consolidate back toward $17 support first or break out directly, the upside conviction appears high. And with momentum metrics like the MACD flashing early trend strength, the technical ingredients for steep continuation look baked in.

Strengthening technicals plus whales posturing for additional rallies through strategic profit-taking, and the stage looks set for LINK to retest its highs. Of course, holding decisive support at $17 and confirming the next resistance break matter. But resilience thus far shows why analysts and algorithms tag Chainlink as an outlier.

Chainlink is down by 5.82% in the last 24 hours amidst the whole cryptocurrency market slump. The global crypto market cap is down by 1.93% and stands at $1.95 trillion.

You may also be interested in:

- ‘Ethereum Will Likely Outrun Bitcoin (BTC) This Week’, Analyst Forecasts Next Leg Up for ETH

- Japan’s Jasmycoin Price Soars Amid Whale Movements: Can JASMY Hit New ATH? Pay Attention To This Metric

- BlockDAG’s $2 Million Giveaway and 5000x ROIs Pull in Investors from ScapesMania and Solana

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.