LINK price has continued to rise, with a close to 200% increase since November 7. Fundamental and technical analyses point to the possibility of the price increasing further in the short and long term.

Chainlink’s recent performance has caught the attention of crypto analyst Michaël van de Poppe, who emphasizes LINK’s position as a blue-chip asset with significant growth potential.

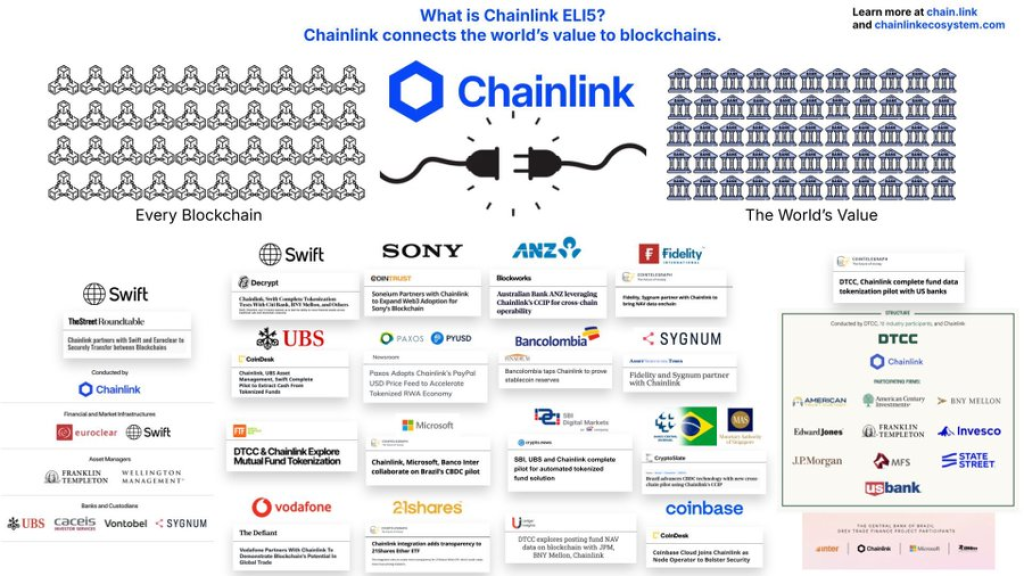

He regards it as still a great opportunity due to the increasing Web2 company adoption of Web3 technologies through tokenized products.

Chainlink is serving as a bridge between traditional and blockchain infrastructures, and its solution could gain more utility at this time. Michaël sees this as super bullish for the blockchain.

What you'll learn 👉

Price Action Confirms Bullish Thesis

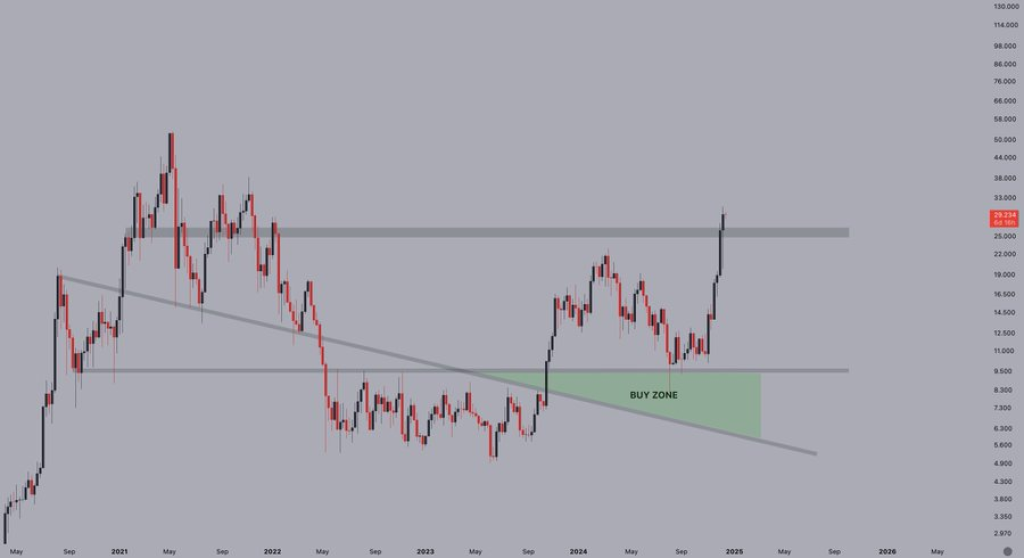

Technical analyst CryptoJelleNL notes a decisive breakout for LINK price above a key resistance level. He has observed sustained upward momentum since departing from established accumulation zones. With this chart pattern, he thinks the rally is not stopping anytime soon.

The price movement has maintained its upward trajectory, showing few signs of exhaustion. The asset ha shown strength by breaking through a major resistance zone that previously capped price movement during the 2021-2022 cycle.

The successful breach of this level, coupled with steady accumulation in the $5-$8 range throughout 2022-2023, has established a solid foundation for continued upward movement.

Expert Analyst Predicts Bitcoin (BTC) Price Could Hit $120k This Week—Here’s Why

Breaking the dominant downward trendline that characterized the 2021-2023 bear market period marks a big shift in market structure. This technical development, combined with rising volume and sustained buying pressure, suggests a potential longer-term trend reversal.

With the previous resistance zone around $23-$25 now potentially acting as support, market participants are eyeing higher price targets. The absence of immediate overhead resistance and a strong fundamental backdrop could pave the way for continued price appreciation toward historical price levels.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.