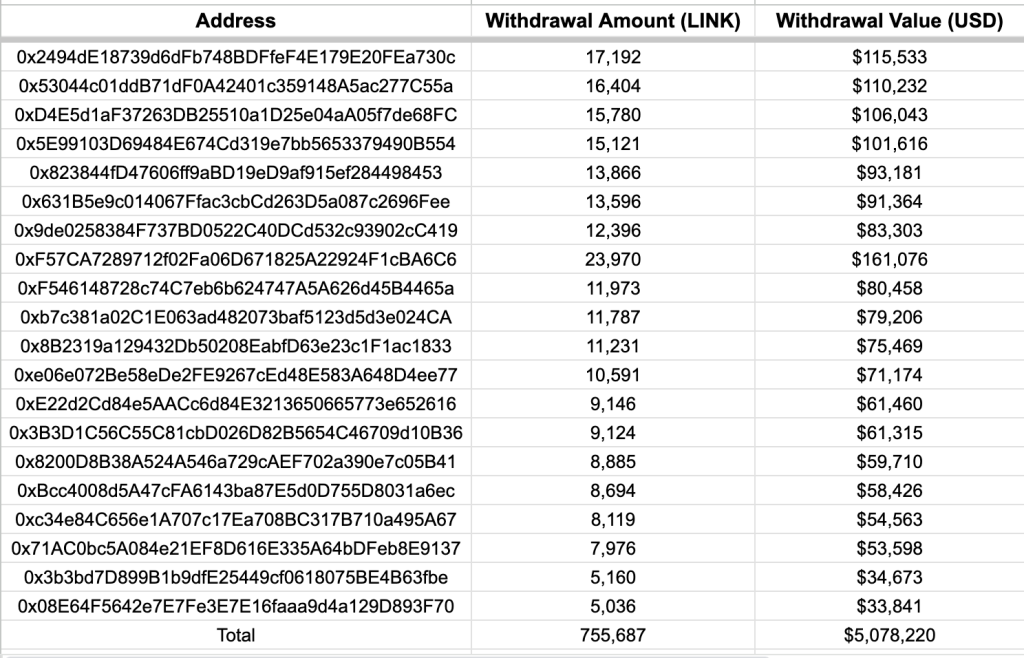

In a recent observation by Lookonchain, a blockchain analytics firm, approximately 35 new wallets were created just three days ago. These wallets have started to withdraw Chainlink (LINK) tokens from Binance, one of the world’s leading cryptocurrency exchanges. The total amount withdrawn so far is a staggering 755,687 LINK, equivalent to $5.08 million. This raises the question: Are these the actions of whales accumulating LINK, or is there a more strategic play at hand?

What you'll learn 👉

The Chainlink Noncirculating Supply Wallet

Interestingly, this activity coincides with another significant transaction. A Chainlink Noncirculating Supply wallet deposited a jaw-dropping 15.7 million LINK (valued at $97.5 million) into Binance three days ago. Could these two events be related? The timing is certainly curious, and it begs the question of whether these new wallets are part of a larger strategy involving Chainlink’s noncirculating supply.

The Fresh Wallets List

For those interested in diving deeper, Lookonchain has provided a comprehensive list of the fresh wallets that have withdrawn LINK from Binance. This could serve as a valuable resource for analysts and investors looking to understand the dynamics behind these large-scale transactions.

Speculations and Implications

While it’s tempting to speculate that whales are accumulating LINK, the deposit from the Chainlink Noncirculating Supply wallet suggests that there might be more to the story. This could be part of a broader strategy by Chainlink or related entities to manage liquidity, facilitate partnerships, or prepare for upcoming developments.

Conclusion

The recent wallet activities involving Chainlink have sparked intrigue and speculation within the crypto community. Whether these are the actions of whales or strategic moves by Chainlink remains to be seen. Either way, these transactions are a testament to the high-stakes, fast-paced world of cryptocurrency, where millions can move in the blink of an eye.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.