So far, Chainlink has had an enviable year. Since last December, LINK experienced a bull run that saw its price rocket nearly 26x. Along the way, Google published a guide on how to use the service with its cloud-based offering and Coinbase and Coinbase Pro listed the coin.

On June 29, 2019, Chainlink reached an all time high of $4.36. Since then, its price has dropped 41 percent.

What you'll learn 👉

Total market cap analysis

Let’s first look at what the overall market is doing. As you know, all coin prices are highly correlated with bitcoin’s price action and by extension with the whole market. Every time we see a surge or plunge of the total market cap, it spills over to the individual coins and their prices.

Market has made a mild recovery yesterday and it hovers around the newly acquired levels today, as it defended the support at $206 billions and is now testing a sturdy resistance at $219 billions (data by Tradingview, CMC data is off by approx +$8 billions).

Should the market break through the $219 billion zone, we could see a swift move up to the $240 billion zone, area from which we saw this horrific drop in the last week of September.

Read our updated guide on best crypto bots.

LINKUSD Price Analysis

- Major Support Level: $1.91

- Major Resistance Level: $2.52

- 23.6% FIB Retracement Level: $2.20

- 38.2% FIB Retracement Level: $2.66

- 62% FIB Retracement Level: $3.39

Chainlink jumped by 6.95% today which makes it 41% up on the week.

A bullish start to the day saw Chainlink rally to an early morning intraday high $2.64 before hitting reverse.

Falling short of the first major resistance level at Fib382 at $2.66, LINK slid back to a the intraday low of $2.48 before settling at the current $2.52.

In spite of the minor step back, LINK steered clear of the first major support level which is a confluence point of two moving averages at $2.36.

If Chainlink manages to close above the resistance at $2.52, there are no major roadblocks for it to reach the Fib618 at $3.39.

On the downside, Chainlink has couple of support zones to land on in case of a stumble, first one being at support level of $1.91.

Social Metrics

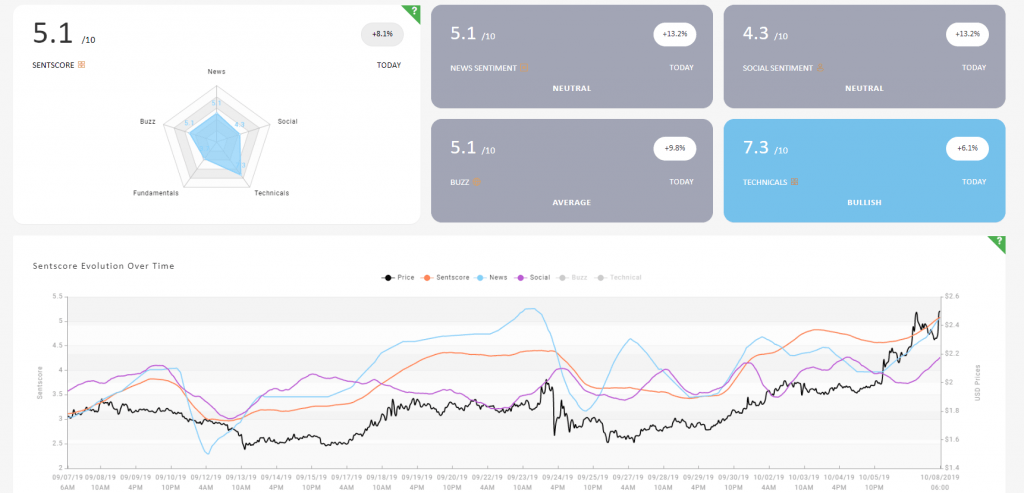

LINK’s market sentiment score, measured by the market analytics firm Omenics, paints a neutral picture.

Omenics wraps its analysis up into a single simple indicator known as the SentScore, which is formed from the combination of five different verticals: news, social media, buzz, technical analysis and fundamentals.

As seen on the chart below, Chainlink has a 5.1 sentscore, which is labeled as neutral but trending towards the bullish zone with an increase of 8.1% in comparison to yesterday.