Chainlink’s LINK token has had a strong start tothe week gaining over 17% in the last week alone. But according to prominent analyst Rekt Capital, this latest price action may indicate LINK is in an “accumulation range,” consolidating before making its next major move.

Accumulation After Rally

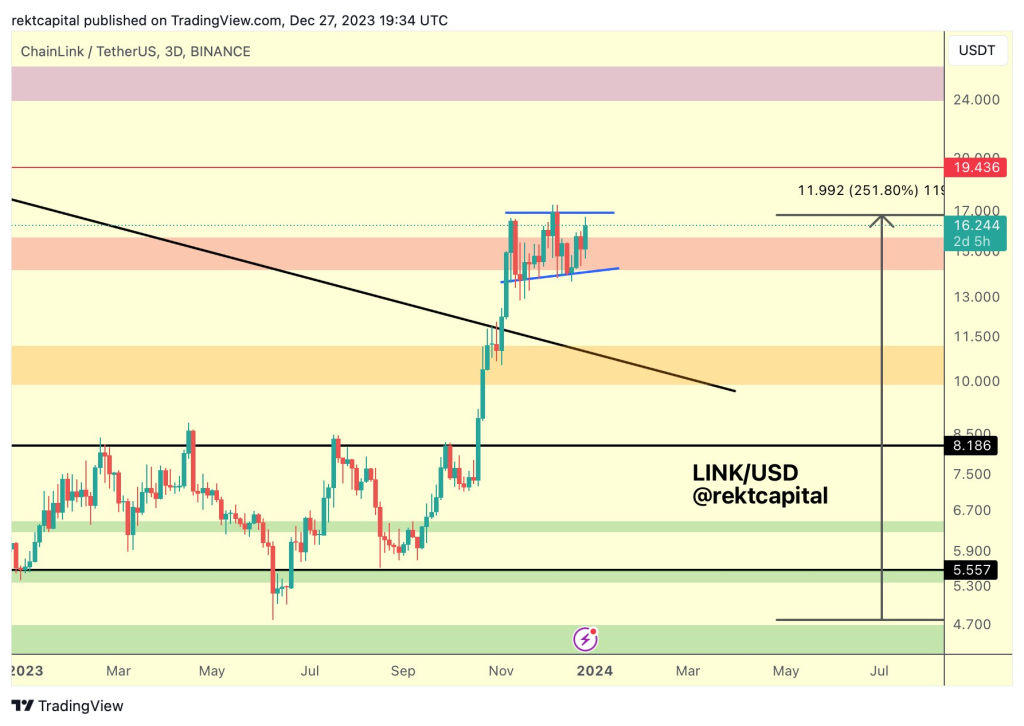

As Rekt Capital highlighted in a recent tweet, Chainlink has traded within a relatively narrow band between $14 and $17 for close to two months now. This period of consolidation started after LINK rallied aggressively for two months from September to October 2022.

Now, Rekt Capital believes this tight trading range indicates strategic accumulation, with strong hands buying up and holding LINK. As he states: “What if Chainlink has been a Re-Accumulation range at highs all this time?”

Rekt Capital shared a chart showing the consolidation forming on the 3-day candles for LINK/USD. If his thesis proves right, Chainlink could be gearing up for a breakout from this range rather soon.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Where Are Prices Headed Next?

Zooming into Rekt Capital’s chart, we see $17 as the key resistance level to watch. A decisive break and hold above $17 is needed to confirm the current consolidation as a re-accumulation range before continuation higher.

In this bullish scenario, Rekt Capital’s analysis suggests LINK could then target $19 in the near-term. That would translate to roughly a 20% move from current price levels near $16.

On the other hand, failure to breach $17 resistance could open the door for a drop back towards the lower boundary around $14. And a breakdown below $14 support would paint a much more bearish picture, with Rekt Capital’s analysis pointing to $11 as the next target.

So in summary, Chainlink looks to be range-bound in the short run between $14 and $17 as it continues building energy for its next major impulse. A break in either direction from this critical re-accumulation range should set the stage for LINK’s next leg up or down. Traders will be closely watching the crucial $17 level, which could determine whether the oracle token’s bull run will resume or falter from here.

You may also be interested in:

- Analyst Links Ripple’s Current Consolidation to 2017 Bull Run Setup: Is a 600x XRP Surge Inevitable?

- VCs Bet Over $360 Million on Top Projects in Q4 as Crypto Investments Show Signs of Recovery

- Here Are Potentially The Two Biggest Gainers of 2024 – Meme Kombat (MK) and Bitcoin Minetrix (BTCMTX)

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.