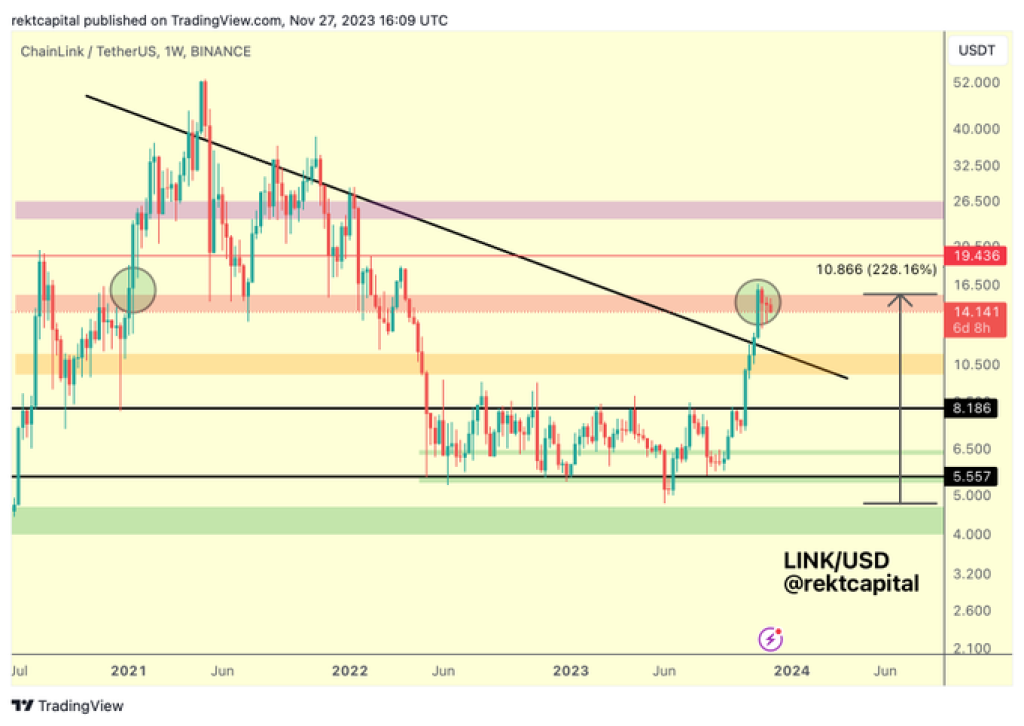

As noted by respected analyst Rekt Capital, Chainlink recently attempted to break out above the $19 resistance but failed to close the weekly candle above this level.

This means Chainlink was rejected from this level, and the price dropped back within the range. Currently, LINK is testing the support and needs to hold this level to maintain the potential for continued range trading.

The inability to achieve a weekly close above the upper threshold signifies a potential vulnerability for Chainlink. As the digital asset now probes the lower boundary of the red box, investors and traders closely monitor this critical juncture.

The ability to find solid support within this range becomes paramount for the asset’s short-term trajectory.

Rekt Capital underscores a key requirement for a successful retest—any downside wicks below the red box must swiftly recover back within its confines. This dynamic is crucial in affirming the resilience of the support level and instilling confidence in the sustainability of Chainlink’s current price position.

Read also:

- Why Did Waltonchain (WTC) Coin Price Crash by 60%?

- 160k+ Cardano Wallets Buy 5 Billion ADA Above Key Support, But This Metric Signals Risk – Top Analyst Reveals Critical Prices

- SUI & NEAR Investors Alert: Why Everyone’s Talking About Rebel Satoshi’s Explosive Presale

So in summary, while Chainlink remains stuck between key levels, the bullish breakout attempt has fizzled out for now. Price action should be closely monitored near range support to see if the equilibrium holds. Managing risk accordingly is warranted given the potential for increased downside volatility if $6 fails to hold.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.