Chainlink (LINK) is gaining momentum as its price surges past key levels, driven by advancements in decentralized oracles and AI integration. The platform’s role in RWA tokenization and secure data feeds for smart contracts is fueling optimism among investors. Meanwhile, rising futures open interest indicates increased speculation, though potential volatility remains a concern.

What you'll learn 👉

Chainlink’s Role in Decentralized Oracles and RWA

Efforts by Chainlink in RWA tokenization and decentralized oracles are positioning it as a key player in the blockchain infrastructure. By offering safe and dependable data feeds for smart contracts, the platform is leading the way in the use of blockchain technology.

Moreover, Chainlink’s decentralized data architecture is being acknowledged more as a link between blockchain applications and AI systems as artificial intelligence becomes more prominent.

@ourcryptotalk noted that Chainlink’s decentralized oracles are essential for providing real-time pricing information for financial markets and supply chain logistics tracking. This capability enhances applications across DeFi, GameFi, and RWA by ensuring accurate and tamper-proof information.

WHY $LINK | @chainlink ?

— Our Crypto Talk (@ourcryptotalk) January 27, 2025

‣ Leader in Decentralized Oracles

‣ Key player in RWA

‣ Made In USA

‣ Potential for AI and blockchain integration

➣ CHAINLINK: THE DATA BRIDGE$LINK 's decentralized oracles provide a vital link between off-chain data and on-chain smart contracts.… pic.twitter.com/WYOdS7CT8D

With AI driving technological progress, the demand for reliable, decentralized data feeds is growing. Chainlink’s scalable infrastructure has positioned it as a solution for AI applications requiring secure blockchain connectivity.

LINK Price Analysis and Market Sentiment

LINK has recently exhibited strong bullish momentum, forming a cup and handle pattern on the weekly chart. Analysts at @ourcryptotalk highlight $23 as a key level, which has been broken and is now being retested. If this support holds, LINK could see further upside movement.

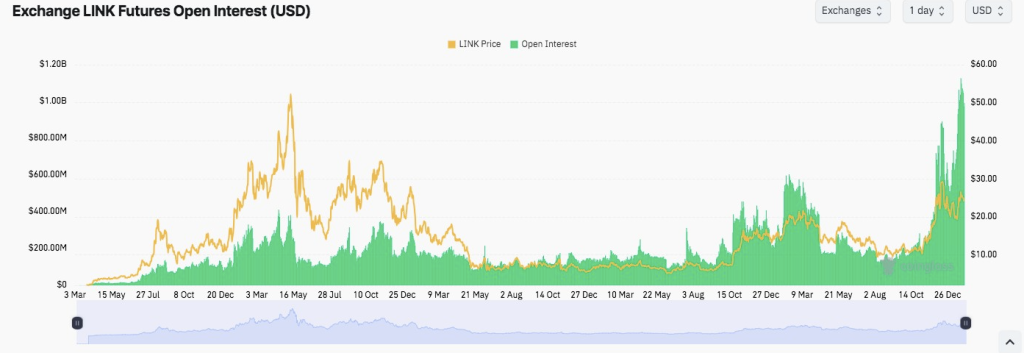

According to Coinglass data, LINK futures open interest has surged above $1 billion. This suggests heightened speculative activity and institutional interest. However, high open interest can also indicate potential volatility, as leverage may lead to liquidation if the price moves sharply in either direction. Monitoring funding rates and market sentiment remains crucial for traders assessing LINK’s next move.

Chainlink’s Indicators Signal Bullish Momentum

An analysis of LINK’s daily chart on TradingView shows LINK in an uptrend since mid-November, characterized by higher highs and lows.

The price is in the middle of the upper and lower bands of the Bollinger Bands, which show increasing volatility. After testing resistance at about $28, LINK just retreated to $24, a crucial support.

The MACD indicator indicates a possible continuation of upward momentum with a bullish crossing, where the MACD line is above the signal line. However, shrinking histogram bars suggest a temporary loss of strength. Meanwhile, the RSI stands at 52.36, indicating neutral market conditions with room for further movement.

Outlook for LINK in the Current Cycle

Market observers anticipate further gains for LINK if it holds above the critical $23.7-$24 support zone. A successful retest could pave the way for a rally toward $28-$30. Conversely, failure to maintain this level might result in a pullback toward $20.

With increasing institutional interest and Chainlink’s expanding role in blockchain and AI, LINK remains a token to watch in the ongoing market cycle.

Read also: Cardano (ADA) Shows Signs of Potential Price Surge as Key Indicator Turns Bullish

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.