Among the tokens that were analyzed in the latest edition of the Rekt Capital newsletter are Chainlink (LINK) and Aptos (APT). These tokens have shown some strength in recent times, but some key levels in their price action could affect their direction. The following analysis is as presented by Rekt Capital.

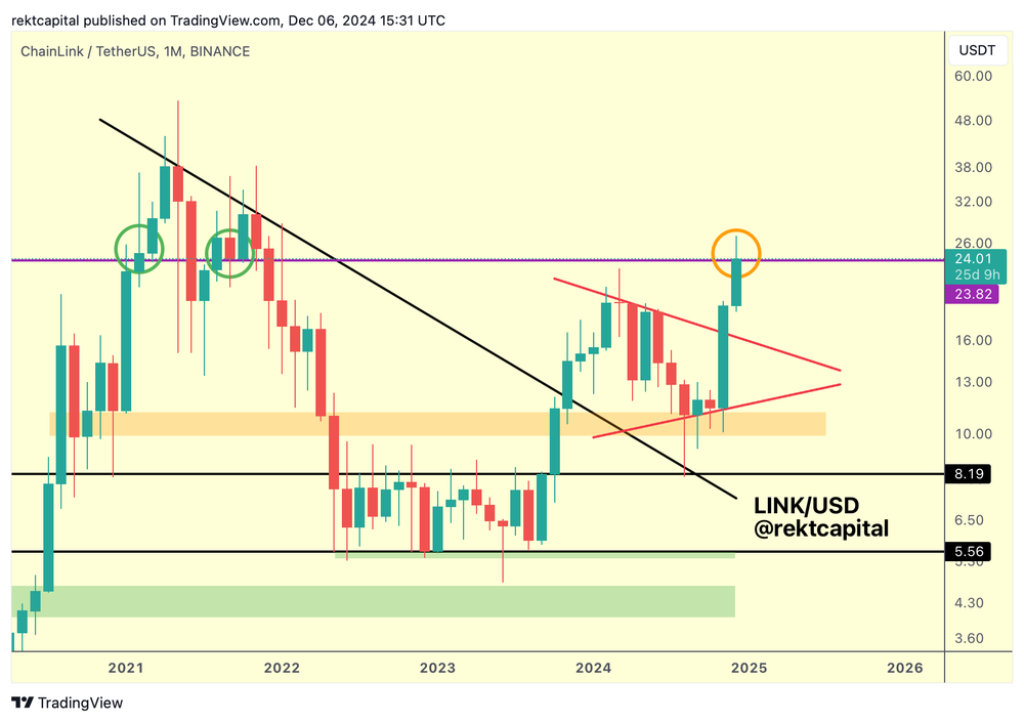

Breaking down the technical landscape for Chainlink (LINK), the asset shows a decisive breakout from its multi-month consolidation pattern, marked by a prominent triangle formation. The foundation of this pattern aligns with a significant historical demand zone, established during the late 2020 to early 2021 period.

A notable development occurred when LINK tested this demand area, simultaneously interacting with two key technical elements: the Macro Downtrend line and the $8.19 Range High of its broader accumulation range.

The asset has successfully broken above the Monthly triangle pattern and is now positioning for a potential reclaim of the $23.82 level. Historical data suggests that Monthly Closes above this threshold, particularly when followed by successful retests, have typically preceded significant upward movements. Rekt Capital notes that Weekly Closes may serve as equally valid confirmation signals

Aptos (APT) Technical Analysis: Developing Macro Structure

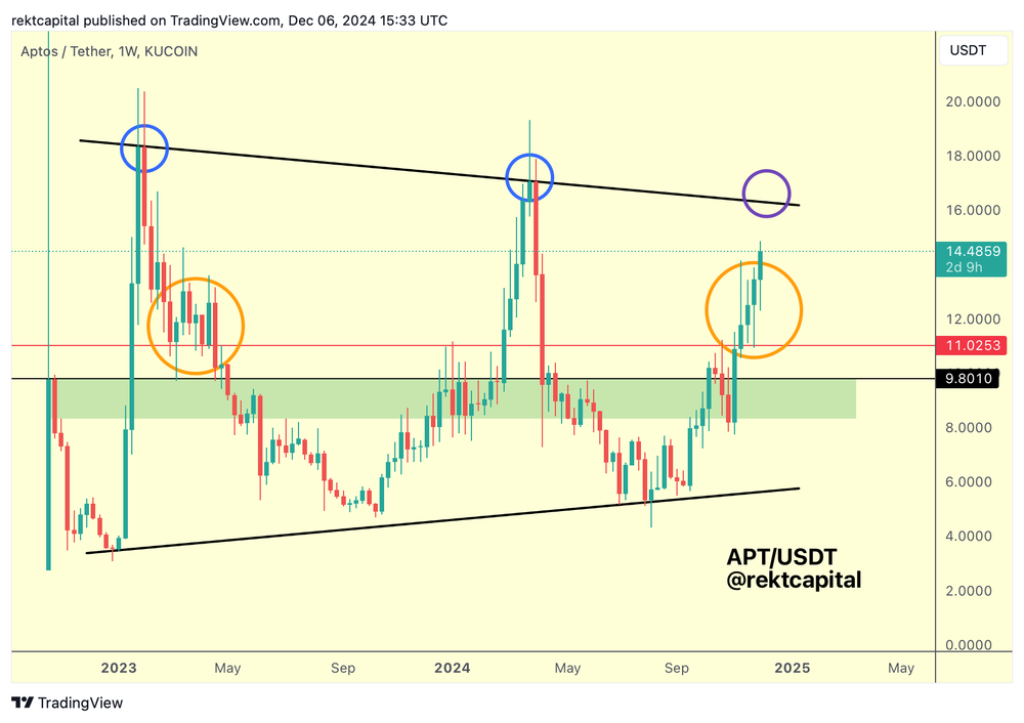

Aptos (APT) demonstrates development within a defined macro wedge pattern. A significant technical event occurred with APT successfully retesting the $11.02 mid-point level, marking a stark contrast to its failed attempt in early 2023. This successful retest signals a notable shift in market sentiment around the $11 zone.

Read Also: dYdX Price Aligns with Predictions: Potential 4x Rally Ahead – Here’s the Outlook

Following this successful mid-point retest, APT faces its next major technical challenge at the macro wedge’s upper boundary. Historical price action shows a pattern where APT typically produces upside wicks beyond this level but fails to secure Weekly Closes above it, leading to significant downward movements.

For sustained upward momentum, APT needs to break its historical pattern by achieving a Weekly Close above the Macro Wedge Top. Converting this level to support would be crucial for potential movement toward early 2023 price levels and possible new all-time highs.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.